Who is the biggest buy now, pay later?

What is the largest buy now pay later company

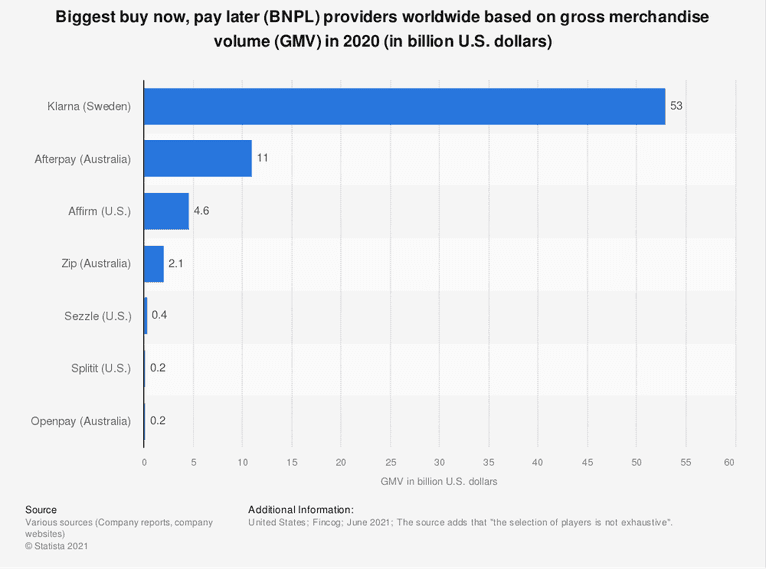

With millions of users, Klarna and Afterpay are the two biggest BNPL companies, according to a 2023 report from yStats.com. Both companies work with tens of thousands of retailers and are responsible for millions of transactions.

Cached

Who are the biggest players in BNPL

Top 10 buy-now-pay-later (BNPL) providers around the worldAfterpay. Afterpay is another indicator of the success of Australia's fintech ecosystem, with no fewer than four Antipodean BNPL firms on this list alone.Klarna.Affirm.Latitude.Tabby.Tamara.Zip.Splitit.

Cached

Who are the BNPL industry players

While PayPal, GooglePay, and other large financial companies offer BNPL, the biggest specific BNPL company is Afterpay, followed by Klarna and Affirm.

Cached

How many people in the US use buy now pay later

“Buy now, pay later” (BNPL) services have firmly established themselves as a credit tool used by millions of Americans. Between the first quarter of 2023 and the first quarter of 2023, 17% of Americans borrowed using BNPL, a new report by the Consumer Financial Protection Bureau (CFPB) on consumer use of BNPL states.

What is the largest Afterpay limit

Limits can be increased as customers show they can make repayments, to a maximum of $3000.

What is the highest Afterpay limit

If you're an Afterpay user in good standing, you can contact the company and try to negotiate a higher spending limit. The maximum spending limit Afterpay will give you is $3,000.

What is the BNPL prediction for 2023

Global BNPL payments are expected to grow by 21.7% on an annual basis to reach US$527,942.3 million in 2023. Global BNPL Payment industry has recorded strong growth over the last four quarters, supported by increased ecommerce penetration.

What is the trend in the BNPL market in 2023

BNPL payments are expected to grow by 19.0% on an annual basis to reach US$112,953.0 million in 2023. The BNPL payment industry in United States has recorded strong growth over the last four quarters, supported by increased ecommerce penetration.

What is the most used online payment in the US

We asked U.S. consumers about "Most used online payments by brand" and found that "PayPal" takes the top spot, while "Skrill" is at the other end of the ranking. These results are based on a representative online survey conducted in 2023 among 4,290 consumers in the United States.

Who uses Afterpay the most

Fashion still dominates purchasing using Afterpay: it accounts for 80 per cent of Gen Z spend and 70 per cent of Millennial spend. However, these younger generations are displaying increasing interest in buying for their homes and spending on recreation such as books, electronics and games.

How do I get $3000 on Afterpay

Currently, customers receive an initial $600 credit limit via Afterpay, which can increase to up to $3,000 after payments are made consistently and on-time.

What’s the highest limit on Klarna

There is no predefined spending limit when using Klarna.

How big is the BNPL market in 2023

The Buy Now Pay Later (BNPL) market size will be valued at $309.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 25.5% over the forecast period. Online payments are rapidly growing as more consumers are taking advantage of online shopping thereby favoring BNPL market growth.

What is the future of BNPL in USA

The market for buy now, pay later (BNPL), an alternative to credit cards whose popularity exploded during the pandemic, could surge to nearly $3.7 trillion by 2030 as more consumers take advantage of ways to pay for goods and services in interest-free installments instead of lump sums.

What markets will boom in 2023

Three Key Sectors in Which to Invest in 2023Consumer staples.Precious metals.Healthcare.

Is there a future for BNPL

Whichever way you look at it, it seems as though BNPL is here to stay. Much-needed regulation is on its way and the march of innovation will see a wider range of data points broaden access to this type of credit. Certainly, people will continue to buy now and worry about the cost later. That will never change.

Who is the biggest payment processing

Top Leading Companies in the Payment Processing Solutions Market: Top 10 By RevenuePayPal Holdings Inc.PhonePe.PayU.Block Inc.Global Payments Inc.Mastercard Incorporated.Visa Inc.Google.

Which is the most used digital payment app

Paytm. One of the most successful online payment applications in the Indian fintech industry.

What is the highest amount for Afterpay

Currently, customers receive an initial $600 credit limit via Afterpay, which can increase to up to $3,000 after payments are made consistently and on-time.

What is the highest limit for Afterpay

For Afterpay, the highest limit is $1,500 per transaction and customers can hold a maximum of $2,000 as outstanding balance, but these limits are variable and depend on a variety of factors such as payment history and frequency of on-time payments.