Who benefits from interchange fee?

How do companies make money from interchange fees

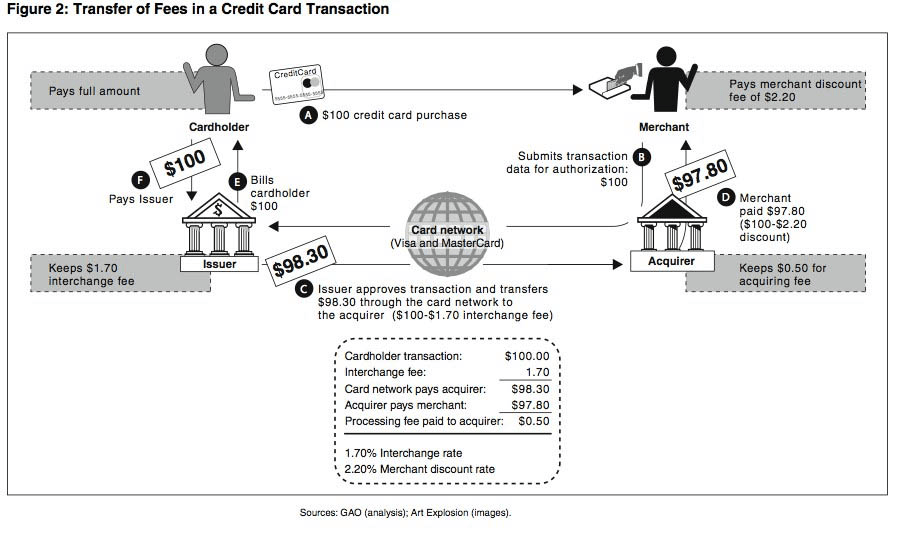

Every time a credit card transaction is done (Visa, Mastercard, AMEX, etc.), the payment processor pays the cardholder's bank an interchange fee. The business then pays the interchange fee back to the payment processor as part of the card processing fees. Interchange fees make up the largest part card processing fees.

What are the benefits of interchange

Why is Interchange Important Interchange is important because it helps drive the growth of the payment system. Interchange fees earned by card-issuing banks provide financial motivation for them to promote and issue more cards to more cardholders. Interchange also helps cover the risk associated with doing so.

Cached

Why are interchange fees important

Interchange delivers major benefits to consumers. Not only does it allow businesses to accept their cards, it contributes to the cost of fraud prevention and pays for the interest free days on credit cards.

Who controls interchange fee

How Interchange Rates Are Determined. Interchange rates are set by credit card companies such as Visa, MasterCard, Discover, and American Express. With Visa and MasterCard, the rate is set on a semiannual basis, usually in April and then in October. Other credit card companies might set their rates annually.

Cached

Do banks make money on interchange fees

Larger banks are subject to a regulation called the Durbin Amendment that caps interchange rates on consumer debit transactions. Smaller banks are exempt. As a result, these smaller banks can earn more revenue from interchange rates—and that benefits the fintechs and embedded finance businesses that partner with them.

Does visa make money from interchange

Get the latest information. Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Visa uses these fees to balance and grow the payment system for the benefit of all participants.

Do credit card companies use interchange to make money

Issuers earn money from merchants with transaction fees, including: Interchange Fees — Credit card issuers charge merchants an interchange fee with each transaction, usually as a percentage of the transaction of around 1% to 3%.

How much does visa make on interchange fees

1.4% – 2.5%

Average Interchange Rates

Visa: 1.4% – 2.5% Mastercard: 1.5% – 2.6% Discover: 1.55% – 2.5%

Why are interchange fees so high in the US

Banks attract customers with advantageous reward systems because they want to get your interchange fees. Interchange fees are also much higher in the U.S. than in Europe because there has been more fraudulent activity — the U.S. has switched to chip-and-pin cards years after Europe.

How much does Visa make on interchange fees

1.4% – 2.5%

Average Interchange Rates

Visa: 1.4% – 2.5% Mastercard: 1.5% – 2.6% Discover: 1.55% – 2.5%

Who makes money from card transactions

The money banks make from issuing credit cards comes from both cardholders and merchants. Profit from cardholders comes mostly from interest fees. However, banks can also profit from annual fees, transaction fees, and penalty fees.

How much do credit card companies make on interchange

about 1% to 3%

The portion of that fee sent to the issuer via the payment network is called “interchange,” and is usually about 1% to 3% of the transaction.

Can you avoid interchange fees

If you really want to avoid interchange fees, there's only one way to do it: Don't accept credit or debit cards. Depending on your industry, not accepting credit cards can hurt your bottom line even more than the fees.

Who do credit card companies make the most money off of

Credit card companies make the bulk of their money from three things: interest, fees charged to cardholders, and transaction fees paid by businesses that accept credit cards.

Do banks make money from card transactions

Banks Make Money With Interchange Fees

Retailers pay interchange fees every time a customer uses a credit or debit card in a sales transaction. Interchange fee rates are set by credit card companies and are normally a percentage of the purchase plus a flat rate.

What do credit card companies make the most profit from

Credit card companies make money by collecting fees. Out of the various fees, interest charges are the primary source of revenue. When credit card users fail to pay off their bill at the end of the month, the bank is allowed to charge interest on the borrowed amount.

What is the credit card billionaires use

What Credit Card Do the Super Rich Use The super rich use a variety of different credit cards, many of which have strict requirements to obtain, such as invitation only or a high minimum net worth. Such cards include the American Express Centurion (Black Card) and the JP Morgan Chase Reserve.

Who profits from interest on credit card debt

Credit card companies profit from the interest you pay on your credit card. In 2023, credit card issuers raked in $76 billion in interest fees. It's not hard to see how credit card companies can generate billions just on interest charges — the average U.S. household with credit card debt revolves over $8,000.

Do banks make money from every transaction

3. Banks Make Money With Interchange Fees. Retailers pay interchange fees every time a customer uses a credit or debit card in a sales transaction. Interchange fee rates are set by credit card companies and are normally a percentage of the purchase plus a flat rate.

What are 4 different ways credit card companies make money

Profit from cardholders comes mostly from interest fees. However, banks can also profit from annual fees, transaction fees, and penalty fees. Even if you don't pay any fees, banks will still profit from your credit card account as long as you make purchases.