Who generates credit note?

Who produces a credit note

A credit note is a document issued by a seller to a buyer to notify them that credit is being applied to their account.

How are credit notes generated

Some of the common reasons for which the seller issues a credit note are: On account of sales returned by the buyer due to quality issues, service rejection, or damaged goods receipt. Erroneously collected higher charges from the buyer or buyer paid amount is more than invoiced value.

Who makes credit note or debit note

The debit note, in this case, is given by the seller to the buyer. As an acknowledgment of the issuance of the debit card, the buyer issues a credit statement.

Who prepares credit memo

A credit memo is usually prepared by the accounts payable department of a business, but any seller of goods or services can prepare a credit memo if necessary.

Is credit note prepared by the supplier

A credit note is a letter sent by the supplier to the customer notifying the customer that he or she has been credited a certain amount due to an error in the original invoice. Or in other words, a receipt given by a shop to a customer who has returned goods, which can be offset against future purchases.

How do I request a credit note from a supplier

To Request a Credit Note from Supplier: Establish communication with your supplier by email, phone, or in person; Address the problem that you are having with them; Request a credit note from your supplier.

Where are credit notes issued

A credit note is a financial document issued by supplier companies to reduce the amount owed to them by the buyers. It helps firms maintain a proper paper trail and is issued when the goods are returned, the price is under dispute, or when there are invoicing errors.

How do I record a credit note from a supplier

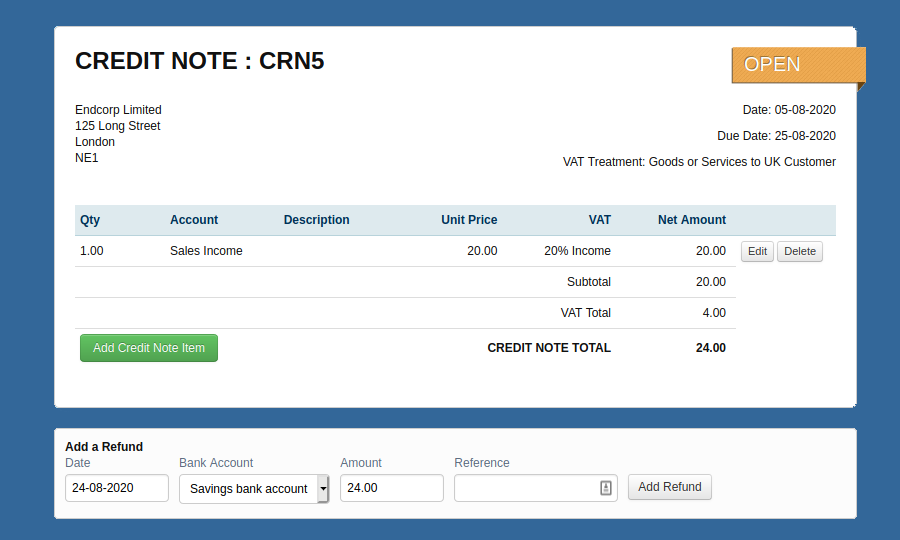

Enter the details of the credit note into the following fields:Supplier: The name of your supplier.ID: A unique number for your records.Supplier Credit No: The number assigned by the supplier.Date: The date of the credit note.Qty: The quantity of goods or services returned (e.g. 15 kilograms or 8 hours).

Where do credit memos come from

A credit memo, or credit memorandum, is sent to a buyer from a seller. This document is issued to a buyer after an invoice is sent out. A credit memo may reduce the price of an item purchased by a buyer or eliminate the entire cost of an item.

Is a credit memo issued by the credit manager

A credit memorandum (memo) is issued by a seller of goods or services to the buyer. The memo reduces the amount that the buyer owes to the seller. The credit issued can be for part or all the respective invoiced amount and is posted against the buyers outstanding balance.

Is a credit note prepared by debtor or creditor

A credit note is a letter sent by the supplier to the customer notifying the customer that he or she has been credited a certain amount due to an error in the original invoice. Or in other words, a receipt given by a shop to a customer who has returned goods, which can be offset against future purchases.

Can customers issue credit notes to suppliers

The credit memos are recorded in red ink to indicate a liability or reduced sales on the supplier or seller side. Buyers can also issue these notes if they are undercharged or paid less than the invoiced amount.

Can banks issue credit notes

It can also be a document from a bank to a depositor to indicate the depositor's balance is being in the event other than a deposit, such as the collection by the bank of the depositor's note receivable.

Why would a company issue a credit note

A credit note is issued to a buyer to indicate debt, typically with reference to a previously issued invoice and/or purchase. A credit note might be issued to correct a mistake, or if goods are returned or if items fail while under guarantee.

Is a credit note issued by a supplier

A credit note is furnished by the supplier when the goods supplied are damaged or when a wrong item is delivered to the buyer. When a seller charges more than the actual price of the goods or services being rendered, he/she issues a memo to reverse the extra sum, which is known as a credit note.

Why would a bank issue a credit memo

Credit memos from a bank are usually in regard that a bank if reversing some sort of transaction in which the bank made a payment it should not have, or the bank may have made a collection upon a note receivable or a certificate of deposit.

What is the difference between a credit memo and a credit note

Credit notes act as a source document for the sales return journal. In other words, the credit note is evidence of the reduction in sales. A credit memo, a contraction of the term "credit memorandum", is evidence of a reduction in the amount a buyer owes a seller under an earlier invoice.

What is the difference between debt note and credit note

A debit note is a notification and request for a debt obligation to be paid. A credit note is issued to correct errors or changes made to an existing invoice or order. The issuance of both types of notes helps to maintain accounting records and provide clarification on the negative or positive amount owed.

Which department should issue credit note

Credit notes are issued by and to accounting departments – i.e., along the same channels regular invoices are issued.

Can a buyer issue a credit note

A credit note is issued in exchange for a debit note. The seller issues debit notes to the buyer if the buyer is undercharged or the seller has sent additional goods. The buyer issues a credit note as an acknowledgement of a debit note received. It is issued in blue ink.