Who qualifies for Roundup settlement?

What proof do you need for Roundup lawsuit

Gather evidence that you were exposed to Roundup at work, on the farm, or at home. This is an extremely important aspect of your claim. These include receipts of purchase, used bottles, standard operating procedures if you've been exposed at work, or landscaping invoices.

Cached

What is the average settlement per person for Roundup

The global Roundup settlement amount is $10.9 billion, and lawyers estimate claimants could get between $5,000 and $250,000, depending on their injuries. The average settlement amount could be about $160,000 per plaintiff, according to experts.

Cached

Is it too late to join the Roundup lawsuit

It's not too late to file a claim against Bayer-Monsanto for glyphosate-related cancer. So long as there are still cases pending, you can contact our OnderLaw Roundup team to discuss your potential case. Time is ticking, however. Once these cases are resolved, it will be too late to be compensated.

Who is eligible for Roundup class action

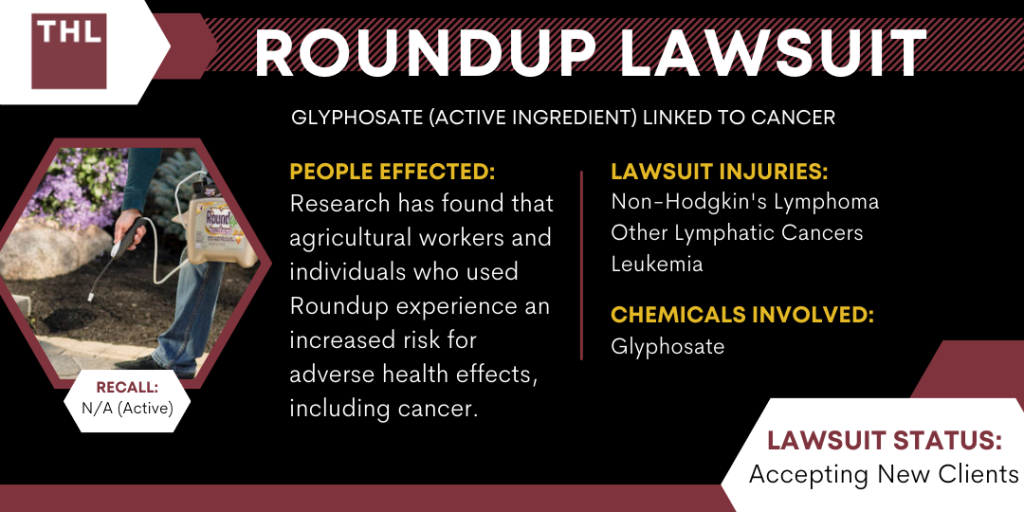

If you had repeated, significant exposure to Roundup and later developed cancer, such as non-Hodgkin's lymphoma, you could be eligible to join this Roundup cancer lawsuit investigation.

Cached

Has anyone received any money from the Roundup lawsuit

Over 80% of Roundup Lawsuits, which amount to over 100,00 cases, have been settled. The landmark $10 billion settlement agreement includes $1.25 billion for future Roundup claims. If you or a loved one suffered injuries resulting from Roundup weed killer exposure, you may qualify to participate in a Roundup lawsuit.

Do you have to pay taxes on Roundup settlement checks

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code.

What is the statute of limitations on the Roundup lawsuit

The Law Limits Your Time to File a Lawsuit

In most Roundup injury cases, the statute of limitations begins running when you know or should have known about your non-Hodgkin's lymphoma diagnosis. Generally, you will have two years to file your case. However, you shouldn't wait that long to pursue a legal recovery.

Are people getting paid from Roundup lawsuit

Has anyone received money from Roundup Lawsuit Yes, there have been a number of people who have received money as part of a Roundup verdict or settlement. Bayer/Monsanto reached an $11 billion settlement with most of the plaintiffs. Approximately 80% of all filed Roundup claims have been settled.

How long does it take to get a Roundup settlement

How long future Roundup claims will take to settle depends on several factors, including the claim's value (higher-valued claims generally take longer to settle) and whether the claim is or becomes part of multi-district litigation. Most claimants in past cases have received a settlement within two to three years.

Do I have to report settlement money to IRS

If you receive a settlement in California that is considered taxable income, you will need to report it on your tax return. You will typically receive a Form 1099-MISC, which reports the amount of taxable income you received during the year.

How much compensation for using Roundup

June 2023: Bayer offered $10.9 billion to settle about 100,000 Roundup weed killer lawsuit claims. May 2023: California state jury awarded $2 billion to a Roundup plaintiff. March 2023: California state jury awarded $80 million to a Roundup plaintiff.

Will IRS take my settlement check

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code.

How do I protect my settlement money

First, you can keep your personal injury settlements separate from all other forms of income and keep that money in a separate bank account. This will prevent creditors from being able to take that money away from you in the future. Another option is to use a prepaid credit card.

Has anyone won a lawsuit against Roundup

30,000 Roundup Cases Left… and Counting. As of December 2023, Monsanto has reached settlement agreements in nearly 100,000 Roundup lawsuits. Monsanto paid approximately $11 billion.

How much will the IRS usually settle for

How much will the IRS settle for The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

Can the IRS take my settlement money

And, the IRS cannot garnish any portion of your workers' compensation settlement. However, once the settlement is finalized and you come into possession of your settlement proceeds, this doesn't mean that the IRS cannot then attempt to take legal action against you to recover any money owed.

How do I cash a large settlement check without a bank account

Cash a Check without a Bank AccountCash it at the issuing bank (this is the bank name that is pre-printed on the check)Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.)Cash the check at a check-cashing store.

Does the IRS ever settle for less

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

How hard is it to get an offer in compromise with the IRS

But statistically, the odds of getting an IRS offer in compromise are pretty low. In fact, the IRS accepted only 15,154 offers out of 49,285 in 2023. It's not impossible, though. Here's how an IRS offer in compromise works, what it takes to qualify and what to know about the program.

What happens when you deposit over $10000 check

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.