Who can take renovation loan?

Are renovation loans a good idea

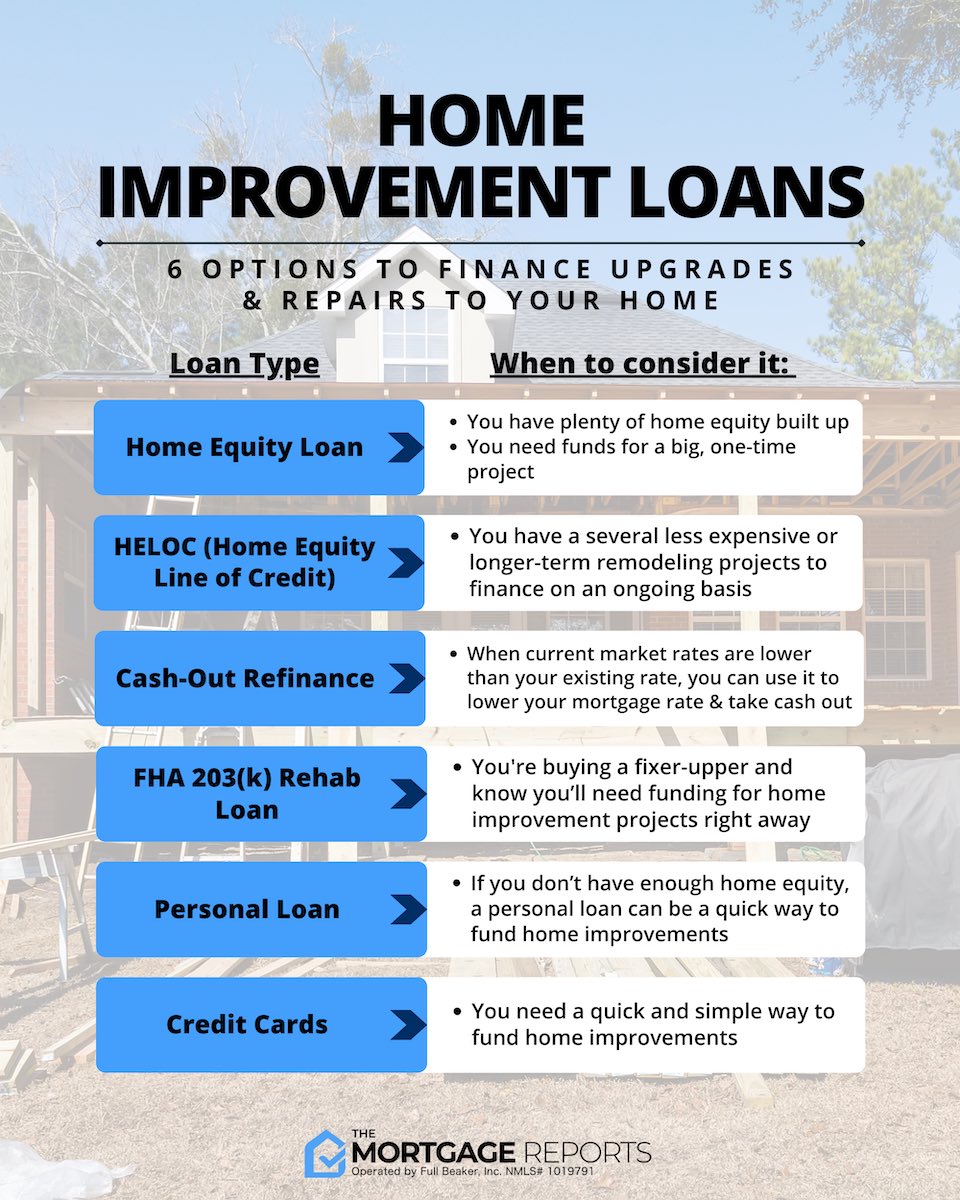

Home improvement loans are an important tool for homeowners who need to make essential or cosmetic changes to their space. Because they come with fixed interest rates and let you borrow a large lump sum at once, they are a useful way to make the payments more manageable.

What is a renovation loan

A renovation loan gives homeowners the funds to make necessary or desirable renovations to a home or access to the credit to make those changes. Renovation loans come in a variety of packages including simple personal loans or government-sponsored loans to get the job done.

