Who can I call about my non filers stimulus check?

How do I get my stimulus check if I’m a non filer

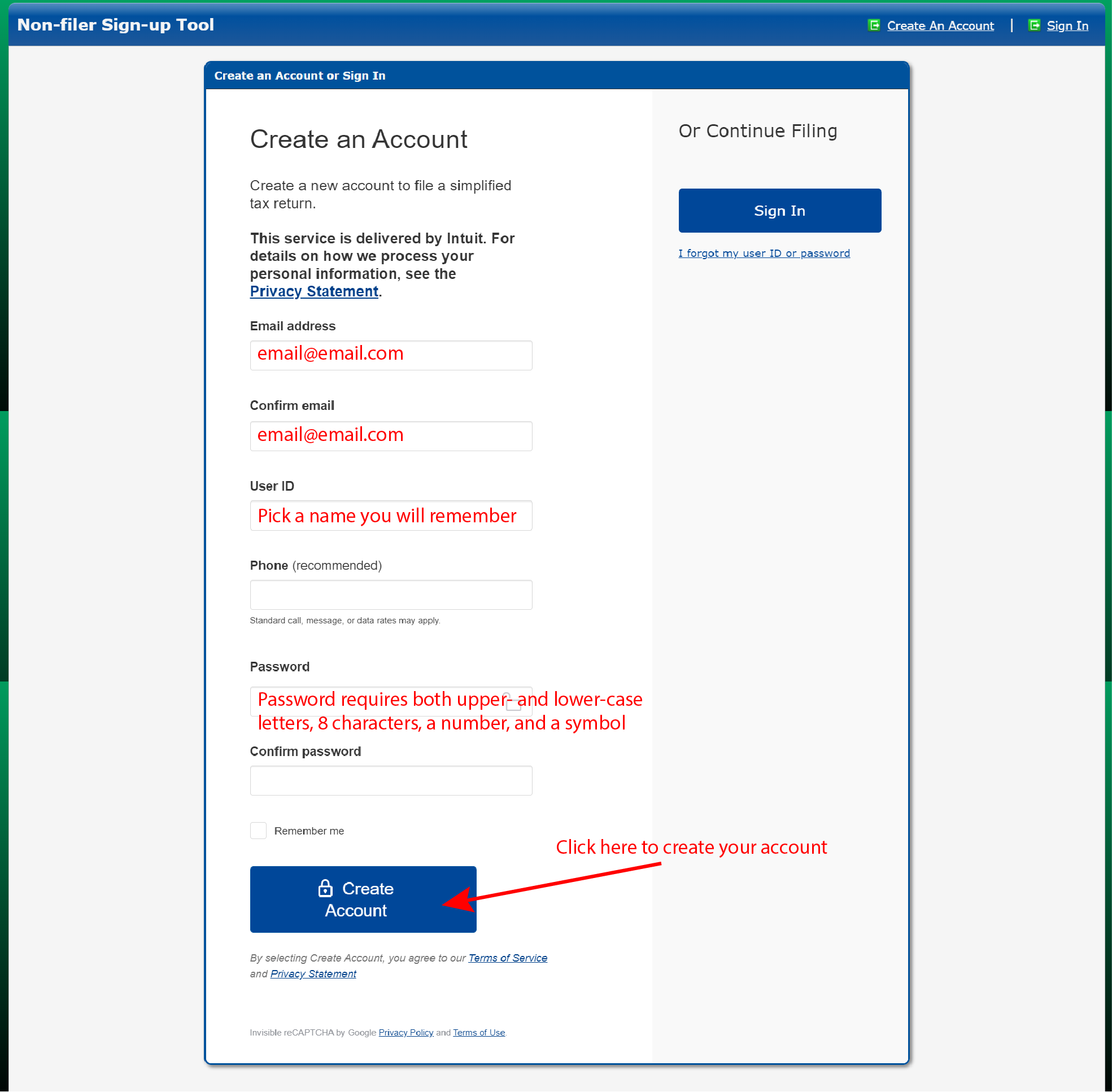

If you cannot use these options, you'll get your payment as a paper check.Step 1: Visit the IRS website to access the Non-filer form.Step 2: Create an account.Step 3: Fill out filing status, claim dependents, and provide banking information.Step 4: Fill out income and personal identification information.

