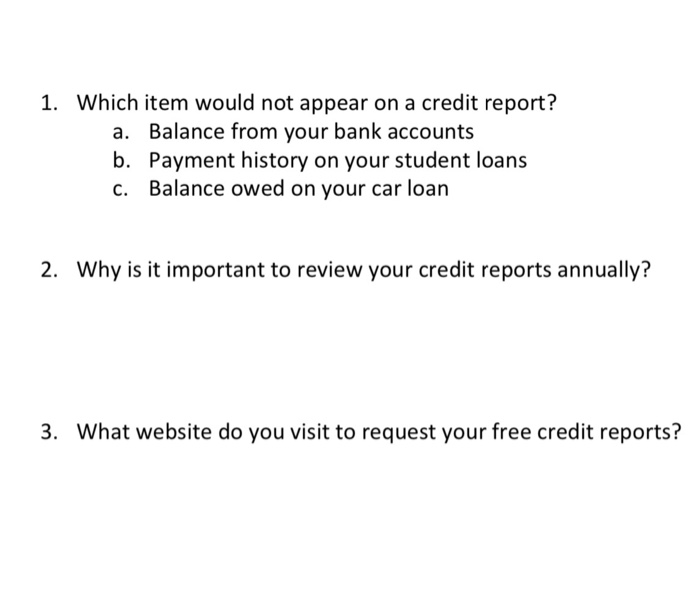

Which of the following would not appear on a credit report *?

What will appear on a credit report

Your credit reports include information about the types of credit accounts you've had, your payment history and certain other information such as your credit limits. Credit reports from the three nationwide consumer reporting agencies — Equifax, TransUnion and Experian — may contain different account information.

Cached

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

Cached

Which of these is not a part of the credit score

Since your credit files never include your race, gender, marital status, education level, religion, political party or income, those details can't be factored into your credit scores.

Which item is not provided on a credit report quizlet

Not included are savings and checking accounts (typically not reported to a credit bureau).

What are the 4 components of a credit report

Your credit report is divided into four sections: identifying information, account history (or credit his- tory), public records, and inquiries.

What 4 items are part of a credit report

As for your three-digit credit score, that's calculated by weighting various factors contained in your credit report including your payment history, your credit utilization, the length of your credit history, recent credit activity, and the types of credit you hold.

What are 5 things not in your credit score

However, they do not consider: Your race, color, religion, national origin, sex and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

What are 3 things you might find on a credit report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.

What does not reported mean on credit report

If you have no credit accounts or have opened an account or accounts with lenders that do not report the payment status to a credit reporting company, you will not have a credit report.

Which of the following is not a credit rating

Answer: RBI is not a credit rating agency in India.

Which of the following is not an example of a credit

Answer: drawing account is the answer.

What is not on a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

What are the 7 basic components of a credit score

We'll break down each of these factors below.Payment history: 35% of credit score.Amounts owed: 30% of credit score.Credit history length: 15% of credit score.Credit mix: 10% of credit score.New credit: 10% of credit score.Missed payments.Too many inquiries.Outstanding debt.

Do all debts show on credit report

While most major lenders and creditors report to at least one of the credit reporting agencies, there is no requirement to report, and not all companies do. Therefore, it is possible to owe a debt that does not appear on any of your credit reports.

Are bank accounts listed on credit report

Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

Which is not one of the 5 C’s of credit

Candor is not part of the 5cs' of credit.

Which of the following is not one of the three credit bureaus

The answer is C.

Bank of America (BOA) is a commercial bank, who will obtain loan applicant's credit report from three credit bureaus to analyze applicant's financial situation. In the U.S, there are three trusted independent credit bureaus: TransUnion, Equifax and Experian.

What are the 5 key credit criteria

One way to do this is by checking what's called the five C's of credit: character, capacity, capital, collateral and conditions. Understanding these criteria may help you boost your creditworthiness and qualify for credit.

What type of debt appears on your credit report

Bills that are unpaid for months may be sent to collections, including loan and credit card debt, medical bills, utility bills, government debts and more. Once a collection account appears on your credit report, it may stay there for seven years.

Does bank account show on credit report

Bank transactions and account balances do not affect credit reports; they are not reported to the national credit bureaus and cannot appear on your credit reports at all. However, unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and can hurt your credit scores.