Which routing do I use for ACH?

Are there different routing numbers for ACH and wire

Not necessarily. Both transactions require a 9-digit number, but you will have to verify with the financial institution where you are sending the funds, if the ABA number for ACH or wires are the same, or which routing number should be used for a wire transfer and for the ACH.

Cached

Is ACH routing number the same as direct deposit

This number may be the same routing number as the one on your checks, but they can be different, so you should verify with the bank or through your online banking portal before using it. The ACH routing number will typically be labeled as “electronic deposit” or “direct deposit.”

Cached

Why do I have 2 routing numbers

A bank or credit union may have more than one routing number. This is often the case with big banks like Bank of America and Chase Bank, which have two routing numbers in some states.

Should I choose ACH or wire

ACH transfers are generally free or low-cost, while wire transfers can cost anywhere from $25 to $50. In other words, a wire transfer is your best option f you need to make an urgent payment or transfer money overseas, Conversely, for domestic payments that can wait a few days, ACH transfers usually make more sense.

What is the difference between ACH and direct ACH

ACH transfers are electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. Direct deposits are transfers into an account, such as payroll, benefits, and tax refund deposits.

Does it matter which routing number in use

If you're not sure which routing number you'll need for a particular transfer type, you should check with your bank beforehand. Careful. Using the wrong number can lead to delays in processing the transfer.

When setting up direct deposit which routing number do you use

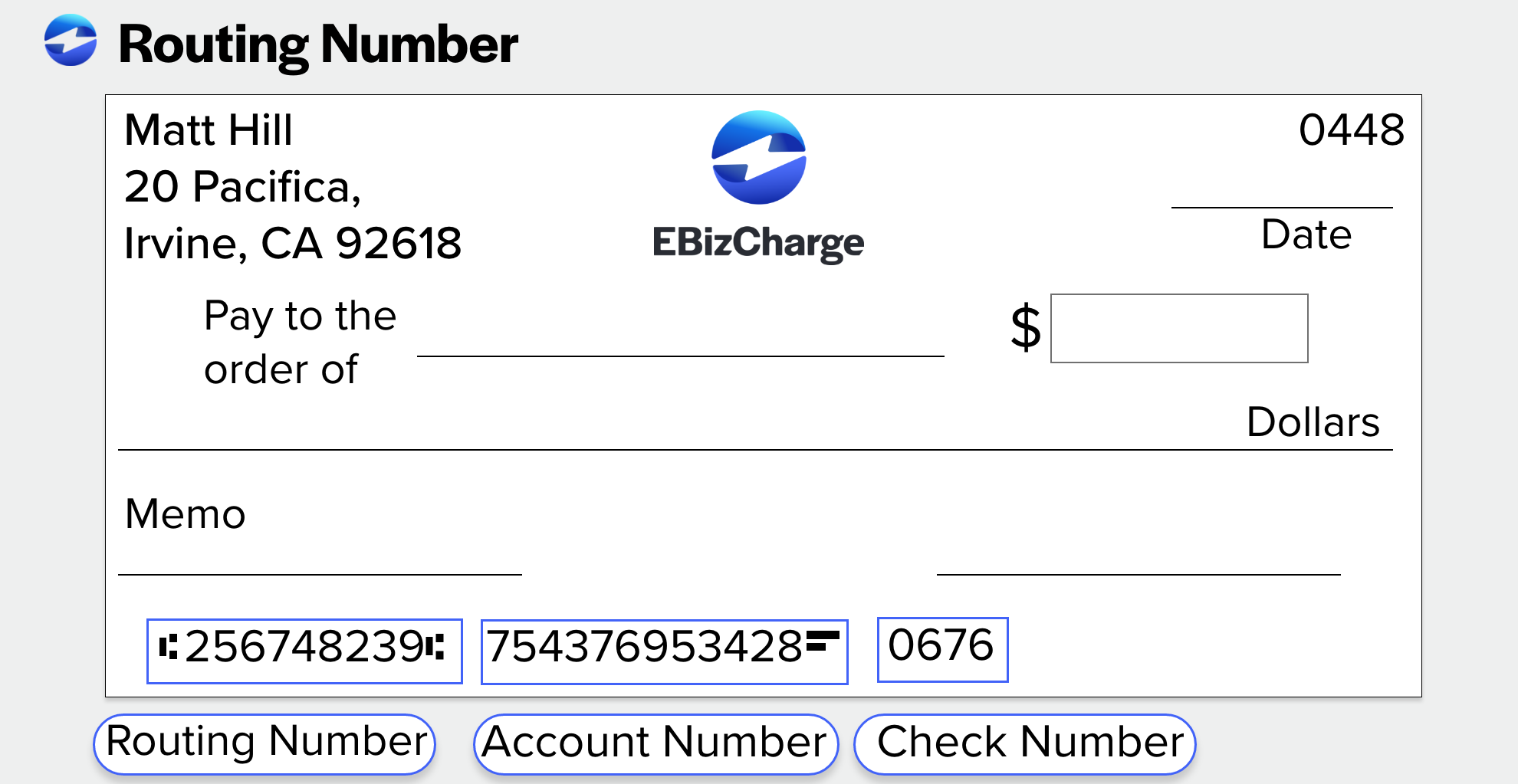

If you use your bank's direct deposit form, you'll likely need your employer's address. Bank's routing number. This is the nine-digit number, also known as the American Bankers Association — or ABA — number, printed on your bank statement or along the bottom left of your checks. Your account number.

Is domestic wire the same as ACH

Both ACH and wire transfers work in a similar way, but with different timelines and rules. Wire transfers are direct, generally immediate transfers between two financial institutions. ACH transfers, meanwhile, pass through the Automated Clearing House, and can take up to a few business days.

Can you use ACH for wire transfer

Availability: ACH transfers only work for domestic transactions. If you want to send funds abroad through the ACH network, you must do so using an international wire transfer.

Do you need routing number for ACH

It's needed for banks to identify where payments should be taken from and sent to. The routing number is used in conjunction with an account number to send or receive an ACH payment.

What are the two types of ACH payments

There are two types of ACH transactions: direct deposit and direct payment.

Why does my bank have 2 routing numbers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.

Why does my bank account have 2 routing numbers

Your Bank might have More than One Number

While no banks will ever have the same routing numbers, one bank might have multiple numbers. Banks often have separate routing numbers per type of transaction. Make sure you use the right routing number if you are transferring via wire, sending checks online, etc.

Do you use wire or electronic routing number for direct deposit

This brings us to a common question: is direct deposit a wire transfer The answer is no, direct deposits are a type of EFT.

Do I use paper or electronic routing number for direct deposit

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers. Transactions using ACH routing numbers “clear” faster (same or next day) than funds transferred on paper checks using ABA numbers.

Do I use domestic wire routing number

When sending a domestic bank wire, you will need to provide the recipient's name, address, bank account number, and ABA number (routing number).

Do you need routing number for ACH transfer

An ACH routing number is a 9-digit, unique numeric ID assigned to each banking institution in the US. It's needed for banks to identify where payments should be taken from and sent to. The routing number is used in conjunction with an account number to send or receive an ACH payment.

How do I perform an ACH transfer

How to make an ACH credit paymentLog into your normal online or mobile banking.Look for the option to make a payment or pay a bill.Follow the onscreen instructions to enter the recipient's banking information.Enter the payment amount, currency and date.

What information is required for ACH transfer

ACH Payment Requirements:The name of the financial institution receiving the funds (bank or credit union)The type of account at that bank (checking vs. savings)The ABA routing number of the financial institution.The recipient's account number.

Is ACH the same as routing

ACH routing numbers are different from ABA routing numbers since they're used specifically for electronic transactions. The first two digits of ACH routing numbers typically range from 61 to 72, whereas the first two digits of ABA routing numbers range between 00 and 12.