Why am I not getting my Child Tax Credit monthly?

What to do if I didn t receive my child tax credit this month

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

Cached

Why didn’t I receive my child credit payment

Your eligibility is pending. If the Child Tax Credit Update Portal returns a "pending eligibility" status, it means the IRS is still trying to determine whether you qualify. The IRS won't send you any monthly payments until it can confirm your status.

Cached

Is the IRS doing monthly child tax credit payments

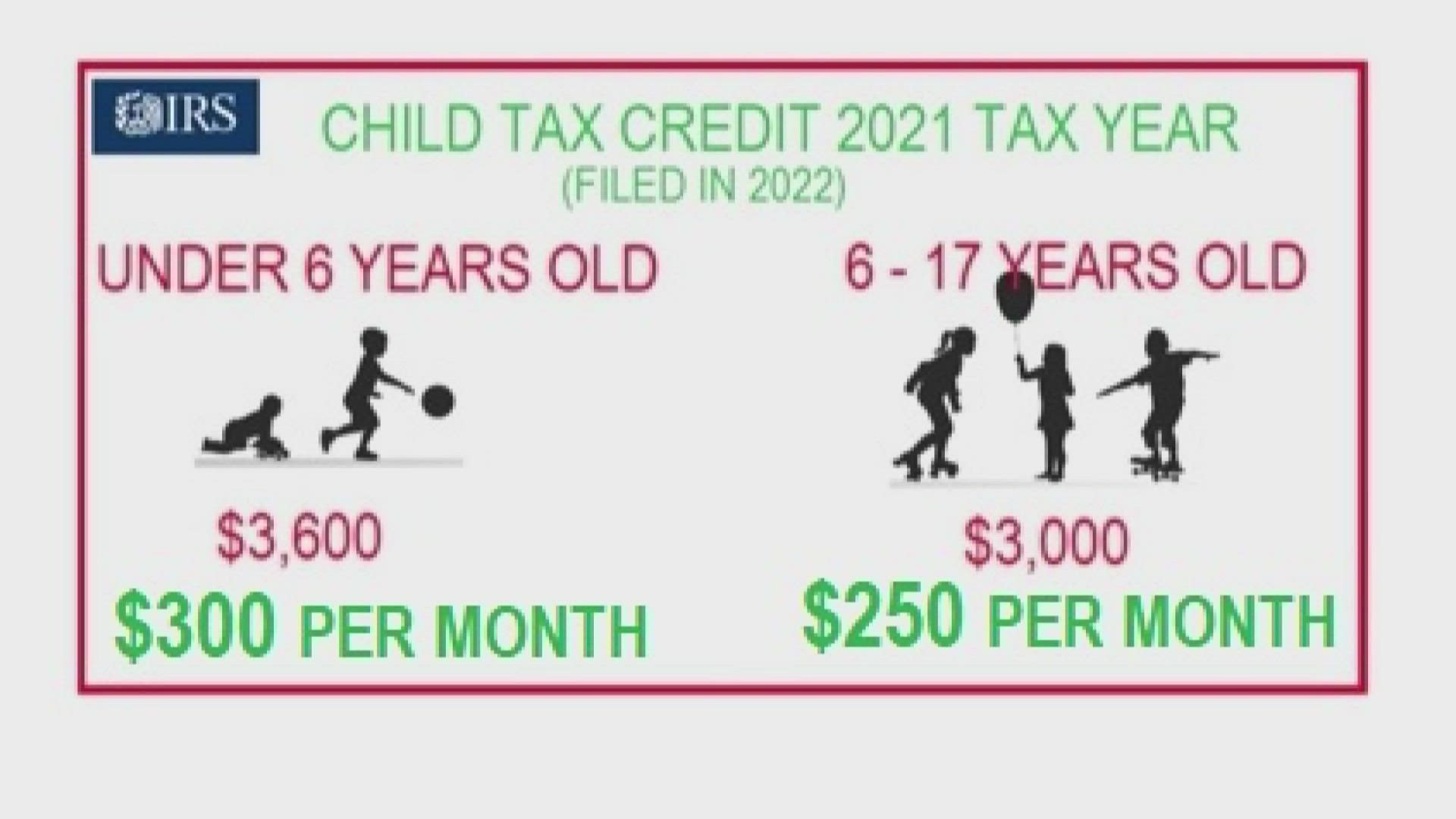

$250 per month for each qualifying child age 6 to 17 at the end of 2023. $300 per month for each qualifying child under age 6 at the end of 2023.

Why was my child tax credit mailed this month

The IRS sends your payments by direct deposit to the bank account they have on file. If they don't have bank account information for you, a check will be mailed to you.

Can I track my child tax credit refund

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Why is the child tax credit delayed

However, people who claim the refundable portion of the child tax credit will see delayed refunds, at least until February 28, IRS warns. That's because of procedures the agency has had in place for over five years to help prevent the issuance of fraudulent refunds pertaining to refundable tax credits.

How do I track my child tax credit deposit

You can check the status of your payments with the IRS:For Child Tax Credit monthly payments check the Child Tax Credit Update Portal.For stimulus payments 1 and 2 check Where's My Refund.For stimulus payment 3 check Get My Payment. FAQ.

Why did I get $250 from IRS today

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

How do I know if I received advance Child Tax Credit

Yes. You can also get information on the total amount of advance Child Tax Credit payments that were disbursed to you during 2023 from the following sources: The IRS's Child Tax Credit Update Portal (CTC UP); and. Your IRS Online Account.

How do I check my EITC status

– It's available 24 hours a day, 7 days a week. If you do not have internet access, call IRS's Refund Hotline at 1-800-829-1954.

How do I track my EIC payment

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

Can the child tax credit be late

What to do if you missed the deadline to claim your money. If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, don't worry. You can still claim that money when you file your taxes in 2023 — you just won't receive it this year.

How long should I wait for my child tax credit

More In Credits & Deductions

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), you can expect to get your refund by February 28 if: You file your return online. You choose to get your refund by direct deposit. We found no issues with your return.

What day of the week does IRS deposit refunds

The IRS generally issues tax refunds through direct deposit within 21 days of processing your tax return. While the exact day of the week that your refund will be deposited can vary, the IRS typically issues refunds on weekdays, Monday through Friday.

Why did I get $2800 from the IRS

The third Economic Impact Payment will be larger for most eligible people. Eligible individuals who filed a joint tax return will receive up to $2,800, and all other eligible individuals will receive up to $1,400. Those with qualifying dependents on their tax return will receive up to $1,400 per qualifying dependent.

Why did I get a $500 check from IRS

Who received this $500 check If you receive this check, it may have come as a surprise. The reason You may not have been required to file a tax return and used the Non-Filer tool on the IRS website to provide information on your dependent children age 17 and younger.

How do I check my tax credit status

Check your federal tax refund status

Before checking on your refund, have your Social Security number, filing status, and the exact whole dollar amount of your refund ready. Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund.

What day will IRS release EITC refunds

Your Refund

By law, the IRS cannot issue EITC and ACTC refunds before mid-February . The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return.

When can I expect my EITC refund

If you file electronically, most refunds are processed within 21 days after the receipt. If you mail your paper return, it may take up to 4 weeks to get processed. You can click here to find out when you will receive the EITC refund.

Can you track your EITC refund

It's Available! – It's available 24 hours a day, 7 days a week. If you do not have internet access, call IRS's Refund Hotline at 1-800-829-1954.