Which of these items is credited to the buyer at closing?

What items are credited to the buyer at closing

Items that are typically credited or debited include the selling price, loan principal and associated points or fees, prepaid interest, earnest money deposit and any down payment, unpaid bills associated with the property, such as utility charges and taxes, and prepaid expenses such as property taxes, insurance, and …

Cached

Which is a credit to the buyer on the buyer’s closing statement

An earnest deposit or earnest money is a deposit made to a seller representing a buyer's good faith to buy a home. At closing, buyers will be credited for this in the form of a credit.

Cached

Which of the following is an item that a buyer usually pays at closing

Closing costs for buyers include fees paid to the mortgage company for originating the loan, legal fees paid to the attorney who handles the real estate transaction, homeowners association fees, and pre-payments for homeowners insurance and property tax.

What is a credit on the closing statement quizlet

Credits. Money to be received by buyer or seller (or conversely, reimbursed) as listed on a closing statement. Debits. Money to be paid by buyer or seller as listed on a closing statement.

What accounts are credited during the closing process

The basic sequence of closing entries is as follows:Debit all revenue accounts and credit the income summary account, thereby clearing out the balances in the revenue accounts.Credit all expense accounts and debit the income summary account, thereby clearing out the balances in all expense accounts.

Which item will show as a credit to the buyer on a closing statement quizlet

The principal balance on the loan also reduces the amount the buyer must bring in at closing, so it must appear on the buyer's closing statement as a credit.

What is a credit on the closing statement

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs. Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate.

Is earnest money a credit to the buyer

If you close on the house, your earnest money is applied as a credit toward your down payment and closing costs. Remember, it's often held in an escrow account until you close.

Which of the following is a closing expense typically paid by the seller

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

Which of the following costs are sellers responsible for paying at closing

While sellers will have to pony up for some expenses at the closing table, they are not generally what you would consider a closing cost. Sellers, for that matter, are expected to pay the real estate commission (or Realtor fee) at the time of closing. The buyer, however, is responsible for just about everything else.

What are debits and credits on closing statement

Debits and credits tend to come up during the closing periods of a real estate transaction. The purchase agreement contains debit and credit sections. The debit section highlights how much you owe at closing, with credit covering the amount owed to you.

Which type of account is always credited during the closing process quizlet

During the closing process for revenue accounts, the Retained Earnings account is credited, which increases Retained Earnings.

What accounts get in closing entries

The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

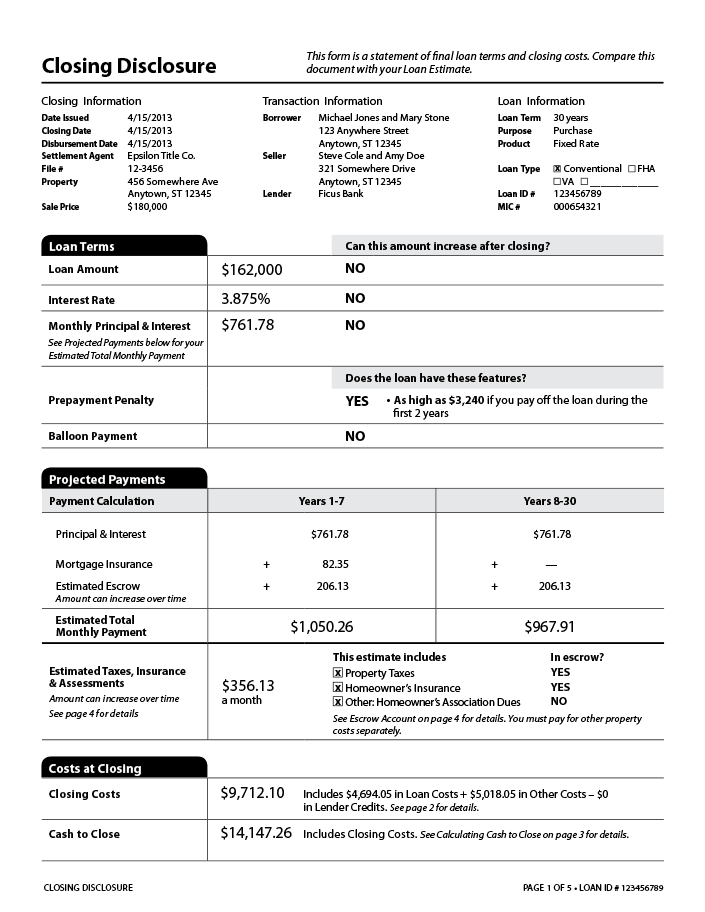

Which two items will appear on a closing statement

It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs). The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan.

What are debits and credits on a closing statement

Debits and credits tend to come up during the closing periods of a real estate transaction. The purchase agreement contains debit and credit sections. The debit section highlights how much you owe at closing, with credit covering the amount owed to you.

What is earnest money also known as

Earnest money, sometimes called a “good faith deposit,” is a sum of money that is included with your offer to purchase a home. Earnest money has become standard, especially in today's competitive real estate markets.

What is a debit to the buyer

A debit note, or a debit memo, is a document issued by a seller to a buyer to notify them of current debt obligations. You'll commonly come across these notes in business-to-business transactions — for example, one business may supply another with goods or services before an official invoice is sent.

Which two items will appear on a closing disclosure

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

What is fees paid at the closing of a real estate transaction called

Closing costs are fees due at the closing of a real estate transaction in addition to the property's purchase price. Both buyers and sellers may be subject to closing costs.

What is included in the buyer’s closing cost quizlet

Closing costs are made up of such items as loan application and loan organization fees, mortgage points, title search and insurance fees, attorneys' fees, appraisal fees, etc.