Who qualifies for the military lending Act?

What loans are covered by military lending Act

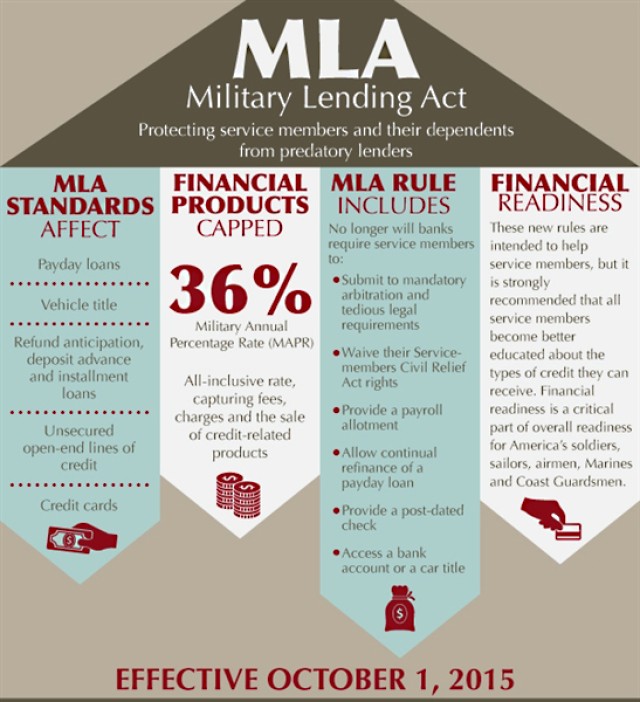

What Loans Are Covered Under the Military Lending ActUnsecured installment loans.Credit cards.Payday loans, vehicle title loans, deposit advance products, pawn loans and tax refund anticipation loans.Overdraft lines of credit (not traditional overdraft services)Some student loans.

Cached

What loans are exempt from MLA

Some loans are exempt from the MLA however. These include: • Residential mortgage loans; • A loan for the purchase of and secured by a motor vehicle; and • A loan for the purchase of and secured by personal property. Is the MLA rule only for open end lending Not necessarily.

What does the military lending Act require for banks

Requires creditors to provide written and oral disclosures in addition to those required by TILA; Prohibits certain loan terms, such as prepayment penalties, mandatory arbitration clauses, and certain unreasonable notice requirements; and. Restricts loan rollovers, renewals, and refinancing by some types of creditors.

Cached

How does military lending Act operate

The Military Lending Act is a federal law that provides special protections to members of the military community against certain lending practices. Under the MLA, creditors may not charge more than a 36% Military Annual Percentage Rate on a wide range of credit products.

Cached

What type of loan is available to military families

VA Purchase Loan Allows qualified service members to buy a home with no minimum down payment. VA Interest Rate Reduction Refinance Loan (IRRRL) Replaces current VA mortgage with a VA loan to lower interest rate or to refinance from an adjustable to a fixed rate.

What are two things under the MLA that creditors Cannot do

A creditor cannot: • Use the title of a vehicle as security for the obligation involving the consumer credit. prepaying all or part of the consumer credit. after the extension of credit in an account established in connection with the consumer credit transaction.

What types of loans are exempted from bank lending limits

Some loans are not subject to loan limits, such as loans secured by U.S. obligations, bankers' acceptances, or certain types of commercial paper, among others.

What is the difference between SCRA and military lending Act

The MLA provides protections to servicemembers and their dependents for credit extended while the servicemember is serving on active duty. In contrast, the SCRA protects servicemembers and their dependents with obligations incurred prior to entry into active duty.

Do I qualify for a VA loan if my father was in the military

No. The children of veterans, deceased veterans and service members are not eligible for VA loans. In addition, preexisting VA loans may not be transferred to the children of veterans, deceased veterans or service members. This applies to dependent and nondependent children.

Who are eligible borrowers on a VA loan

“To qualify for a VA loan as a veteran or service member, you must have served at least 90 consecutive days of active duty service during wartime, 181 active-duty service days during peacetime, or six service years in the National Guard,” says Eric Nerhood, owner of Premier Property Buyers.

What is the difference between the military lending Act and the SCRA

SCRA and MLA are two different laws that serve to provide financial protection for servicemembers and their families during times of need. The SCRA provides additional protections for those who are already members of the military, while the MLA expands the scope of financial products covered by federal law.

What is the penalty for violating the military lending Act

Knowingly violating the MLA or its implementing regulation is a misdemeanor under the criminal code of the United States. Penalties include a fine and imprisonment of not more than one year.

What types of loans are not covered by the Truth in lending Act

What Is Not Covered Under TILA THE TILA DOES NOT COVER: Ì Student loans Ì Loans over $25,000 made for purposes other than housing Ì Business loans (The TILA only protects consumer loans and credit.) Purchasing a home, vehicle or other assets with credit and loans can greatly impact your financial security.

What type of loans are exempt from Regulation Z

The following loans aren't subject to Regulation Z laws: Federal student loans. Credit for business, commercial, agricultural or organizational use. Loans that are above a threshold amount.

What loans are not covered under SCRA

Obligations NOT Covered by These Statutes

SCRA: Any obligation that is entered into after the start date of military service. MLA: Mortgages (secured by real estate) Car/boat/mobile home loans (secured by the asset)

Who is not covered by the SCRA

The SCRA does not apply to criminal cases, only civil cases. Civil cases are those in which one individual or business sues another to protect, enforce, or address private or civil rights.

Can I get a VA home loan if my parent is a veteran

No. The children of veterans, deceased veterans and service members are not eligible for VA loans. In addition, preexisting VA loans may not be transferred to the children of veterans, deceased veterans or service members. This applies to dependent and nondependent children.

Does a child of a veteran qualify for a VA loan

A: No, the children of an eligible veteran are not eligible for the home loan benefit.

What disqualifies me from the VA loan

Dishonorable Discharge

Veteran status requires that service members are discharged or released from the military under conditions other than dishonorable. A veteran with a dishonorable discharge will not be eligible to participate in the VA Loan Guaranty program.

Can all Veterans get a VA loan

You meet the minimum active-duty service requirement if you served for: At least 90 days of non-training active-duty service, or. At least 90 days of active-duty service including at least 30 consecutive days (your DD214 must show 32 USC sections 316, 502, 503, 504, or 505 activation), or.