Who does TD use for credit check?

Which credit report does TD Bank pull

Experian credit report

TD Bank. TD will usually pull your Experian credit report. See real-time data in our Credit Card Database.

Cached

What credit score company does TD use

Equifax

Get your free credit score in 3 easy steps

Step 3 — Select “Get your updated credit score.” The app will then connect to the credit reporting agency Equifax.

Is TD with Equifax or TransUnion

According to Loans Canada, CIBC, TD, HSBC, Desjardins, and Meridian Credit Union only use Equifax. Conversely, RBC, Laurentian Bank, and Vancity use TransUnion only. Many other lenders use both bureaus, like BMO, Scotiabank, National Bank, and Tangerine.

Does TD Bank do a hard pull

If one of the options works for you, choose it and continue to apply. At this step, TD will perform a hard credit pull, which can affect your credit score. You'll verify your info and get a decision on your loan by email.

Which banks pull Equifax only

Credit Cards That Use Equifax

Some of the major credit card companies that use Equifax include American Express, Bank of America, Capital One, Chase, Citi, Discover, and Wells Fargo. These companies use Equifax to verify your identity, check your credit history, and evaluate your credit score.

What bureau does Truist pull

According to reports, Truist uses either TransUnion, Equifax, or both, for checking an applicant's credit history.

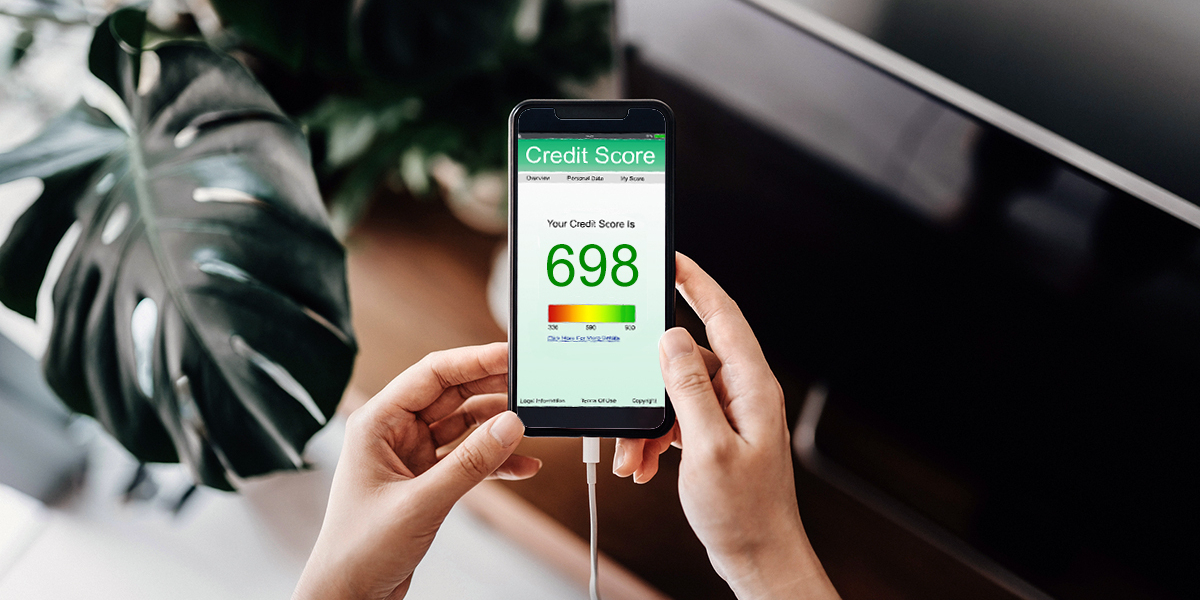

What is the minimum credit score for TD

A credit score of 660 or better is required for a personal loan if you have a TD Bank checking or savings account. If not, a score of 750 is required.

Which banks pull from Equifax

Some of the major credit card companies that use Equifax include American Express, Bank of America, Capital One, Chase, Citi, Discover, and Wells Fargo. These companies use Equifax to verify your identity, check your credit history, and evaluate your credit score.

Which is more accurate TransUnion or Equifax

Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Does TD Bank do a soft credit check

TD Bank only uses a soft pull of your credit, which does not affect your score, to pre-qualify potential borrowers, and your odds of approval are very high if you get pre-qualified.

Is Equifax stricter than TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Why is Equifax so much higher than TransUnion

One of the most evident differences between these two bureaus is that Equifax scores range from 280 to 850, but TransUnion scores range from 300 to 850. Regarding credit reports, Equifax includes 81 months of credit history, whereas TransUnion includes 84 months.

What credit score do you need for Truist

580 to 620

How does Truist compare to other lenders

| Minimum credit score | |

|---|---|

| Truist | 580 to 620 |

| AmeriSave | 600 to 700 |

| Rocket Mortgage | 580 to 620 |

Dec 5, 2023

What is the credit limit for Truist

Overdrafts or unforeseen expenses, a Truist Ready Now credit line has your back. Lines range from $300 to $7,500. No transfer fees. Available to clients with a Truist checking account.

What is TD Bank standard credit limit

TD Bank credit limits are $300 to $5,000, at a minimum, depending on the card. The TD Bank credit card with the highest starting credit limit is the TD First Class Credit Card, which is also rumored to offer limits as high as $18,000 to people with a lot of income.

Does TD have TransUnion credit score

TD Bank in the United States uses TransUnion.

Which banks pull TransUnion only

Which Banks Pull TransUnion OnlyAvianca.Apple Card – Goldman Sachs Bank.Barclays.Capital One.Synchrony Bank.U.S Bank.

Do banks check Experian or Equifax

This is because not all financial institutions report all the same information to credit reporting bureaus, although this is a rare case. However, most smaller lenders typically use Equifax.

Do most lenders look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.