Who routing number is 071000013?

What is the routing number for JP Morgan Chase wire transfers

021000021

Chase routing numbers for wire transfers

The domestic and international wire transfer routing number for Chase is 021000021.

What is Columbus Chase routing

Chase Ohio routing numbers

The routing number for Chase in Ohio is 044000037 for checking and savings account.

What is the routing number for Charles Schwab

121202311

The routing number for all Charles Schwab Bank accounts is 121202311.

What is a Chase account number

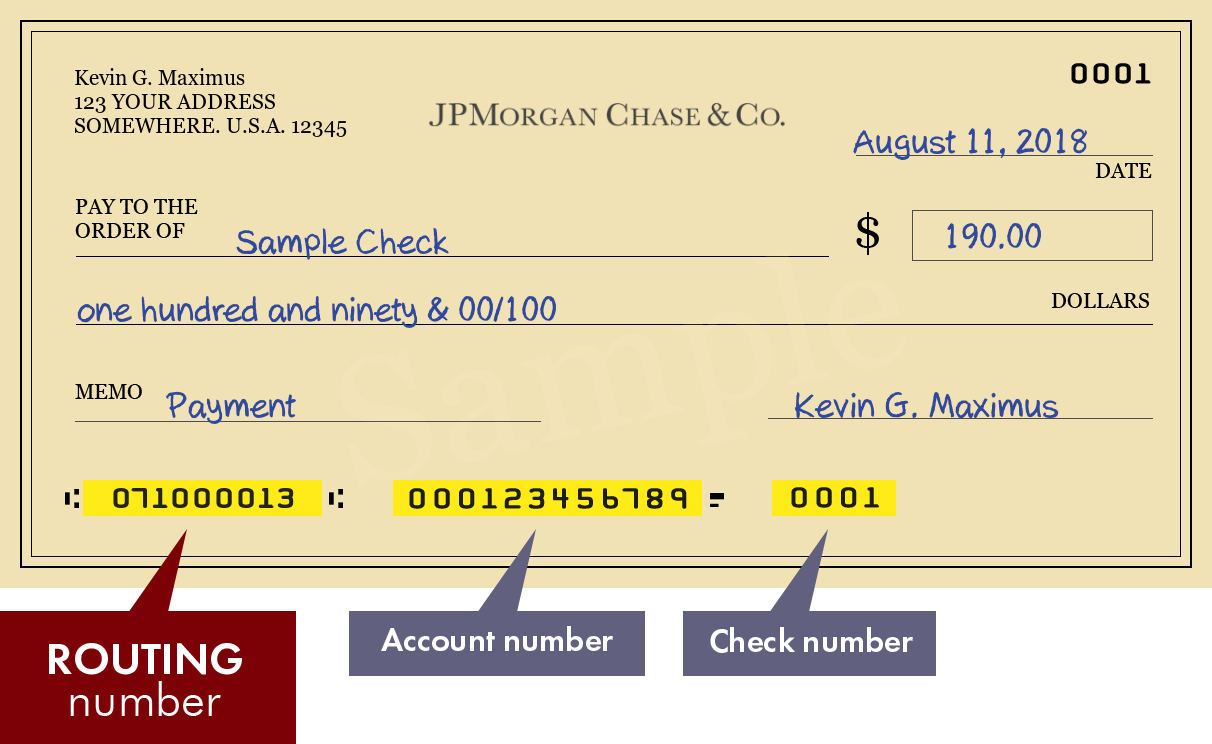

Finding information on a paper check

Here's where to find your numbers: The 9-digit number on the bottom left is your routing number. After the routing number is your account number on the bottom center.

What is the name of Chase bank for wire transfer

JPMorgan Chase & Co.

Does JPMorgan Chase have multiple routing numbers

Many banks have only one routing number, but because Chase is so big, it has multiple routing numbers across the U.S. If you're a Chase customer, your routing number depends on where you opened your account.

Why does Chase have two routing numbers

Chase has branches throughout the United States and uses different routing numbers for different regions. You'll also need a different routing number for ACH and wire transfers.

Why is my Chase routing number different

Many banks have only one routing number, but because Chase is so big, it has multiple routing numbers across the U.S. If you're a Chase customer, your routing number depends on where you opened your account.

What is the bank name for Charles Schwab

Bank Sweep deposits are held at up to two FDIC-insured banks (Charles Schwab Bank, SSB; Charles Schwab Premier Bank, SSB; or Charles Schwab Trust Bank – collectively "Affiliated Banks") that are affiliated with Charles Schwab & Co., Inc.

Is Charles Schwab connected to a bank

The company becomes "America's Largest Discount Broker," and later a subsidiary of Bank of America.

Does Chase have 2 routing numbers

Many banks have only one routing number, but because Chase is so big, it has multiple routing numbers across the U.S. If you're a Chase customer, your routing number depends on where you opened your account.

How do I find out what bank an account number belongs to

You cannot determine from the account number alone what bank holds the account. You can, however, determine what bank holds the account from the routing number (9-digit number for banks in the United States).

What is the difference between Chase ACH and wire

Wire transfers are another widespread means of electronic funds transfer, but they're initiated and processed by banks instead of the ACH system. Because wire transfers require more effort and verification by both the sending and receiving bank, they cost more than ACH payments.

Why does Chase have 2 routing numbers

Chase has branches throughout the United States and uses different routing numbers for different regions. You'll also need a different routing number for ACH and wire transfers.

Why does my bank have 2 different routing numbers

Banks also can have separate routing numbers for different types of transactions — one for processing paper checks and another for wire transfers, for example.

Can a bank have 2 routing numbers

A bank or credit union may have more than one routing number. This is often the case with big banks like Bank of America and Chase Bank, which have two routing numbers in some states.

Can a bank have 2 different routing numbers

A bank or credit union may have more than one routing number. This is often the case with big banks like Bank of America and Chase Bank, which have two routing numbers in some states.

Why are there 2 routing numbers

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers. Transactions using ACH routing numbers “clear” faster (same or next day) than funds transferred on paper checks using ABA numbers.

Is TD bank owned by Schwab

Since Charles Schwab acquired TD Ameritrade, we've been working to bring together our complementary strengths—including our innovative services, industry-leading platforms, and long-standing commitment to low costs.

Is Charles Schwab associated with Citibank

Taking control of your financial future is exciting. And, as a Citi employee, you'll enjoy multiple benefits from Schwab along the way, including: Our low prices on online equity and ETF trades.