Who can claim the recovery rebate credit?

Does everyone get recovery rebate credit

Generally, you are eligible to claim the Recovery Rebate Credit if: You were a U.S. citizen or U.S. resident alien in 2023. You are not a dependent of another taxpayer for tax year 2023.

Cached

Can I claim the recovery rebate credit on my taxes

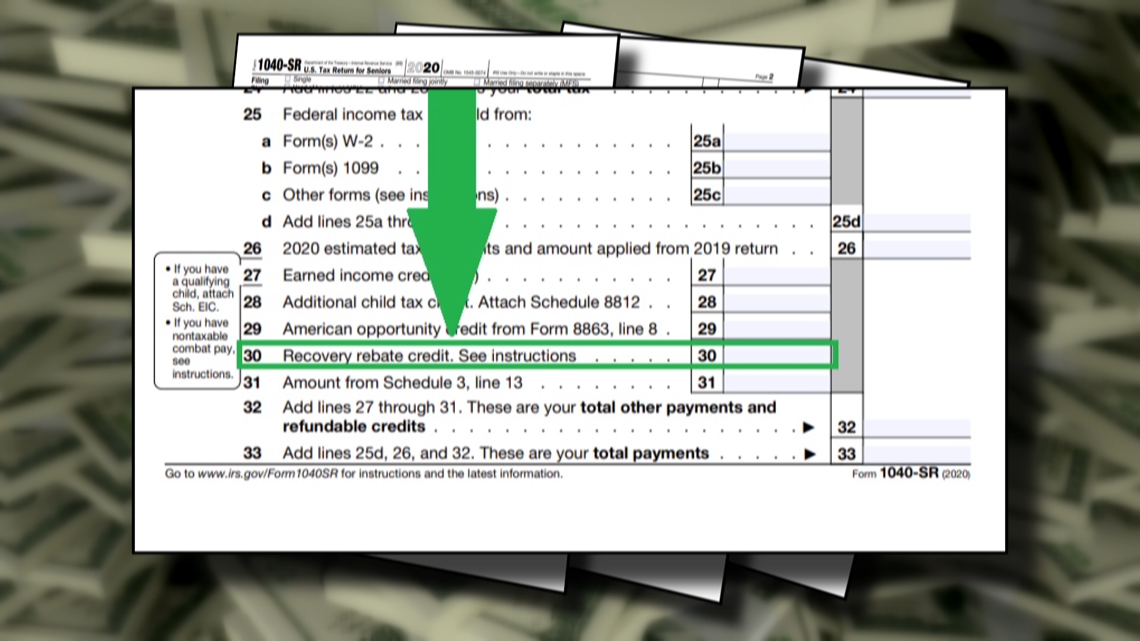

If you didn't get the full amount of the third Economic Impact Payment, you may be eligible to claim the 2023 Recovery Rebate Credit and must file a 2023 tax return – even if you don't usually file taxes – to claim it.

How do I know if I got the recovery rebate credit

Your Online Account: Securely access your IRS online account to view the total amount of your first, second and third Economic Impact Payment amounts under the Tax Records page. IRS Notices : We mailed these notices to the address we have on file.

Cached

Are Social Security recipients eligible for the Recovery Rebate credit

A valid SSN for the Recovery Rebate Credit claimed on a 2023 tax return is one that is valid for employment in the United States and is issued by the Social Security Administration (SSA) before the due date of your 2023 tax return (including an extension to October 15, 2023, if you requested it).

Who is not eligible for recovery rebate credit

You aren't eligible to claim the 2023 Recovery Rebate Credit if any of the following apply: You could be claimed as a dependent on another taxpayer's 2023 tax return. You're a nonresident alien.

What is the difference between the stimulus check and the recovery rebate credit

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

Who is not eligible for the recovery rebate credit

No credit is allowed when AGI is at least the following amount: $160,000 if married and filing a joint return or if filing as a qualifying widow or widower. $120,000 if filing as head of household or. $80,000 for all others.

Is the recovery rebate credit the same as a stimulus check

The income requirements for the recovery rebate tax credit are the same as for the stimulus payments. So if a stimulus check missed you or you received a partial payment, you may be eligible for additional cash if you file a federal tax return and claim the credit.

What is the income level for recovery rebate credit

Income thresholds changed.

However, the 2023 Recovery Rebate Credit amount is fully reduced to $0 more quickly. For example, individuals can't claim any credit with adjusted gross income of $80,000 or more if filing as single or $160,000 or more for if filing as married filing jointly.

Why did I get denied for recovery rebate credit

The 2023 Recovery Rebate Credit has the same income limitations as the third Economic Impact Payments. No credit is allowed if the adjusted gross income (AGI) amount on line 11 of your 2023 Form 1040 or Form 1040-SR is at least: $160,000 if married and filing a joint return or if filing as a qualifying widow or widower.

Who is eligible for the $1,400 stimulus check

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Why did I get recovery rebate credit

You qualify for the recovery rebate credit only if the IRS didn't give you a stimulus payment, or if you received a partial payment. To find out you whether you missed out on money you were entitled to, you can contact the IRS, review your IRS online account or use the tax agency's Get My Payment tool.

Why am I getting a recovery rebate credit

Qualifying for a Recovery Rebate Credit

Been a U.S. citizen or U.S. resident alien in 2023 and/or 2023. Not have been a dependent of another taxpayer for tax years 2023 and/or 2023. Had a Social Security number issued before the due date of your 2023 and/or 2023 tax return (including extensions).

Who Cannot get stimulus check

You won't get a stimulus check if your adjusted gross income (AGI) is greater than: $80,000, if your filing status was single or married and filing separately. $120,000 for head of household. $160,000, if your filing status was married and filing jointly.

Who qualifies for the $3,000 stimulus check

Families with children between 6 and 17 years old will get $3,000. As for extending the tax credit into 2023, President Joe Biden wants the child tax credit to continue into 2023. It was part of the president's Build Back Better plan.

Why am I not eligible for recovery rebate credit

You aren't eligible to claim the 2023 Recovery Rebate Credit if any of the following apply: You could be claimed as a dependent on another taxpayer's 2023 tax return. You're a nonresident alien.

Who is eligible for the $1400 stimulus check

Those with an adjusted gross income — which is gross income minus certain adjustments — of $75,000 or less are eligible to get the full $1,400. Those filing as head of household and earning at least $112,500 were not eligible for the stimulus payments.

Does everybody get a stimulus check

Eligible individuals with adjusted gross income up to $75,000 will automatically receive the full $1,200 payment. Eligible married couples filing a joint return with adjusted gross income up to $150,000 will automatically receive the full $2,400 payment. Parents also get $500 for each eligible child under 17.

Who is eligible for $2800 stimulus check

Under the terms, individuals could receive up to $1,400 through the third stimulus checks. Couples who file jointly could get up to $2,800. Additionally, eligible dependents could also receive $1,400. To qualify, you had to be either a U.S. citizen or resident alien in 2023.

Who gets the $2,000 stimulus check

Individuals who earn more than $87,000 a year. Couples who make more than $174,000 a year. Heads of household with adjusted gross income greater than $124,500. Individuals who earned more than $87,000 last year but are unemployed in 2023.