Which would not be considered an extension of credit?

What is not considered an extension of credit under Reg O

Regulation O prohibits a member bank from extending credit to an insider that is not made on substantially the same terms as, or is made without following credit underwriting procedures that are at least as stringent as, comparable transactions with persons that are non-insiders and not employees of the bank.

Cached

What is considered extension of credit

(q) Extend credit and extension of credit mean the granting of credit in any form (including, but not limited to, credit granted in addition to any existing credit or credit limit; credit granted pursuant to an open-end credit plan; the refinancing or other renewal of credit, including the issuance of a new credit card …

Cached

What is an example of credit extension

Also, extend someone credit. Allow a purchase on credit; also, permit someone to owe money. For example, The store is closing your charge account; they won't extend credit to you any more, or The normal procedure is to extend you credit for three months, and after that we charge interest.

Is a mortgage an extension of credit

Section 1003.2(d) defines a closed-end mortgage loan as an extension of credit that is secured by a lien on a dwelling and that is not an open-end line of credit under § 1003.2(o).

Is an overdraft an extension of credit

Unlike non-sufficient funds penalties, where a financial institution incurs no credit risk when it returns a transaction unpaid for insufficient funds, clearing an overdraft transaction is extending a loan that can create credit risk for the financial institution.

Which extensions of credit are covered under Reg O

It covers, among other types of insider loans, extensions of credit by a member bank to an executive officer, director, or principal shareholder of the member bank; a bank holding company of which the member bank is a subsidiary; and any other subsidiary of that bank holding company.

Is a guarantee an extension of credit

A guarantee on an extension of credit is part of a credit transaction and therefore subject to the regulation. A creditor may require the personal guarantee of the partners, directors, or officers of a business, and the shareholders of a closely held corporation, even if the business or corporation is creditworthy.

Which of the following acts applies to the extension of credit

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

What should be considered when extending credit to customers

Decide how much credit you're willing to extend and how long you can afford to wait for payment. The terms can vary all the way from 10-day terms to 90 days or more. Requiring a certain percentage down can minimize your risk. Many companies do this on the first few purchase orders before they offer 100% financing.

Is a standby letter of credit considered an extension of credit

As it involves an extension of credit by the issuing bank, the application process is similar to the process of obtaining any loan.

What is overdraft extension

Essentially, it's an extension of credit from the financial institution that is granted when an account reaches zero. The overdraft allows the account holder to continue withdrawing money even when the account has no funds in it or has insufficient funds to cover the amount of the withdrawal.

Is a standby Letter of Credit considered an extension of credit

As it involves an extension of credit by the issuing bank, the application process is similar to the process of obtaining any loan.

What is ECOA extension of credit

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

Which of the following extensions of credit are exempted from the attribution rule

Section 223.16(c) of Regulation W exempts from the attribution rule an extension of credit to a nonaffiliate if (i) proceeds are used to purchase goods and services from an affiliate of the bank, and (ii) the extension of credit is made pursuant to and consistent with the conditions of a general purpose credit card.

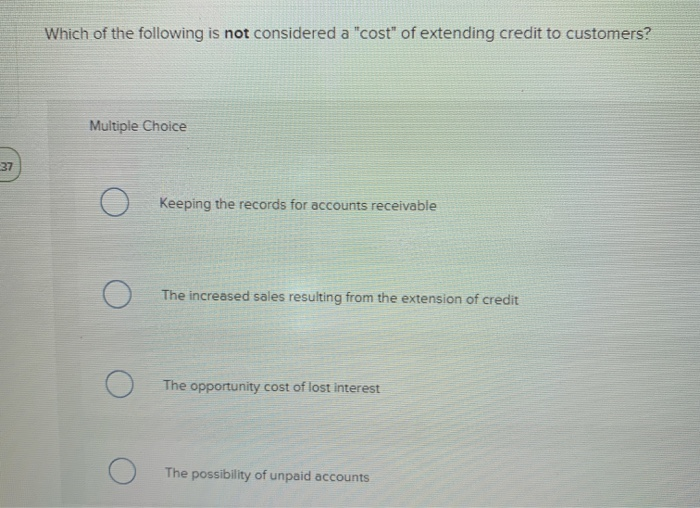

Which of the following is not considered a cost of extending credit to customers

Option c is the correct option

The increased sales resulting from the extension of credit is not a cost but rather it is a benefit for the company. By giving credit options, the company can attract more customers and increase its level of sales.

Which is not a benefit to extending credit to customers

What are the disadvantages to extending credit to customers The disadvantages of selling on credit include increased wage costs incurred in hiring personnel to monitor and track credit customers, bad debt costs from accounts that are collected late or not at all, and delayed receipt of cash.

Is overdraft protection a line of credit

Both overdraft protection and a credit card are personal lines of credit—loaning you funds which you must repay with interest. Overdraft protection is usually attached to a checking account, ensuring that checks don't get returned for insufficient funds.

What is not covered by ECOA

What loans are not covered by the ECOA Valuations Rule The ECOA Valuations Rule does not cover second liens and other subordinate loans and loans that are not secured by a dwelling (such as loans secured solely by land).

Which term is prohibited when extending credit to insiders

A bank is prohibited from extending credit to insiders unless the extension of credit is made on substantially the same terms (including interest rates and collateral) as, and following underwriting procedures that are not less stringent than, those prevailing at the time for comparable transactions by the bank with …

What is an example of extended cost

In accounting, an extended cost is the unit cost multiplied by the number of those items that were purchased. For example, four apples purchased at a unit cost of $1 have an extended cost of $4 (=$1 × 4 apples).