Which one of the following is not a method of credit control?

Which of the following is not a credit control

Out of the given options, managed floating is not an instrument of credit control.

What are the methods of credit control

Credit control methods include credit checks, setting credit limits, regular monitoring of accounts, debt collection procedures, and offering discounts for early payment. Credit control helps improve cash flow, reduce bad debt, and maintain financial stability. However, it may also result in reduced sales and higher.

Cached

Which of the following is not a method of credit control adopted by central bank

Answer: ii) Margin requirements.

Which of the following is not a method of qualitative credit control

Explanation: Changes in cash reserve ratio is a quantitative method of credit control, as it directly affects the money supply in the economy. It does not come under the purview of qualitative credit control methods, which are indirect methods of influencing credit creation.

How many methods of credit control are there

two methods

Methods of Credit Control

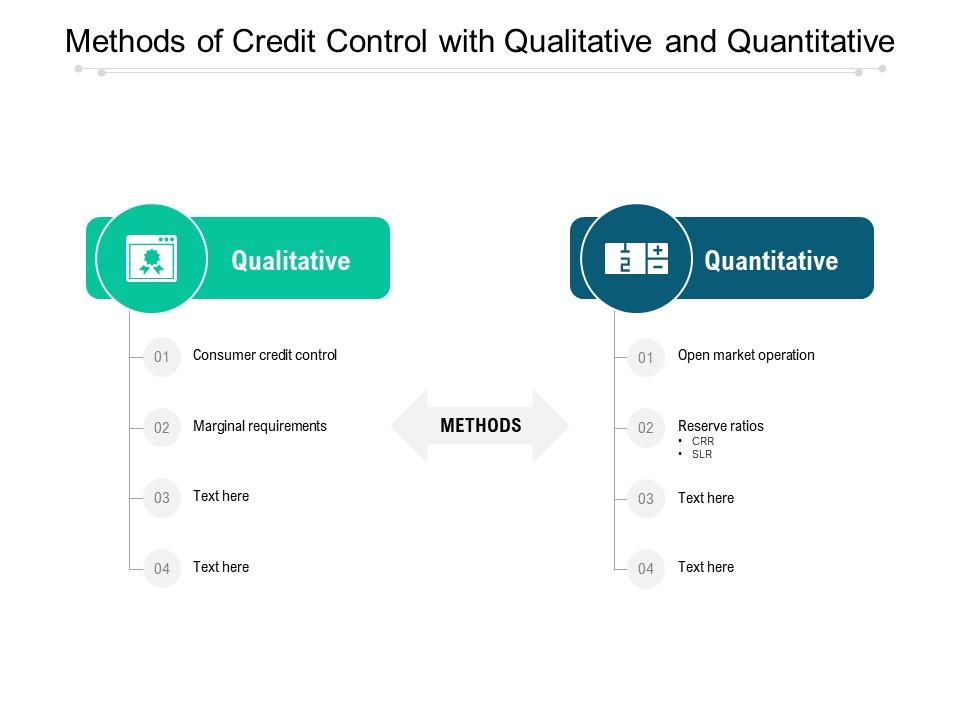

There are basically two methods of controlling the credit. They are Qualitative and the Quantitative or the General Methods.

Which of the following controls credit

Credit control is a monetary policy tool used by the Reserve Bank of India to control the demand and supply of money, or liquidity, in the economy. The Reserve Bank of India (RBI) supervises the credit granted by commercial banks.

What are the three types of credit methods

The three main types of credit are revolving credit, installment, and open credit. Credit enables people to purchase goods or services using borrowed money.

How many types of credit controlling are there in central bank

Rationing of credit is another selective method of controlling and regulating the purpose for which credit is granted by the commercial banks. It is generally of four types.

What is qualitative or selective credit control method

Qualitative credit control refers to selective credit control that focuses on allocation of credit to different sectors of the economy. Flow of credit is encouraged to the priority sectors, while it is discouraged to the non-priority sectors.

What are the quantitative and quantitative methods of credit control

Methods of Credit Control

(1) Quantitative Methods: (i) Bank rate fixation; (ii) Open market operations; (iii) Change in cash reserves ratios; (iv) Repos and reverse repos; and (v) Statutory liquidity ratio.

What are the 4 main types of credit

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

Which of the following are types of credit control measures

There are two types of credit control measures: Quantitative and Qualitative. Quantitative measures are the ones that involve the use of money as a tool to control credit. Bank Rate is one such quantitative measure.

What are the 4 types of credits

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What are the 4 types of credit instruments

The different types of credit market instruments are simple loans, fixed-payment loans, coupon bonds, and discount bonds.

What are quantitative methods of credit control

Methods of Credit Control

(1) Quantitative Methods: (i) Bank rate fixation; (ii) Open market operations; (iii) Change in cash reserves ratios; (iv) Repos and reverse repos; and (v) Statutory liquidity ratio.

What is selective and quantitative credit control

Quantitative credit control refers to overall credit in the economy, affecting all sectors of the economy equally and without discrimination. Qualitative credit control refers to selective credit control that focuses on allocation of credit to different sectors of the economy.

Which is a qualitative method of credit control

Regulation of consumer credit act as a qualitative credit control measure of the central bank as in the time of inflation or deflation, they regulate the consumer credit on a certain relative products in order to regulate uncertain market conditions.

What are the types of quantitative credit control

Methods of Credit Control

(1) Quantitative Methods: (i) Bank rate fixation; (ii) Open market operations; (iii) Change in cash reserves ratios; (iv) Repos and reverse repos; and (v) Statutory liquidity ratio.

What are the 5 types of credit

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What are the 5 ways of credit

The five Cs of credit are character, capacity, capital, collateral, and conditions.