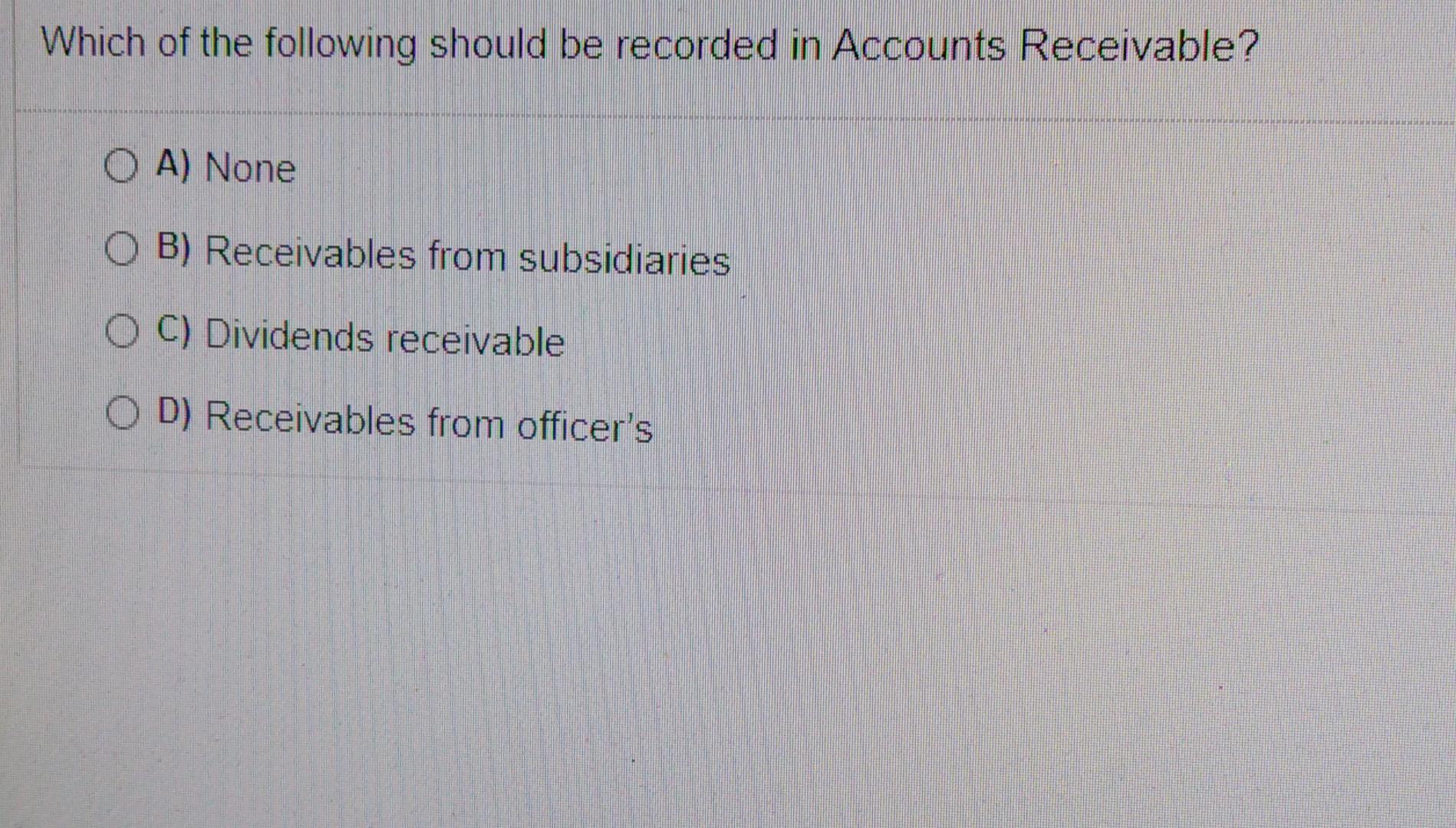

Which should be recorded in accounts receivable *?

Which should be recorded in accounts receivable

Your accounts receivable consist of all the unpaid invoices or money owed by your customers. Accounts receivable are recorded as an asset on your company's balance sheet. Understanding the importance of accounts receivable is very crucial for maintaining the good financial health of your business.

What goes up with accounts receivable

How to Interpret Accounts Receivable If a company's accounts receivable balance increases, more revenue must have been earned with payment in the form of credit, so more cash payments must be collected in the future.

What is accounts receivable reported at

Accounts receivable is reported under Current Assets on the balance sheet.

What are the different types of accounts receivable

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

Is accounts receivable recorded as an asset

Accounts receivable are considered an asset in the business's accounting ledger because they can be converted to cash in the near term. Instead, the business has extended credit to the customer and expects to receive payment for the transaction at some point in the future.

What goes with accounts receivable on journal entry

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

How do you report receivables

Report receivables at the net amount expected to be collected, after allowances for uncollectibles. The amount of the allowance can be presented on the balance sheet parenthetically, as a separate entry deducted from the receivables or in the notes to the financial statements.

Is accounts receivable recorded as debit or credit

debit

Accounts receivable is a debit, which is an amount that is owed to the business by an individual or entity. In this article, we explore how receivables work in a business, how accounts receivable processes ensure customers pay promptly, and how quicker payments can benefit your business.

What is an example of an accounts receivable asset

Let's take the example of a utilities company that bills its customers after providing them with electricity. The amount owed by the customer to the utilities company is recorded as an accounts receivable on the balance sheet, making it an asset.

What are the two most common receivables accounts

The two most common receivables are accounts receivable and notes receivable. Other receivables include interest receivable, rent receivable, tax refund receivable, and receivables from employees. Accounts receivableAmounts due from customers for credit sales; backed by the customer's general credit standing.

What type of assets are receivables

Accounts receivable are considered a current asset because they usually convert into cash within one year. When a receivable takes longer than one year to convert, it will be recorded as a long-term asset. In addition to accounts receivable, there are other current assets found on the balance sheet.

What type of account is accounts receivable

The amount of money owed to a business from their customer for a good or services provided is accounts receivable. Accounts receivable is recorded on your balance sheet as a current asset, implying the account balance is due from the debtor in a year or less.

What credit goes with accounts receivable

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you.

How do you record accounts receivable and payable

As mentioned earlier, accounts receivables are recorded under assets, while accounts payables are recorded under liabilities in the balance sheet. While managing APs is simply a matter of making payments, and recording due and completed payments, managing your AR requires some extra effort on your part.

How do you record accounts receivable on a balance sheet

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

How do you record accounts receivable and revenue

When a company makes a sale, they record the sale as revenue on their income statement. If the customer hasn't yet paid them for the sale, they then record the money owed as accounts receivable on their balance sheet. Accounts receivable offsets the amount listed on the income statement.

When an entry is recorded with a debit to accounts receivable

Remember, a debit to accounts receivable increases the account, which is an asset on a balance sheet. Then, when the customer pays cash on the receivable, the company would debit cash and credit accounts receivable. A credit to accounts receivable decreases the account.

What is an example of accounts receivable in general journal

Accounts Receivable Journal EntryAccounts receivables are the money owed to the company by the customers.Accounts receivables.E.g., The Indian Auto Parts (IAP) Ltd sold some truck parts to Mr.While making sales on credit, the company is well aware that not all of its debtors.Bad debts provision.

What are the 4 types of account receivable

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

What is the most common receivable

Accounts Receivable are the most common kind of receivable. Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 – 60 days. They are classified on the Balance Sheet as current assets.