Who are the biggest buy now, pay later companies?

Who are the biggest players in BNPL

Top 10 buy-now-pay-later (BNPL) providers around the worldAfterpay. Afterpay is another indicator of the success of Australia's fintech ecosystem, with no fewer than four Antipodean BNPL firms on this list alone.Klarna.Affirm.Latitude.Tabby.Tamara.Zip.Splitit.

Cached

Who are the BNPL industry players

While PayPal, GooglePay, and other large financial companies offer BNPL, the biggest specific BNPL company is Afterpay, followed by Klarna and Affirm.

Cached

What companies allow you to pay later

The 5 best 'buy-now, pay-later' platforms of 2023Sezzle.Zip.Klarna.Afterpay.Paypal.

Cached

What are the largest BNPL companies by GMV

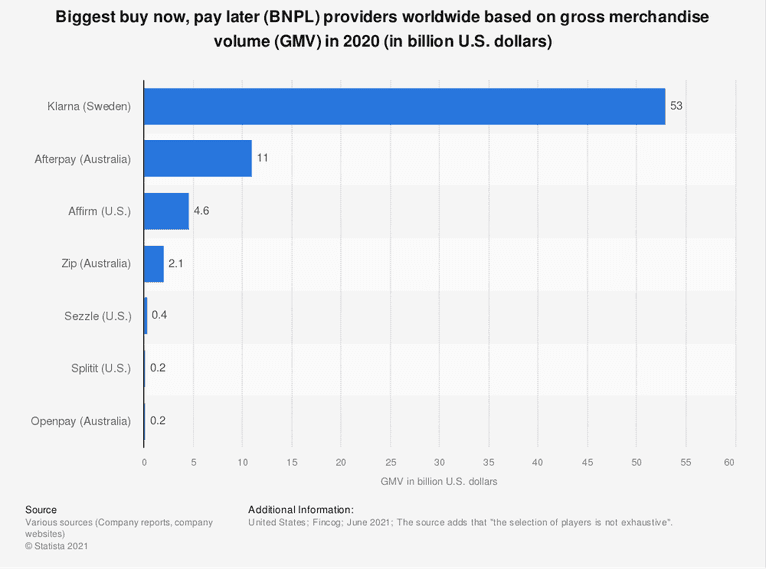

Klarna, Afterpay, and Affirm are the leading companies in the buy-now-pay-later (BNPL) sector. Klarna, however, dominates the market. As of June 2023, the Swedish fintech company reported 90 million active users, with a gross merchandising value (GMV) of 39 billion U.S. dollars.

What is the most common BNPL

Consumers claim to be paying for approximately 3.8 items in installments on average. The most frequent monthly installment amount ranges from $101 to $205. The average cost of the last item customers purchased using BNPL was $689.

Which is the largest BNPL market in the world

The US tops the BNPL market. According to recent research, BNPL users in the country have increased by 300% since 2023, with 45 million users in 2023.

Does Walmart have a buy now, pay later

Walmart financing with Affirm: buy now pay later with our payment option. Shop everything you need at Walmart—from household essentials to outdoor furniture and everything in between–and pay over time with Affirm.

What is the highest Afterpay limit

If you're an Afterpay user in good standing, you can contact the company and try to negotiate a higher spending limit. The maximum spending limit Afterpay will give you is $3,000.

How many companies are in the BNPL

More than 170 companies have now entered the BNPL market (data as of October 2023), with new solutions emerging every month. By 2025, the number of active users of BNPL will cross 76 million in the US. The global BNPL is expected to exceed $258 billion.

What percentage of Americans use BNPL

A new LendingTree survey shows about 46% of consumers used BNPL this year. That's up from 43% a year ago and 31% in 2023.

Does Walmart do 4 payment plans

Shop what you love from Walmart, without breaking your budget, when you split your purchase into 4 smaller payments with Klarna.

Who is Walmart partner with BNPL

Affirm

Walmart currently offers BNPL loans through a partnership with Affirm.

How do I get $3000 on Afterpay

Currently, customers receive an initial $600 credit limit via Afterpay, which can increase to up to $3,000 after payments are made consistently and on-time.

What is the highest limit on Klarna

No. There is no set limit for how many purchases you can place using Klarna.

What is the trend in the BNPL market in 2023

BNPL payments are expected to grow by 19.0% on an annual basis to reach US$112,953.0 million in 2023. The BNPL payment industry in United States has recorded strong growth over the last four quarters, supported by increased ecommerce penetration.

Does Target have payment plans

Pay over 3, 6, or 12 months. For example, you might pay $20.76/month for a $300 purchase at 15% APR for 12 months. You'll never pay more than what you agree to up front. There are no late fees or other hidden fees.

Does Walmart get Afterpay

Afterpay is a popular “buy now, pay later” service that allows customers to make purchases and pay for them in installments over a period of time. However, Walmart does not currently accept Afterpay as a payment method.

Does Amazon offer BNPL

As part of the new partnership, any Amazon Pay merchants in the U.S. can now choose to offer their customers the option to “buy now, pay later” using Affirm's technology.

Who is Amazon pay later partner

Amazon Pay Later is offered to you by Amazon Finance India Private Limited ("Amazon") in partnership with one of its third-party lending partners – axio (and its co-lender Karur Vysya Bank, "KVB") or IDFC FIRST Bank.

What is the highest limit for Afterpay

For Afterpay, the highest limit is $1,500 per transaction and customers can hold a maximum of $2,000 as outstanding balance, but these limits are variable and depend on a variety of factors such as payment history and frequency of on-time payments.