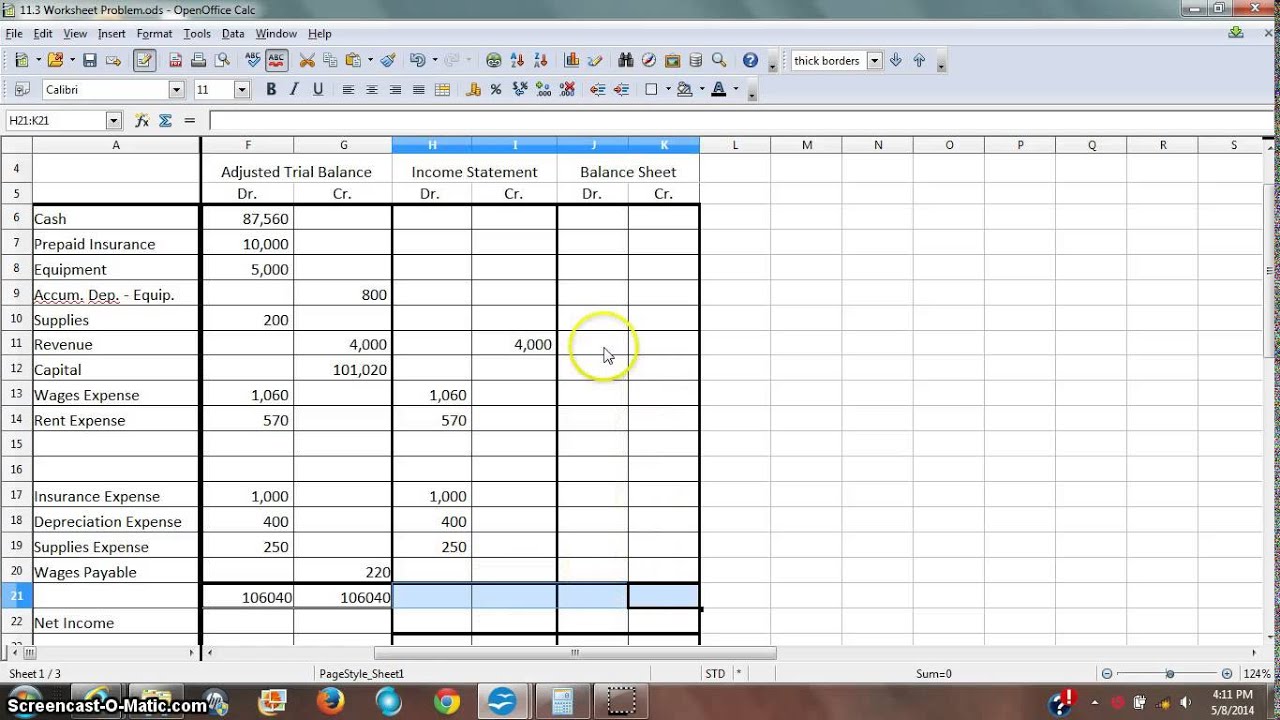

Which should be included in the income statement columns of a worksheet?

What goes in the income statement column

Also known as profit and loss (P&L) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

Which columns of a worksheet is net income entered into

Net income is entered as a debit at the bottom of the Income Statement section of the work sheet. On the same line, enter the net income amount in the Balance Sheet Credit column.

Cached

What is in the income statement and balance sheet columns

The Difference Between an Income Statement and Balance Sheet

Line Items Reported: The income statement reports revenue, expenses and profit or loss, while the balance sheet reports assets, liabilities and shareholder equity.

What is in the income statement column on the 10 column worksheet

4. Income Statement – these columns record the revenue and expense account balances from the adjusted trial balance.

Cached

What are the 3 columns in an income statement

Other names include the profit and loss statement, or the P&L. The income statement shows us three columns, the far-right column being the full year audited results, and the other two columns being six months for the period ended for the current year and the previous year in order to compare.

What are the two columns of the income statement

It consists of two columns: one for debit and one for credit. To use it effectively, you need to understand the basic principles of accounting.

Which of the following will not appear in the income statement columns of a worksheet

Unearned fees and prepaid expenses are not classified as costs of the period, and therefore, do not appear in the income statement. The net loss appears in the income statement and it shows the amount by which the company's costs exceed its revenues.

What types of data are entered into a worksheet

The data that you enter can be numbers, text, dates, or times. You can format the data in a variety of ways. And, there are several settings that you can adjust to make data entry easier for you. This topic does not explain how to use a data form to enter data in worksheet.

What is income statement in worksheet

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time.

Why are there two columns on an income statement

The purpose of using a two column journal is to keep track of all financial activities within an organization accurately. By having these records available, businesses can easily prepare their financial statements such as income statements and balance sheets.

What should be in a 10 column worksheet

The 10-column worksheet is an all-in-one spreadsheet showing the transition of account information from the unadjusted trial balance through the financial statements. Accountants use the 10-column worksheet to help calculate end-of-period adjustments.

What are the two columns in income statement

It consists of two columns: one for debit and one for credit. To use it effectively, you need to understand the basic principles of accounting.

How many columns are there in the income statement

There is a maximum of 30 columns that may be included on the Income Statement. When you attempt to add more than 30, you will receive Error: You cannot define more than 30 columns.

What are the three columns in an income statement

A statement of financial position is often formatted as a table with three columns. The first column lists the asset accounts, the second column lists liability or equity accounts and the final column contains totals for each section that are used to calculate net worth.

What are the 3 main parts of an income statement

The income statement presents revenue, expenses, and net income.

What is not found on an income statement

Income statements don't differentiate cash and non-cash receipts or cash vs. non-cash payments and disbursements. EBITDA (earnings before interest, taxes, depreciation, and amortization) can be included but are not present on all P&Ls.

Which item would not appear on the income statement

Answer and Explanation: (b) Dividends would not be found on an income statement. An income statement shows all the revenues and expenses of a company for a period of time, typically for a year.

What are the three types of data that can be entered into a worksheet

Entering text in a cell

You can enter three types of data in a cell: text, numbers, and formulas. Text is any entry that is not a number or formula. Numbers are values used when making calculations.

What are the 3 types of worksheet data

numbers, formulas, labels.

What is shown on an income statement

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement.