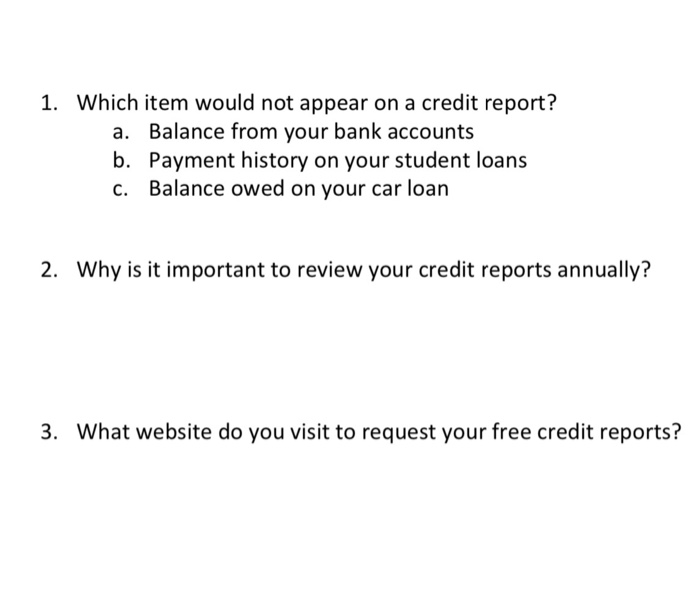

Which of the following would not appear on a credit report?

What can appear on a credit report

Your credit reports include information about the types of credit accounts you've had, your payment history and certain other information such as your credit limits. Credit reports from the three nationwide consumer reporting agencies — Equifax, TransUnion and Experian — may contain different account information.

Which item is not provided on a credit report quizlet

Not included are savings and checking accounts (typically not reported to a credit bureau).

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

Cached

Which of the following is not one of the credit reporting agencies

The answer is C.

Bank of America (BOA) is a commercial bank, who will obtain loan applicant's credit report from three credit bureaus to analyze applicant's financial situation. In the U.S, there are three trusted independent credit bureaus: TransUnion, Equifax and Experian.

What does not reported mean on credit report

If you have no credit accounts or have opened an account or accounts with lenders that do not report the payment status to a credit reporting company, you will not have a credit report.

Which information is found on a credit report quizlet

The report contains personal information, anything found in public records, information from collection agencies, information about credit cards or loans, and a list of those who have requested a copy of the report. Mark wants to buy a new computer and apply for a new credit card to pay for it.

Which of the following is not a part of credit

Hence, the correct answer is that savings are not included in terms of credit.

Which of these is not a part of the credit score

Since your credit files never include your race, gender, marital status, education level, religion, political party or income, those details can't be factored into your credit scores.

What are 5 things not in your credit score

However, they do not consider: Your race, color, religion, national origin, sex and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

What are 3 things you might find on a credit report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.

What do the 3 main credit report agencies do

The three major credit reporting bureaus in the United States are Equifax, Experian, and TransUnion. They compile credit reports on individuals, which they sell to prospective lenders and others. The three bureaus can have somewhat different information in their reports, depending on which creditors provide it to them.

What 3 agencies are responsible for collecting information for a credit report

Check your reports regularly

It's important to review your credit reports from the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—every twelve months to ensure they are accurate and complete.

Are bank accounts listed on credit report

Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

Do all debts show on credit report

While most major lenders and creditors report to at least one of the credit reporting agencies, there is no requirement to report, and not all companies do. Therefore, it is possible to owe a debt that does not appear on any of your credit reports.

What 3 types of information would be included on a credit report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus.

What are 3 types of information you can expect to find on a credit report

Information about credit that you have, such as your credit card accounts, mortgages, car loans, and student loans. It may also include the terms of your credit, how much you owe your creditors, and your history of making payments.

What 4 items are part of a credit report

These four categories are: identifying information, credit accounts, credit inquiries and public records.

What is not the source of credit information

Employers do not fall under formal sources of credit lenders in our country.

Which of the following is not an example of a credit

Answer: drawing account is the answer.

Which of the following is not a credit rating

Answer: RBI is not a credit rating agency in India.