Which of the following is the correct formula for the computation of the liquid ratio Mcq?

What is the formula for the computation of the liquid ratio

Absolute liquidity ratio =(Cash + Marketable Securities)÷ Current Liability =(2188+65) ÷ 8035 = 0.28.

Which of the following is the correct formula for the computation of the current ratio

Calculating the current ratio is very straightforward: Simply divide the company's current assets by its current liabilities.

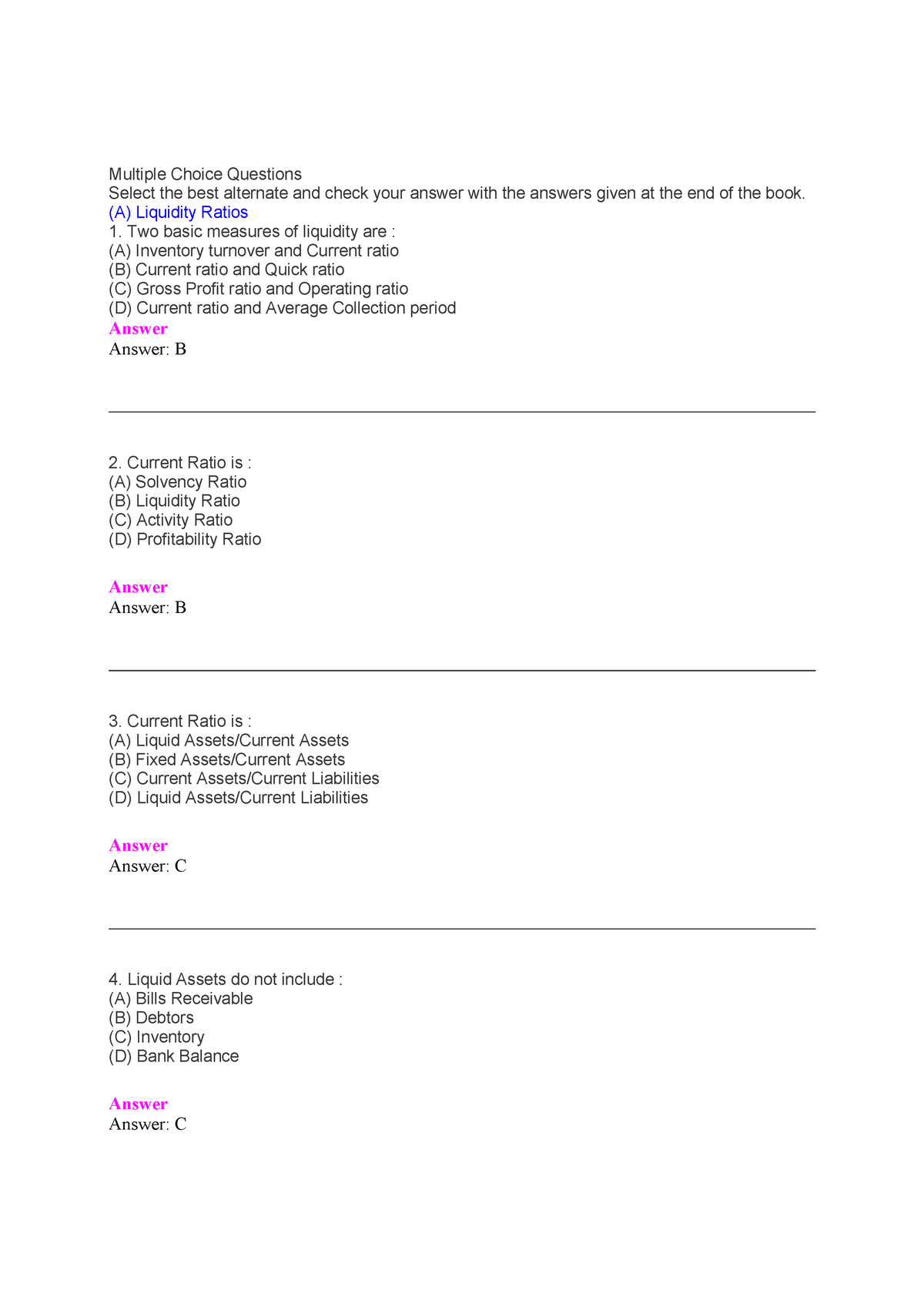

Which of the following is a liquidity ratio Mcq

The liquidity ratios include the current ratio and the acid test or quick ratio. The current ratio and quick ratio are also referred to as solvency ratios.

