Why am I not eligible for a Square Checking account?

Why would I not be eligible for a Square checking account

Eligibility for Square Checking requires us to verify your information. If your information is not able to be verified, you won't be able to sign up for Square Checking, but you can still take advantage of Square's other transfer options.

Cached

Why was I denied a Square account

We don't have access to any of the information you entered for privacy and security reasons. Some common reasons why we're unable to approve customers to accept credit cards include: Typos or incorrect information entered. Providing a business name, or a recently changed name.

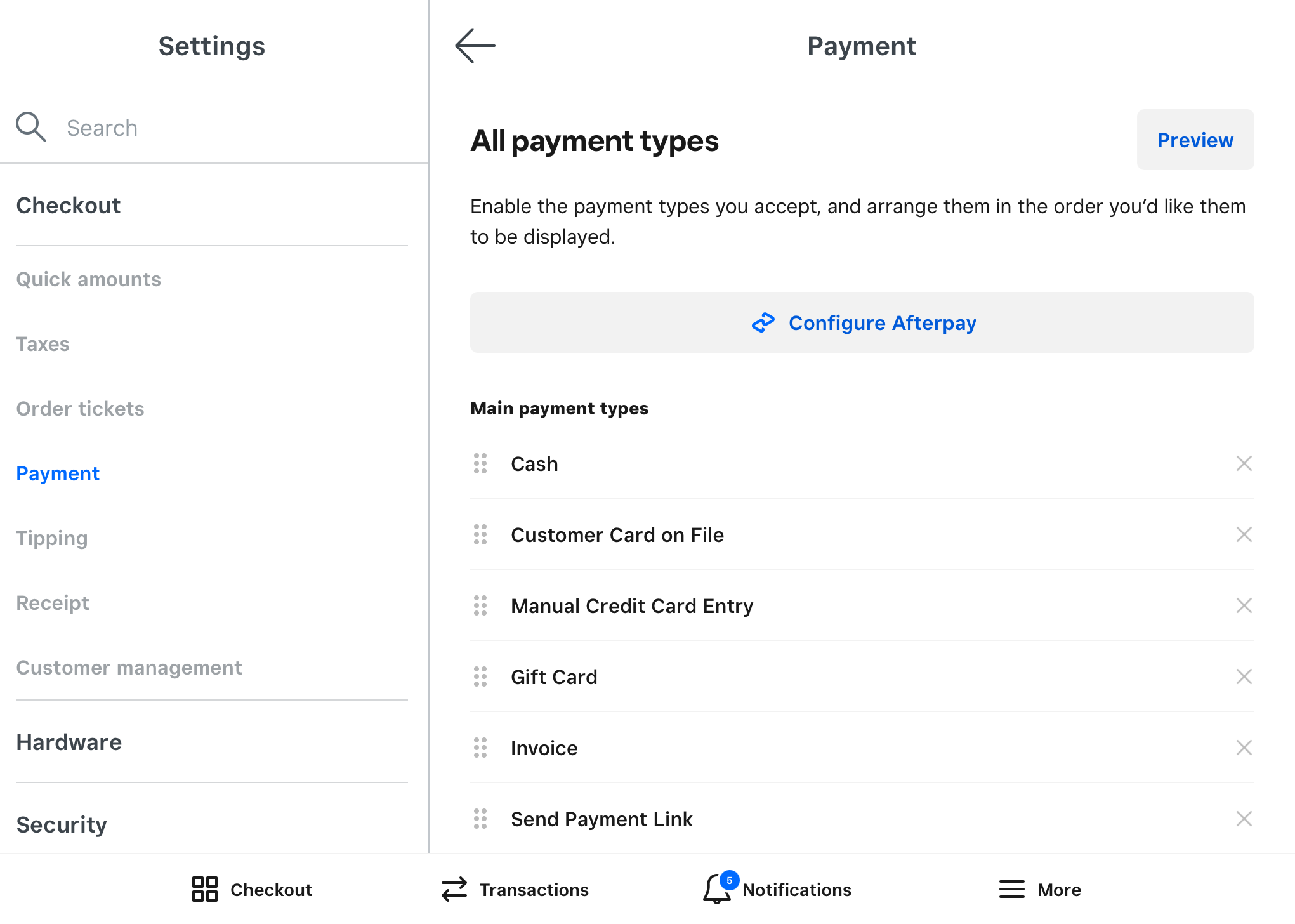

How do I set up a checking account on Square

Open a Square Checking AccountFrom your Square app, go to Balance > Checking > Get started.Verify that your name and business name matches the account owner's name on the Square account.Personalize your Square Debit Card.Enter a shipping address to receive your physical Square Debit Card.Set a PIN for your account.

What kind of bank account do I need for Square

transactional bank account

Square requires a transactional bank account (an account that allows for both transfers and withdrawals) to support refunds or chargebacks. This means prepaid cards or online-only accounts (such as PayPal) aren't supported at this time.

Can anyone have a Square account

If you're not a business, you can state that you're using Square as an individual or you can select a specific business type to best reflect the goods or services you provide. Licensed healthcare providers and pharmacies can accept HSA and FSA cards with Square if the business type is set to Medical.

How does Square verify your bank account

To verify your bank account, Square will transfer and withdraw a small amount. Sometimes this transfer and withdrawal may process simultaneously, so you'll need at least $1.00 in your bank account before you begin the verification process.

How long does it take Square to verify bank account

4 business days

How long will it take to verify my bank account The entire verification process can take up to 4 business days (excluding weekends and holidays). Square isn't able to expedite the process.

Can you use Square as a bank account

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. Square Debit Card may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000.

Do you have to have a business to have a Square account

If you're not a business, you can state that you're using Square as an individual or you can select a specific business type to best reflect the goods or services you provide. Licensed healthcare providers and pharmacies can accept HSA and FSA cards with Square if the business type is set to Medical.

