Which one of the following is used for recording accounts receivable in the journal entry?

What is the journal entry for recording accounts receivable

The journal entry for account receivables is made by debiting the accounts receivable account and crediting the sales account.

How do you record accounts receivable

Accounts receivable are recorded in the current asset section of the balance sheet. If the business has to wait more than one year to convert AR to cash, it is considered a long-term asset.

Which of the following should be recorded in accounts receivable

Expert Answer. The correct choice is option D – None of these. It shall include amounts receivable from debtors, unpaid invoices, and late payments from customers but it does not include receivables from subsidiaries, receivables from employees, or receivables from friends and family.

Which journal would most commonly be used for recording accounts receivable payments

Most accounts receivables journal entries go into the general ledger or general journal and sometimes are entered into a subsidiary journal. The journal entry should include both the debit from accounts receivables and credit to sales.

Cached

What is the journal entry to adjust accounts receivable

The adjusting journal entry will credit accounts receivable and debit the cash account once that money is received. The revenue was earned and recognized earlier, so an adjusting journal entry is needed to properly recognize the cash that has now been received.

How do you write off accounts receivable in journal entries

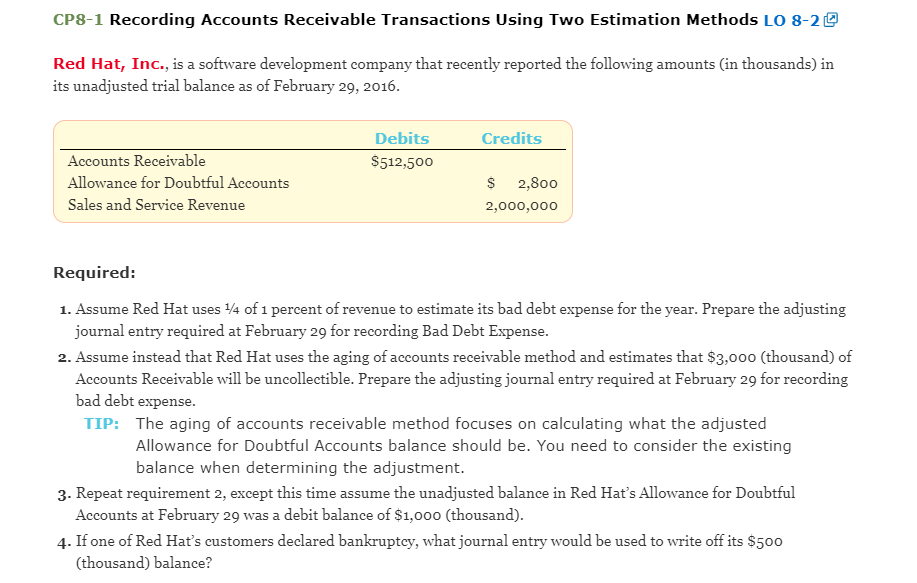

Assuming the allowance method is being used, you would have an allowance for doubtful account reserve already established. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable.

What accounting method is used with accounts receivable

The accrual method

The accrual method records accounts receivables and payables and, as a result, can provide a more accurate picture of the profitability of a company, particularly in the long term.

How do you write-off accounts receivable in journal entries

Assuming the allowance method is being used, you would have an allowance for doubtful account reserve already established. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable.

How do you record accounts payable journal entry

When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash.

How do you record journal entry adjustments

How to prepare your adjusting entriesStep 1: Recording accrued revenue.Step 2: Recording accrued expenses.Step 3: Recording deferred revenue.Step 4: Recording prepaid expenses.Step 5: Recording depreciation expenses.

What is to write-off an account receivable

A write-off is a request to remove any uncollectible revenue from the sale of a good or services that is at least 1 year old from a department's account and reclass it as a bad debt expense. At no time is a department allowed to waive an uncollectable debt without submitting a write-off request.

How are accounts receivable written off

A receivable becomes past due if payment is not received by the payment due date. If concerted reasonable collection effort has been made, and no further collection is foreseen, it is understood that invoices may be written off if they meet the following criteria: Invoice age is one year old from the date of issuance.

What are two methods of recording accounts receivable

Two different methods of recording accounts receivables

The journal entry will report debit of discount allowed, cash, and credit to accounts receivables on cash receipt. 2. Net method: The business entity reports credit sales after adjusting the discount allowed under net method.

What is the entry of accounts receivable and payable

Both accounts are recorded when revenues and expenses are incurred, not when cash is exchanged. Create an accounts receivable entry when you offer credit to your customers. Make an accounts payable entry when you purchase something on credit.

Which is used to record the payment of accounts payable

All accounts payable is considered a liability. These transactions are generally recorded as a debit on a company's balance sheet. However, if a business makes early payments or pays more than the balance, it can also be recorded as a credit.

What is an example of an adjusting entry in accounts receivable

Here's an example of an adjusting entry: In August, you bill a customer $5,000 for services you performed. They pay you in September. In August, you record that money in accounts receivable—as income you're expecting to receive. Then, in September, you record the money as cash deposited in your bank account.

How do you write-off accounts receivable journal entry

Assuming the allowance method is being used, you would have an allowance for doubtful account reserve already established. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable.

What are the two methods of writing off accounts receivable

Companies use two methods to account for bad debts: the direct write‐off method and the allowance method. Direct write‐off method. For tax purposes, companies must use the direct write‐off method, under which bad debts are recognized only after the company is certain the debt will not be paid.

What is the journal entry for written off

Direct Write Off Method

The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account.

When a specific account receivable is written off the entry

When a specific customer's account is identified as uncollectible, the journal entry to write off the account is: A credit to Accounts Receivable (to remove the amount that will not be collected) A debit to Allowance for Doubtful Accounts (to reduce the Allowance balance that was previously established)