What is liquid ratio ratio

Liquidity ratios are a measure of the ability of a company to pay off its short-term liabilities. Liquidity ratios determine how quickly a company can convert the assets and use them for meeting the dues that arise. The higher the ratio, the easier is the ability to clear the debts and avoid defaulting on payments.

Which ratio is a liquidity ratio quizlet

The current ratio is a liquidity ratio that measures a company's ability to pay short-term and long-term obligations.

What is the formula for current ratio quizlet

What is the formula for the Current Ratio Total Current Assets ÷ Total Current Liabilities.

What is the current ratio formula used for

The current ratio is a metric used by accountants and finance professionals to understand a company's financial health at any given moment. This ratio works by comparing a company's current assets (assets that are easily converted to cash) to current liabilities (money owed to lenders and clients).

What ratio is a liquidity ratio quizlet

-is the ratio of quick assets (generally current assets less inventory) to current liabilities.

Which ratio is an example of liquidity ratio

Common liquidity ratios include the quick ratio, current ratio, and days sales outstanding. Liquidity ratios determine a company's ability to cover short-term obligations and cash flows, while solvency ratios are concerned with a longer-term ability to pay ongoing debts.

What is the liquidity ratio known as quizlet

The current ratio is a liquidity ratio that measures a company's ability to pay short-term and long-term obligations.

What is the formula and example of current ratio

For example, company A has cash worth $50,000 plus $100,000 in accounts receivable. Its present-day liabilities, of accounts payable, stands at $100,000. In this situation, the current ratio of company A will be 1.5, which is by dividing its current asset ($150,000) by its current liabilities ($100,000).

What is an example of a ratio

For example, if there is 1 boy and 3 girls you could write the ratio as: 1 : 3 (for every one boy there are 3 girls) 1 / 4 are boys and 3 / 4 are girls. 0.25 are boys (by dividing 1 by 4)

Which ratio is correctly classified as a liquidity ratio quizlet

The current ratio is a liquidity ratio that is computed as current assets divided by current liabilities.

What are liquidity ratios used to assess quizlet

Liquidity ratios measure the company's ability to pay off short-term debt obligations. They can be used to see if a company can repay its debt to its lenders and pay suppliers. It can also be used to judge a company's ability to take on more debt, spend cash, or explore new means of growth/acquisition.

How do you solve a ratio example

We need to write two fractions separated by an equal sign now the ratio of boys to girls is eight to seven so that means that if there are eight boys in the class. There's going to be seven girls in

What are the 3 types of ratios

Financial ratios are grouped into the following categories: Liquidity ratios. Leverage ratios. Efficiency ratios.

What is the liquidity ratio quizlet

-is the ratio of quick assets (generally current assets less inventory) to current liabilities. Indicates a company's ability to satisfy current liabilities with its most liquid assets.

What is the best ratio to measure liquidity

A good current ratio is between 1.2 to 2, which means that the business has 2 times more current assets than liabilities to covers its debts. A current ratio below 1 means that the company doesn't have enough liquid assets to cover its short-term liabilities.

What is the most used liquidity ratio that can be used to measure

The current ratio is the simplest liquidity ratio to calculate and interpret. Anyone can easily find the current assets and current liabilities line items on a company's balance sheet. Divide current assets by current liabilities, and you will arrive at the current ratio.

What is a ratio equation

A ratio is an ordered pair of numbers a and b, written a / b where b does not equal 0. A proportion is an equation in which two ratios are set equal to each other. For example, if there is 1 boy and 3 girls you could write the ratio as: 1 : 3 (for every one boy there are 3 girls) 1 / 4 are boys and 3 / 4 are girls.