Which of the following transactions would result in an account receivable quizlet?

What are the transactions for accounts receivable

Accounts receivable are unpaid invoiced transactions held by a business for goods supplied and/or services rendered that customers have not paid. Unpaid invoices generally include terms for payment within an agreed time frame. Accounts receivable is shown in a balance sheet as an asset.

What type of transaction results in an increase in accounts receivable

The Dual Effect of Transactions

For example, the accounts receivable balance increases because of a sale. Cash decreases as a result of paying salary expense. Cost of goods sold increases because inventory is removed. No account balance can possibly change without some identifiable cause.

What is the cause of an account receivable quizlet

Accounts receivable are amounts owed by customers on account. They result from the sale of goods and services.

Which of the following should be recorded in accounts receivable

Expert Answer. The correct choice is option D – None of these. It shall include amounts receivable from debtors, unpaid invoices, and late payments from customers but it does not include receivables from subsidiaries, receivables from employees, or receivables from friends and family.

What is an example of an account receivable

An example of accounts receivable includes an electric company that bills its clients after the clients received the electricity. The electric company records an account receivable for unpaid invoices as it waits for its customers to pay their bills.

What are the main types of accounts receivable

The main types of receivables are trade accounts receivable, notes receivable and “other” receivables. Trade AR represents amounts due from customer sales made on credit in the ordinary course of business.

What causes increase in accounts receivable

Accounts Receivable (A/R) days rise and fall for numerous reasons including: An increase or decrease in case volume. An increase or decrease in net revenue. An increase or decrease in collections.

What type of transaction results in a decrease in accounts receivable

A decrease in accounts receivable implies that more cash has entered the company from customers paying off credit accounts. The amount accounts receivable decreased is added to the company's net sales. However, if accounts receivable increases, the amount of the increase must be deducted from net sales.

What is the cause of an account receivable

Accounts receivable are created when a company lets a buyer purchase their goods or services on credit. Accounts payable are similar to accounts receivable, but instead of money to be received, they are money owed.

What affects accounts receivable

Accounts receivable is a current asset that results when a company reports revenues from sales of products or the providing of services on credit using the accrual basis of accounting. The effect on the company's balance sheet is an increase in current assets and an increase in owner's or stockholders' equity.

What goes up with accounts receivable

How to Interpret Accounts Receivable If a company's accounts receivable balance increases, more revenue must have been earned with payment in the form of credit, so more cash payments must be collected in the future.

What assets are accounts receivable

Accounts receivable or AR is the money a company is owed by its customers for goods and services rendered. Accounts receivable is a current asset and shows up in that section of a company's balance sheet.

What are the 4 functions of accounts receivable

The various functions that an accounts receivable department performs include:1) Build monthly financial statements.2) Perform account reconciliations.3) Generate invoices and account statements.4) Manage the billing system.

What is the most common type of receivable

Accounts Receivable are the most common kind of receivable. Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 – 60 days. They are classified on the Balance Sheet as current assets.

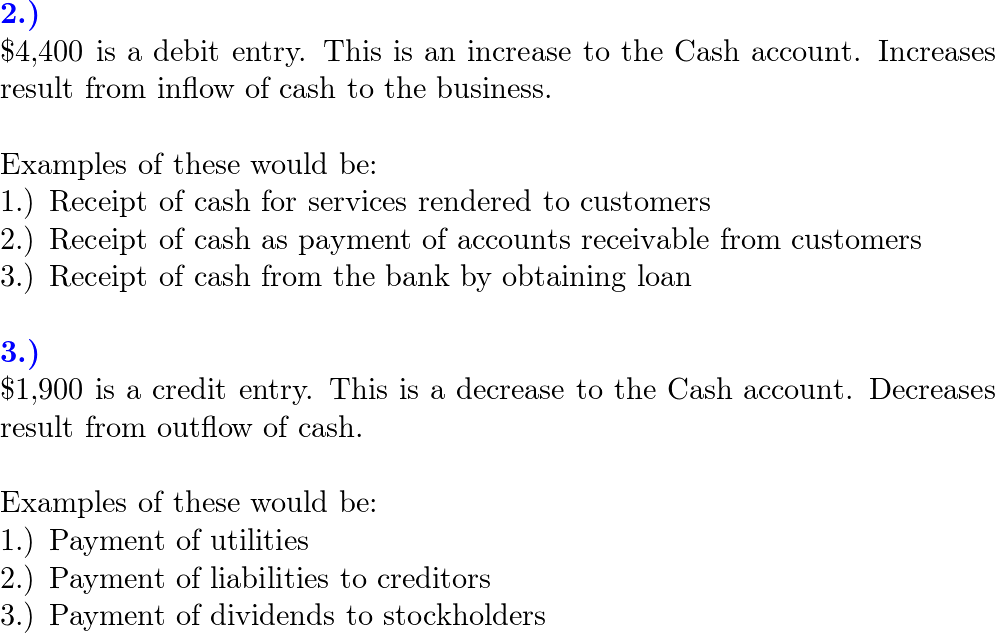

What causes accounts receivable to increase or decrease

The amount of accounts receivable is increased on the debit side and decreased on the credit side. When cash payment is received from the debtor, cash is increased and the accounts receivable is decreased. When recording the transaction, cash is debited, and accounts receivable are credited.

What is an account receivable quizlet

Accounts Receivables (Definition) Amounts owed by customers due to the sale of goods and services (payment usually due within 30 days)

What increases and decreases accounts receivable

The amount of accounts receivable is increased on the debit side and decreased on the credit side. When cash payment is received from the debtor, cash is increased and the accounts receivable is decreased. When recording the transaction, cash is debited, and accounts receivable are credited.

What credit goes with accounts receivable

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you.

What are the different types of accounts receivable

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

What are accounts receivable classified on the balance sheet as

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 – 60 days. They are classified on the Balance Sheet as current assets.