Why am I getting a premium tax credit?

Will I have to pay back my premium tax credit

If at the end of the year you've taken more premium tax credit in advance than you're due based on your final income, you'll have to pay back the excess when you file your federal tax return. If you've taken less than you qualify for, you'll get the difference back.

Does everyone get the premium tax credit

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2023 and 2023, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable …

How much do you pay back premium tax credit

Example 1: A single individual with income under $25,760 would have to repay no more than $325 if they received too much federal premium tax credit. A single individual with income between $25,760 and $38,640 would have to repay no more than $825 if they received too much federal premium tax credit.

How do premium tax credits affect my refund

If the premium tax credit computed on your return is more than the advance credit payments made on your behalf during the year, the difference will increase your refund or lower the amount of tax you owe. This will be reported on Form 1040, Schedule 3.

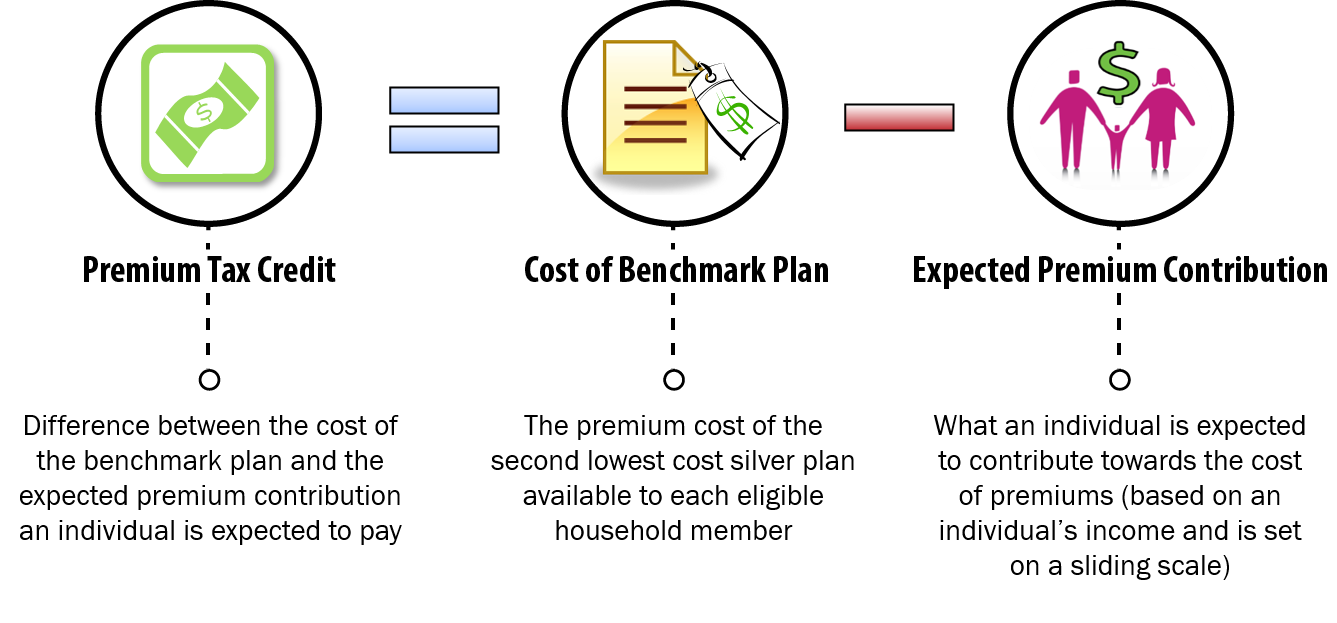

What is a premium tax credit and how does it work

The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace.

What happens if you don’t reconcile premium tax credit

If you don't reconcile:

If you don't reconcile, you won't be eligible for advance payments of the premium tax credit or cost-sharing reductions to help pay for your Marketplace health insurance coverage for the following calendar year.

How does premium tax credit work

A tax credit you can use to lower your monthly insurance payment (called your “premium”) when you enroll in a plan through the Health Insurance Marketplace ®. Your tax credit is based on the income estimate and household information you put on your Marketplace application.

What is the income limit for premium tax credit 2023

Premium tax credits are available to people who buy Marketplace coverage and whose income is at least as high as the federal poverty level. For an individual, that means an income of at least $13,590 in 2023. For a family of four, that means an income of at least $27,750 in 2023.

What is a premium tax credit for dummies

A tax credit you can use to lower your monthly insurance payment (called your “premium”) when you enroll in a plan through the Health Insurance Marketplace ®. Your tax credit is based on the income estimate and household information you put on your Marketplace application.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

What is the difference between health coverage tax credit and premium tax credit

HCTCs lowered health insurance costs for eligible recipients, paying 72.5% of qualified health insurance premiums. Premium tax credits (PTCs) are tax credits that recipients can use to lower their monthly health insurance premium when they enroll through the Health Insurance Marketplace.

Do you have to pay back the ERTC tax credit

No. The Employee Retention Credit is a fully refundable tax credit that eligible employers claim against certain employment taxes. It is not a loan and does not have to be paid back. For most taxpayers, the refundable credit is in excess of the payroll taxes paid in a credit-generating period.

Will there be advanced premium tax credit in 2023

Improved premium tax credits that eliminated or reduced out-of-pocket premiums for millions of people in 2023 and 2023 are also in place in 2023 (and 2024 and 2025), under the Inflation Reduction Act enacted in August.

What happens if you underestimate your income for Obamacare

If you underestimated your income but your actual income ends up being under 400% of the poverty level for 2023, the maximum amount you'd have to pay back varies from $325 to $2,800, depending on your tax filing status and your actual income.

How are people getting $10,000 tax returns

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000. “If you are low-to-moderate income and worked, you may be eligible for the Federal and State of California Earned Income Tax Credits (EITC).

How to get the biggest tax refund in 2023

Follow these six tips to potentially get a bigger tax refund this year:Try itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

How does the tax credit work

A tax credit is a dollar-for-dollar amount taxpayers claim on their tax return to reduce the income tax they owe. Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund.

Is the ERC a tax credit or refund

The Employee Retention Credit (ERC) is a refundable tax credit for businesses that continued to pay employees while either shut down due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2023 to Dec. 31, 2023.

Has anyone received ERC refund 2023

You could receive your refund 21 days after filing your 2023 taxes in 2023. This means you could receive your refund three weeks after the IRS receives your return. It may take several days for your bank to have these funds available to you.

Who gets the advance premium tax credit

The Advanced Premium Tax Credit is provided to those who qualify to help pay for health coverage. Your APTC is calculated based on your estimated annual household income, household size and where you live. If your income or family size changes, this may impact the APTC you receive.