Which of the following is not an advantage of organizing a business in the form of a corporation?

Which of the following is not advantage of the corporate form of business organization

Correct answer: Option c) government regulation. Explanation: For a corporate form of organization, there is much intervention of the government and the regulations imosed by it. Only if the regulations turn out to be favorable in any manner, then can it be of any advantage otherwise it is a disadvantage.

Which of the following is not an advantage of a corporation quizlet

The advantages of a corporation are limited liability, the ability to raise investment money, perpetual existence, employee benefits and tax advantages. The disadvantages include expensive set up, more heavily taxed, taxes on profits.

What are the 5 disadvantages of a corporation

The Disadvantages of Forming a CorporationDistinct Legal Entity.Double Taxation.Expensive to Form.Complicated to Form.Extensive Rules to Follow.Frequently Asked Questions (FAQs)

What is not an advantage of the corporate form of business organization quizlet

A disadvantage of the corporate form of organization is that corporate stockholders are more exposed to personal liabilities in the event of bankruptcy than are investors in a typical partnership. Partnerships and proprietorships generally have a tax advantage over corporations.

Which one of the following is not an advantage of a corporation

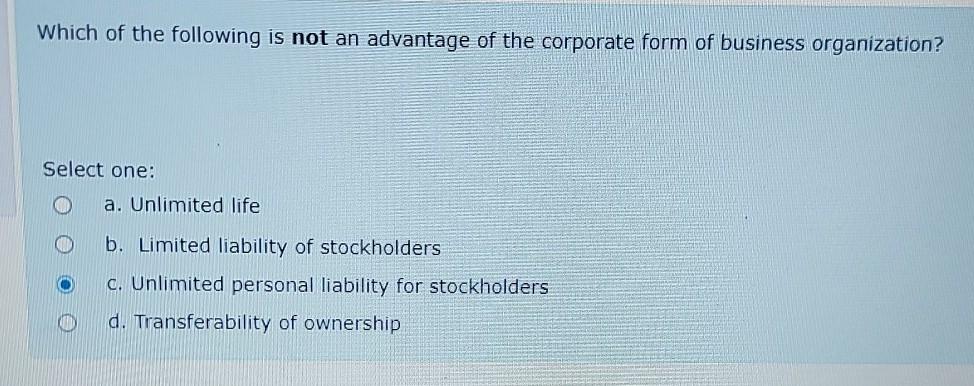

Answer and Explanation: c) Unlimited liability is not an advantage of a corporation.

What is the disadvantage of the corporate form of business quizlet

The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends.

What is not an advantage of a corporation

Advantages of a corporation include personal liability protection, business security and continuity, and easier access to capital. Disadvantages of a corporation include it being time-consuming and subject to double taxation, as well as having rigid formalities and protocols to follow.

Which of the following is not an advantages of a corporation

Answer and Explanation: c) Unlimited liability is not an advantage of a corporation.

What are 4 disadvantages of corporations

Disadvantages of a company include that:the company can be expensive to establish, maintain and wind up.the reporting requirements can be complex.your financial affairs are public.if directors fail to meet their legal obligations, they may be held personally liable for the company's debts.

Which answer is not an advantage of a corporation

Answer and Explanation: c) Unlimited liability is not an advantage of a corporation.

What are the disadvantages of as corporation

An S corporation may have some potential disadvantages, including:Formation and ongoing expenses.Tax qualification obligations.Calendar year.Stock ownership restrictions.Closer IRS scrutiny.Less flexibility in allocating income and loss.Taxable fringe benefits.

Which of the following is a disadvantage of the corporate form of organization

The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends.

What is a disadvantage of the corporate form

The primary disadvantage of the corporate form is the double taxation to shareholders of distributed earnings and dividends. Some advantages include: limited liability, ease of transferability, ability to raise capital, unlimited life, and so forth. 4.

What is a disadvantage of a corporation

Disadvantages of a corporation include it being time-consuming and subject to double taxation, as well as having rigid formalities and protocols to follow. This article is for entrepreneurs who are trying to determine their business structure and whether a corporation makes sense for them.

What is a disadvantage of a corporation quizlet

Limited liability of stockholders, government regulations, and additional taxes are the major disadvantages of a corporation.

What are the main disadvantages of a corporation quizlet

Limited liability of stockholders, government regulations, and additional taxes are the major disadvantages of a corporation.

Which of the following is not an advantage of a corporation

Answer and Explanation: c) Unlimited liability is not an advantage of a corporation. Unlimited liability is a disadvantage of a sole proprietorship or partnership where personal assets are exposed to risk.

Which of the following is not considered to be an advantage of a corporation

The correct answer is a.

In doing business, government regulation is not considered an advantage of creating a corporation.

What is not an advantage of C Corp

Unlike an S Corporation or an LLC, it pays taxes at the corporate level. This means it is subject to the disadvantage of double taxation. As well, a C corp also must comply with many more federal and state requirements than an LLC.

What are 3 disadvantages of corporation business

Before becoming a corporation, you should be aware of these potential disadvantages: There is a lengthy application process, you must follow rigid formalities and protocols, it can be expensive, and you may be double taxed (depending on your corporation structure).