Which of the two methods of accounting for uncollectible accounts the allowance method or the direct write-off method is preferable Why?

Which is better direct write-off or allowance method

Bad debt expense recognition is delayed under the direct write-off method, while the recognition is immediate under the allowance method. This results in higher initial profits under the direct write-off method.

Cached

Why is the allowance method preferable to the direct write-off method

Direct write off method vs.

With the allowance method, the business can estimate its bad debt at the end of the financial year. Rather than writing off bad debt as unpaid invoices come in, the amount is tallied up only at the end of the accounting year.

Cached

Which of the two methods of estimating uncollectible accounts would normally be more accurate why

The aging of receivables is the most accurate when estimating the amount of receivables that may become uncollectable in the future. This approach applies a lower percentage to accounts with newer balances and a higher percentage to accounts that are past due.

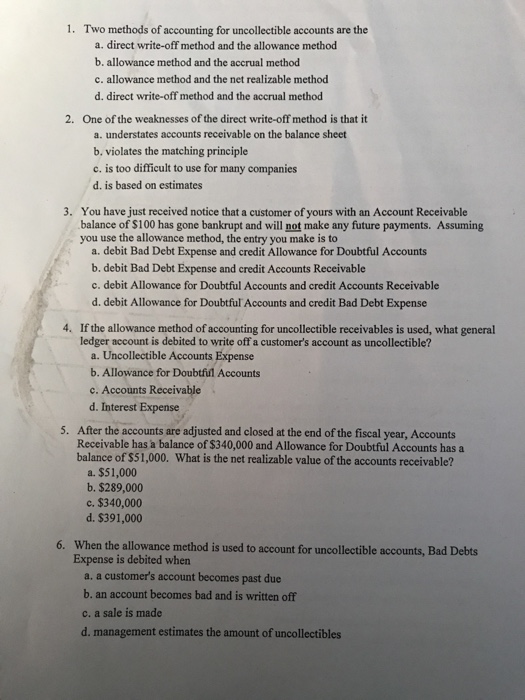

What are the two methods used in accounting for uncollectible accounts method and the method

¨ Two methods are used in accounting for uncollectible accounts: (1) the Direct Write-off Method and (2) the Allowance Method. § When a specific account is determined to be uncollectible, the loss is charged to Bad Debt Expense.

CachedSimilar

What is the difference between the direct write-off and allowance method of writing off bad debts

The allowance method requires a small business to estimate at the end of the year how much bad debt they have, while the direct write off method lets owners write off bad debt whenever they decide a customer won't pay an invoice.

When would you use direct write-off method

The direct write-off method is used only when we decide a customer will not pay. We do not record any estimates or use the Allowance for Doubtful Accounts under the direct write-off method. We record Bad Debt Expense for the amount we determine will not be paid.

Why is the allowance method preferable to the direct write-off method quizlet

Why is the allowance method preferred over the direct write-off method of accounting for bad debts Improved matching of bad debt expense with revenue.

Which of the two methods of estimating uncollectibles provides for the most accurate estimate

Answer and Explanation: The allowance method for writing off bad debts provides the most accurate estimate of the current net realizable value of the receivables.

Which method for accounting for doubtful accounts is more accurate

The allowance method

The allowance method is generally considered more accurate than the direct write-off method, as it better matches the bad debt expense to the period in which the related revenues were earned, adhering to the matching principle in accrual accounting.

Which method of accounting for uncollectible accounts results in a better matching

In order to provide the best matching, the allowance method is used. Under the allowance method, the uncollectible account expense for the period is matched against the sales for that period. This requires estimating the uncollectible account expense in the period of the sale.

What are the 2 methods of accounting for bad debts and uncollectible accounts receivable

There are two different methods used to recognize bad debt expense. Using the direct write-off method, uncollectible accounts are written off directly to expense as they become uncollectible. On the other hand, the allowance method accrues an estimate that gets continually revised.

What is the difference between write-off and written off

Write-Offs vs.

The difference between a write-off and a write-down is just a matter of degree. A write-down is performed in accounting to reduce the value of an asset to offset a loss or expense. A write-down becomes a write-off if the entire balance of the asset is eliminated and removed from the books altogether.

What is the main difference between the direct write-off method and the allowance method of recording bad debts

The key difference between direct write off method and allowance method is that while direct write off method records the accounting entry when bad debts materialize, allowance method sets aside an allowance for possible bad debts, which is a portion of credit sales made during the year.

What is an example of a direct write-off method

Accounting for the Direct Write-Off Method

For example, a business records a sale on credit of $10,000, and records it with a debit to the accounts receivable account and a credit to the sales account. After two months, the customer is only able to pay $8,000 of the open balance, so the seller must write off $2,000.

What is the main advantage of the allowance method of handling uncollectible accounts over the direct method apex

Answer and Explanation: The main advantage of using the allowance method in business is; it allows the firm to provide accurate financial reports to the interested parties. The accurate account receivable in the balance sheet can be estimated through allowance method.

Why is the allowance method preferable

The allowance method is preferred over the direct write-off method because: The income statement will report the bad debts expense closer to the time of the sale or service, and. The balance sheet will report a more realistic net amount of accounts receivable that will actually be turning to cash.

Which method of estimating is most accurate

First principles estimating

First principles estimating is considered to be best practice and the most accurate method of estimating possible. It is used by millions of estimators, engineers and project managers all over the world.

Which method provides the most accurate estimates

Detail Estimating

This approach is closely related to scheduling, planning and resource allocation and is both time-consuming and costly. It requires a good knowledge of the activity and also needs to have a reasonable level of definition. It also results in the most accurate estimates.

Which method of accounting is the best method to use

Accrual-based accounting is the more widely used of the two methods and is used by all large companies. Accrual accounting is suited for businesses that sell on credit. You can record transactions and keep track of invoices even if you haven't received the cash for them.

What is the preferred method for accounting for uncollectible accounts

allowance method

The preferred method of accounting for uncollectible accounts is the: allowance method. a specific account receivable is decreased for the actual amount of bad debt at the time of write-off.