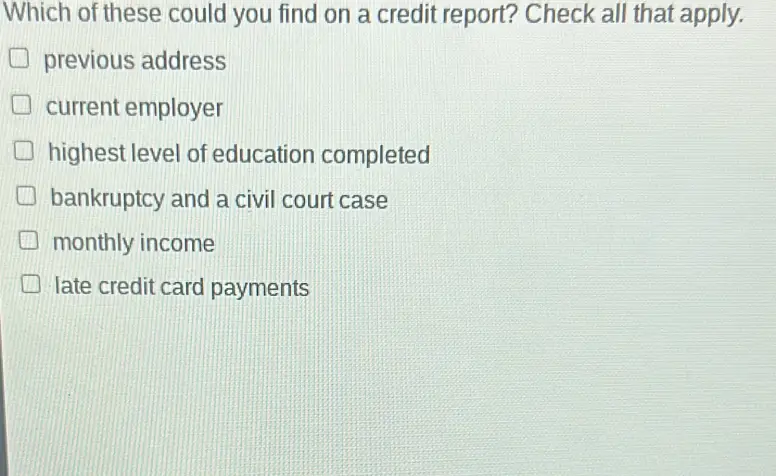

Which of these could you find on a credit report?

What can be found on a credit report

Your credit reports include information about the types of credit accounts you've had, your payment history and certain other information such as your credit limits. Credit reports from the three nationwide consumer reporting agencies — Equifax, TransUnion and Experian — may contain different account information.

Cached

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

Cached

What are 3 types of information you can expect to find on a credit report

Information about credit that you have, such as your credit card accounts, mortgages, car loans, and student loans. It may also include the terms of your credit, how much you owe your creditors, and your history of making payments.

CachedSimilar

What are the 4 sections of a credit report

Your credit report is divided into four sections: identifying information, account history (or credit his- tory), public records, and inquiries.

Cached

What is not found on a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

Which information is found on a credit report quizlet

The report contains personal information, anything found in public records, information from collection agencies, information about credit cards or loans, and a list of those who have requested a copy of the report. Mark wants to buy a new computer and apply for a new credit card to pay for it.

What are 4 examples of information not found in a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

What are the most important things on your credit report

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score. That's more than any one of the other four main factors, which range from 10% to 30%.

What are the 3 big things you must look for when reviewing your credit report

When you review your credit reports, look for changes to your personal information. This includes account details, inquiries and public record data. If something looks suspicious, double check that it's not a mistake on your end, then dispute the error.

What a credit report is and what information it contains

A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. Most people have more than one credit report.

What type of information is reported by credit reporting agencies

Credit reporting companies collect credit account information about your borrowing and repayment history including: The original amount of a loan. The credit limit on a credit card. The balance on a credit card or other loan.

What are the 3 biggest components of a credit score

What Makes Up Your Credit ScorePayment History: 35%Amounts Owed: 30%Length of Credit History: 15%New Credit: 10%Credit Mix: 10%

What is the most important thing in a credit report

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score.

What are 3 factors that determine a credit score

The 5 factors that impact your credit scorePayment history.Amounts owed.Length of credit history.New credit.Credit mix.

What are the 7 basic components of a credit score

We'll break down each of these factors below.Payment history: 35% of credit score.Amounts owed: 30% of credit score.Credit history length: 15% of credit score.Credit mix: 10% of credit score.New credit: 10% of credit score.Missed payments.Too many inquiries.Outstanding debt.

Which of the following would not appear on a credit report *

Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not. Did you buy a car Your purchase won't appear on your credit report, but any loan you used to finance it will.

What is the most important part of a credit report quizlet

Payment history is the most important ingredient in credit scoring, and even one missed payment can have a negative impact on your score.

What are 3 items not included in a credit score

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education.

What are the 3 types of credit and how do they impact your credit score

There are three general categories of credit accounts that can impact your credit scores: revolving, open and installment. Although having a variety of credit types can be good for your credit health, it's not the most important factor in determining your scores.

What are the 5 main categories of a credit score

Credit scores typically range from 300 to 850. Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and excellent.