Cached

Can renovations be loans

With a renovation loan, you need not tap into your savings and worry about cash flow. However, like a personal loan, a renovation loan comes with an interest rate, and it varies between banks. Note that a renovation loan can only be used for the intended purpose and cannot be diverted towards any other area of spend.

Are interest rates higher on renovation loans

So if the work is done poorly, or not at all, then the lender is at risk of losing money on the transaction. Because of these risk factors, home improvement loans typically have a slightly higher interest rate than other loan programs.

What is the debt to income ratio for a renovation loan

In general, most lenders consider DTI ratios below 43% to be optimal. You'll need a DTI of 50% or less to qualify for most conventional loans outside of RenoFi Loans, but it depends on the loan type and the lender.

What are the pros and cons of home renovation loans

The pros of a home improvement loan include building credit with on-time payments, being able to undertake large projects without having all the money up front, and increasing your home's value. The cons include the potential for fees and a high APR, as well as credit score damage if you don't make the payments.

What would the payment be on a 50000 home equity loan

Loan payment example: on a $50,000 loan for 120 months at 7.50% interest rate, monthly payments would be $593.51. Payment example does not include amounts for taxes and insurance premiums.

What is the downside to a home equity loan

Home Equity Loan Disadvantages

Higher Interest Rate Than a HELOC: Home equity loans tend to have a higher interest rate than home equity lines of credit, so you may pay more interest over the life of the loan. Your Home Will Be Used As Collateral: Failure to make on-time monthly payments will hurt your credit score.

What is the difference between a refinance and a top up loan

While refinancing is the act of switching to a new home loan, home loan top-ups are when you increase your existing home loan, allowing you to borrow more by using the equity in your home.

What is top up financing

A Top up loan meaning an extra loan is a financing option that is offered over and above the existing loan amount for products such as home loan and personal loan. The top-up loan is offered to customers who have an existing relationship with the lender, have a good credit score and have repayment ability.

What is too high for debt-to-income ratio

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high. The biggest piece of your DTI ratio pie is bound to be your monthly mortgage payment.

Can I get a mortgage with a 50% DTI

There's not a single set of requirements for conventional loans, so the DTI requirement will depend on your personal situation and the exact loan you're applying for. However, you'll generally need a DTI of 50% or less to qualify for a conventional loan.

Are home renovations worth the money

Remodeling can boost the return on investment (ROI) of a house. Wood decks, window replacement, and kitchen and bathroom upgrades tend to generate the highest ROIs. For cost recovery, remodeling projects generally must fix a design or structural flaw to earn back the cost of construction.

Is it better to pay off mortgage or renovate

Not only would you save money in interest costs, and reduce your repayment amount, but the renovation will (hopefully) increase the value of your home. If you're not looking at putting your home up for sale anytime soon, paying down the mortgage as fast as possible before renovating is often the sensible thing to do.

What credit score do you need for a home equity loan

In most cases, you'll need a credit score of at least 680 to qualify for a home equity loan, but many lenders prefer a credit score of 720 or more. Some lenders will approve a home equity loan or HELOC even if your FICO® Score falls below 680.

How much is a $50000 loan payment for 7 years

But if you take out a $50,000 loan for seven years with an APR of 4%, your monthly payment will be $683. Almost all personal loans offer payoff periods that fall between one and seven years, so those periods serve as the minimum and maximum in our calculations.

Is pulling equity out of your house a good idea

Pros of home equity loans

Taking out a home equity loan can help you fund life expenses such as home renovations, higher education costs or unexpected emergencies. Home equity loans tend to have lower interest rates than other types of debt, which is a significant benefit in today's rising interest rate environment.

What is the payment on a 50000 home equity loan

Loan payment example: on a $50,000 loan for 120 months at 7.50% interest rate, monthly payments would be $593.51.

What are the disadvantages of topping up a loan

The biggest disadvantage of top-up loans is that only existing home loan customers can apply for them. In addition, customers with poor track records cannot avail this facility. No tax advantage is available on top-up loan amounts raised for personal purposes.

What happens if I pay an extra $200 a month on my 30 year mortgage

If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.