Cached

How do I check my non-filers status

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Cached

Is it too late to claim stimulus money

It's not too late to claim any stimulus checks you might have missed! You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third one.

How do I call the IRS and speak to a live person

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

Can I still get stimulus if I didn’t file taxes

First and Second Stimulus Check

You will need to file a tax return for Tax Year 2023 (which you file in 2023). The deadline to file your taxes was last October 15, 2023. If you missed the October 2023 filing deadline, you can still file your tax return to get your first and second stimulus checks.

Can I still get my stimulus check 2023

Internal Revenue Service declared in Nov 2023 that many people are eligible to receive the benefit of Stimulus Check 2023. According to information released by the Federal Revenue Service late in 2023 on its official portal irs.gov, it is possible to get benefits in 2023.

Is the non filers form still available

Note: On November 21, 2023, the IRS closed the non-filer tool. To claim your stimulus checks, you will need to file a Tax Year 2023 tax return (filed in 2023). Learn how to claim the stimulus checks on your tax return here.

How long does it take for the IRS to process a non filers form

Mail or fax the completed IRS Form 4506-T to the address (or FAX number) provided on page 2 of Form 4506-T. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided on their request within 5 to 10 days.

Can you still file for stimulus payments

If you didn't receive the most recent stimulus payment, you can claim it when you file your 2023 tax return.

Can I still claim my stimulus checks

Any missing or partial third-round stimulus payments can be claimed on your 2023 federal tax return only. If you're behind on your returns, you have until Sept. 30 to file your 2023 taxes penalty-free. Taxpayers who got extensions to file their 2023 returns must submit those by Oct.

What phone number is 800 829 0922

Visit www.irs.gov/paymentplan for more information on installment agreements and online payment agreements. You can also call us at 1- 800-829-0922 to discuss your options. For information on how to obtain your current account balance or payment history, go to www.irs.gov/balancedue.

What is the best time to call the IRS

A good rule of thumb: Call as early in the morning as possible. Phones are open from 7 a.m. to 7 p.m. (your local time) Monday to Friday, except: Residents of Hawaii and Alaska should follow Pacific time. Puerto Rico hours are 8 a.m. to 8 p.m. local time.

How do I get a non filers form from the IRS

Available from the IRS by calling 1-800-908-9946. Non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 5 to 10 days from the time of the request.

Can I still file for my stimulus check in 2023

Internal Revenue Service declared in Nov 2023 that many people are eligible to receive the benefit of Stimulus Check 2023. According to information released by the Federal Revenue Service late in 2023 on its official portal irs.gov, it is possible to get benefits in 2023.

Will SSI get a 4th stimulus check

SSI and veterans will get this payment in the same way they got their first stimulus check.

Are people on SSI getting a stimulus check in 2023

Although the federal government has not authorized stimulus payments, if you receive an SSI check 2023, you may be entitled to money from the state where you live.

Can I still file for my stimulus check

If you missed the October 2023 filing deadline, you can still file your tax return to get your first and second stimulus checks. If you don't owe taxes, there is no penalty for filing late. To learn more about your options, read the IRS page Filing Past Due Tax Returns.

Can I still claim my stimulus check in 2023

You also may be able to claim missed stimulus checks through GetYourRefund.org which opens on January 31, 2023. If you didn't get your first, second, or third stimulus check, don't worry — you can still claim the payments as a tax credit and get the money as part of your tax refund .

Can you still claim the stimulus check 2023

The Internal Revenue Service stated late in 2023 that many people can still receive stimulus payments in 2023, or perhaps at least a rebate on their tax returns from previous years. This includes about 25 million Californians who could qualify.

What phone number is 800 829 7650

The state and IRS notices refer you to call 800-829-7650 or 800-829-3903 for assistance.