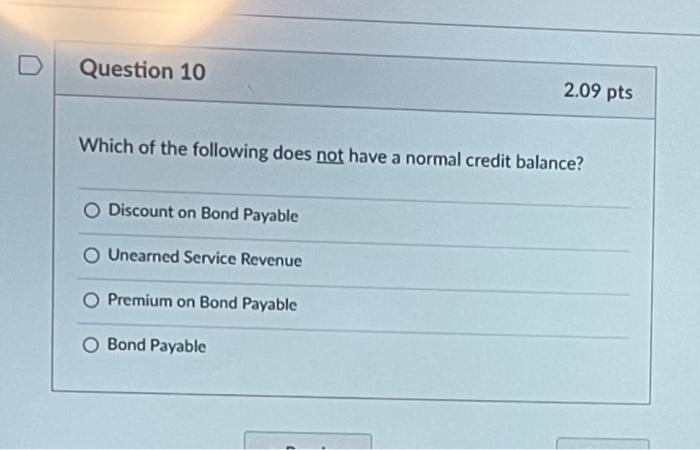

Which of the following is not a credit balance?

Which of the following does not have credit balance

Answer: d.

Expense accounts have normal debit balances.

Cached

Which of the following is a credit balance

Liabilities, revenue, and owner's capital accounts normally have credit balances.

What are the types of credit balance

Credit Balance ExplainedEntire amount overdue on the credit card.Positive bank balance.Amount outstanding in the margin account after buying securities.A positive balance in the equity, liability, gain, or revenue account.Negative balance in the asset account.

Cached

Which is not an example of credit

Answer: drawing account is the answer.

Which of the following accounts can not have a credit balance quizlet

Liabilities, Retained Earnings, and Revenues would have normal credit balances on the Adjusted Trial Balance. Cash is an asset and would have a debit balance, so it is the only account listed that would not have a credit balance.

What is a credit balance quizlet

DEFINITION. Credit balances occur in receivable pt. accounts when improper payments and adjustments are made to the practice and exceed the related posted charges. Often they are the result of increasingly complicated healthcare billing and payment processes.

Which of the following accounts has a credit balance quizlet

20. Which of the following accounts normally has a credit balance Rationale:Assets, dividend, and expense accounts normally have debit balances, whereas liabilities, common stock, and revenue accounts normally have credit balances.

What are the 4 types of credit

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What are the 4 types of credits

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What are the 5 types of credit

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What accounts are under credit

A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry. Debits (DR) Credits (CR) Increase asset, expense and loss accounts.

What is a credit balance quizlet medical assistant

what a credit balance A credit balance is when the amount that paid is greater than was due or the account is being paid in advance of service provided.

What is a credit statement balance

Your statement balance is the amount shown on your monthly billing statement. It doesn't reflect any new activity since your last statement ended. Instead, a statement balance represents the purchases and payments on your card during a set period, known as your billing cycle, which falls between 28 to 31 days.

Which of the following accounts does not have a credit balance quizlet

Liabilities, Retained Earnings, and Revenues would have normal credit balances on the Adjusted Trial Balance. Cash is an asset and would have a debit balance, so it is the only account listed that would not have a credit balance.

What are the 3 credit types

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

What are the 7 types of credits

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What are 5 credits

Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral. There is no regulatory standard that requires the use of the five Cs of credit, but the majority of lenders review most of this information prior to allowing a borrower to take on debt.

What are the 7 types of credit

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What are the 4 types of credit account

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What assets have a credit balance

Examples of Asset Accounts with Credit BalancesAccumulated Depreciation which is associated with a company's property, plant and equipment accounts.Allowance for Doubtful Accounts which is associated with the Accounts Receivable.