Who are the creditors of a bank?

Who is debtor and creditor in banking

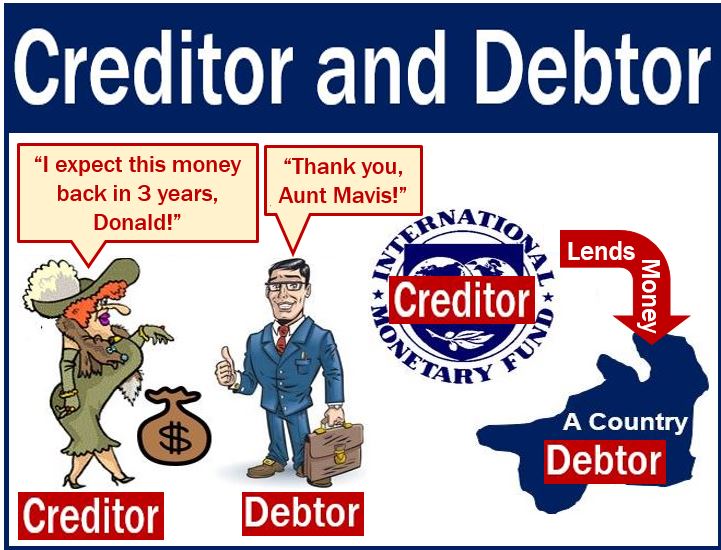

Creditors are individuals/businesses that have lent funds to another company and are therefore owed money. By contrast, debtors are individuals/companies that have borrowed funds from a business and therefore owe money.

What are examples of creditors

What is an example of a creditor Here are some common creditors you may encounter: Friend or family member you owe money to. Financial institution, like a bank or credit union, that extends you a personal loan, installment loan, or student loan.

Cached

Is a bank customer a creditor

The legal relationship between a customer and the bank is based on contract and is generally classified as a debtor-creditor relationship.

What are the three types of creditors

There are three types of bankruptcy creditors: secured, unsecured and priority. Secured bankruptcy creditors hold collateral for a debt, such as liens on personal or real property.

Who is the debtor of the bank

A debtor is a person or an entity that owes money to another, which could be any individual or institution (including the government). In most cases, the debtor has to pay interest on debt along with the principal debt.

Is a customer a debtor or creditor

Is a Customer a Creditor or Debtor Bank customers are debtors if they have a loan or owe the bank. Customers that buy goods or services and pay on the spot are not debtors. However, customers of companies that provide goods or services can be debtors if they are allowed to make payment at a later date.

What’s considered a creditor

A creditor is someone (or an entity) to whom an obligation is owed. Most commonly, the obligation owed is an obligation to pay money for some prior services or to pay off a loan. The person who owes a creditor an obligation is known as a debtor.

Who are the biggest creditors

As of January 2023, the five countries owning the most US debt are Japan ($1.1 trillion), China ($859 billion), the United Kingdom ($668 billion), Belgium ($331 billion), and Luxembourg ($318 billion).

Is Wells Fargo a creditor

While Wells Fargo is technically considered a creditor, or the original owner and issuer of debt, US court cases have also declared that Wells Fargo can be considered a debt collector in certain circumstances.

Who is also known as creditor

A creditor or lender is a party (e.g., person, organization, company, or government) that has a claim on the services of a second party. It is a person or institution to whom money is owed.

What are the most common creditors

Examples of common creditorsReal creditors: A real creditor is a financial institution, such as a bank or credit card issuer, that has a right to be repaid.Personal creditors: These are friends or family you owe money.

How do you classify creditors

“Secured creditor” and “unsecured creditor” are both defined terms in s. 2(1) of the CCAA. In short, what distinguishes a secured creditor from an unsecured creditor is that the debt owed to a secured creditor is secured by property that is pledged by the debtor as collateral for the obligation.

Is a banker a ____ debtor

a) Banker is only a debtor in respect of customer's money:

taken loan or any other form of financial accommodation from the banker, the customer becomes the debtor and the banker becomes the creditor.

What is the difference between lender and creditor

The creditor (aka the lender) lends money or issues credit to the debtor (aka borrower). The debtor then has a contractual obligation to pay back the debt, often with interest. If the borrower fails to pay back the debt, the creditor might have legal recourse and the ability to take the debtor to court.

Who is considered a creditor

According to the Consumer Financial Protection Bureau (CFPB), a creditor is “any person who offers or extends credit creating a debt or to whom a debt is owed.” A financial institution, individual or nonprofit could all be examples of creditors, so long as they lend money to another party.

Is my customer a creditor

In general, if a person or entity have loaned money then they are a creditor. Usually, each creditor has a specific agreement with their debtors about the terms of payment, discounts, etc.

What are the two types of creditors

Creditors provide credit to debtors, giving them permission to borrow money which will later be repaid.There are several types of creditors.Real creditors take the form of companies and financial institutions.Personal creditors are friends and family.Secured creditors conduct asset-based loans.

Is Bank of America a creditor

Sometimes, creditors like Bank of America may reach a settlement with you and then go behind your back and continue with the court case by filing a default judgment against you when you fail to Answer in time. After responding in court, use SoloSettle to send a debt settlement offer and begin the negotiation process.

Who is the US largest creditor

Japan and China have been the largest foreign holders of US debt for the last two decades.

Who are the United States biggest creditors

Investors in Japan and China hold significant shares of U.S. public debt. Together, as of September 2023, they accounted for nearly $2 trillion, or about 8 percent of DHBP. While China's holdings of U.S. debt have declined over the past decade, Japan has slightly increased their purchases of U.S. Treasury securities.