Does Square require a business bank account

No, Square requires a transactional bank account that allows for transfers and withdrawals in case of refunds or chargebacks.

Why is my Square checking not working

Some of the most common reasons are: insufficient funds in your Square Checking balance, ATM limit reached, suspected fraud payment, unactivated Square Debit Card, or incorrect billing zip code or CVC.

How to bypass Square verification

To disable two-step verification:Go to Account & Settings > Personal Information > Sign in and security from your online Square Dashboard.Under Two-step verification, click Manage two-step verification.To remove a verified phone number, select Remove next to the phone number in question.

Why is my Square Checking not working

Some of the most common reasons are: insufficient funds in your Square Checking balance, ATM limit reached, suspected fraud payment, unactivated Square Debit Card, or incorrect billing zip code or CVC.

Can you use Square with a personal bank account

Square requires a transactional bank account that allows for deposits and withdrawals (in case of refunds or chargebacks). Prepaid cards or online-only accounts, like PayPal, aren't supported.

Who can have a Square account

Full legal name. Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) Date of birth: Current credit card regulations require our customers to be 18 years of age or older to create a Square account.

Can I get Square for personal use

If you're not a business, you can state that you're using Square as an individual or you can select a specific business type to best reflect the goods or services you provide. Licensed healthcare providers and pharmacies can accept HSA and FSA cards with Square if the business type is set to Medical.

Can an individual open a Square account

Even if you plan on using Square as a business or organization, in order to create a Square account you must provide your individual name, mailing address, date of birth, and a valid SSN or ITIN.

Do you need an EIN number for a Square account

While all Square customers have to provide a valid Social Security Number (SSN) during sign-up, we also encourage providing your EIN during sign-up. By providing an EIN, your account will be identified as a business entity and all tax reporting will be associated with your business name and EIN.

How long does it take Square to verify a bank account

4 business days

How long will it take to verify my bank account The entire verification process can take up to 4 business days (excluding weekends and holidays). Square isn't able to expedite the process.

Is Square Checking a bank

Is Square a bank Square, Inc. is a financial services company, not a bank. Square Checking is provided by Sutton Bank, Member FDIC.