Why are credit card interest rates so high now?

Will credit card interest rates go down in 2023

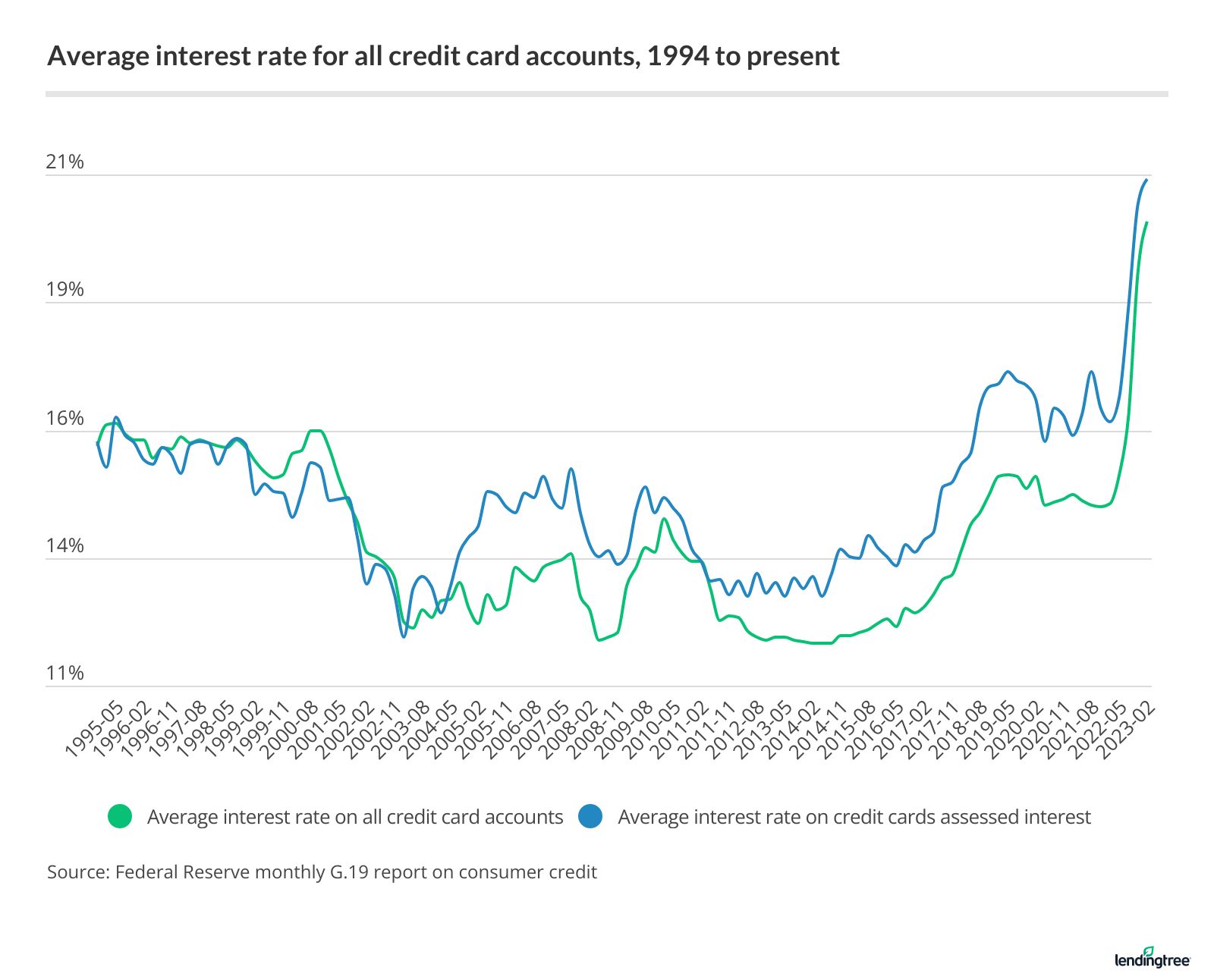

And when the prime rate goes up, variable interest rates soon follow. In fact, interest rates on credit cards continue moving up, with the national average APR higher than 20 percent as of May 3, 2023, up from 16.34 percent in March 2023.

Cached

Why did my credit card interest rate go up 2023

It's certainly possible your credit card interest rate will go up in 2023. Most credit cards have variable interest rates, meaning your account's interest rate is tied to a benchmark such as the Prime Rate. When the Prime Rate increases, your credit card APR also goes up.

How can I get my credit card interest rate down

How can I lower my credit card APRPaying your bills on time.Keeping your balances low.Paying off any debt in a timely manner.Diversifying your credit mix if possible.Keeping overall credit utilization low.

What is the average credit card interest rate right now

CreditCards.com's Weekly Rate Report

| Rate | Avg. APR | Last week |

|---|---|---|

| National average | 20.69% | 20.63% |

| Low interest | 17.90% | 17.82% |

| Cash back | 19.99% | 19.93% |

| Balance transfer | 18.98% | 18.88% |

Cached

Will interest rates go back down in 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

How long until interest rates go back down

"Possibly in 2024, but it will depend on the Fed's decisions about raising rates in the second half of the year," says Fleming. "And even if they do go down, it won't be back to the rates of yesteryear. 6% mortgage rates used to be normal, and that's more reasonable to expect too."

Will interest rates go down in 2023 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

Will interest rates go down in late 2023

“[W]ith the rate of inflation decelerating rates should gently decline over the course of 2023.” Fannie Mae. 30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast.

Do credit card companies ever lower your interest rate

While everyone has at least a small chance of negotiating a lower credit card interest rate, some cardholders are more likely to get better deals than others. If you're a good customer but have poor credit, the credit card company may still work with you.

Will interest rates on credit cards go back down

“Credit card rates go up faster when interest rates are rising, then they come down when interest rates fall,” McBride says. “The Federal Reserve isn't projecting they'll begin cutting interest rates before 2024, so for cardholders, your best hope for relief from high rates is to shop around for a better deal.

Is 26.99 APR good for a credit card

Is a 26.99% APR good for a credit card No, a 26.99% APR is a high interest rate. Credit card interest rates are often based on your creditworthiness. If you're paying 26.99%, you should work on improving your credit score to qualify for a lower interest rate.

What is the highest credit card interest rate allowed by law

Legally, there actually is no highest credit card interest rate that's possible. Credit card companies are allowed to charge any interest rate.

How long will interest rates stay high

'I believe by the end of 2023 we will see rates start to fall with a target of between 2.5 to 3 per cent in 2024.

How high will interest rates go by the end of 2023

The Mortgage Bankers Association predicts rates will fall to 5.5 percent by the end of 2023 as the economy weakens. The group revised its forecast upward a bit — it previously expected rates to fall to 5.3 percent.

How high will interest rates go 2023

Mortgage rate predictions for 2023

| Housing Authority | 30-Year Mortgage Rate Forecast (Q2 2023) |

|---|---|

| National Association of Home Builders | 6.36% |

| Fannie Mae | 6.40% |

| Mortgage Bankers Association | 6.40% |

| Average Prediction | 6.35% |

Will the interest rates go down in 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

Can I ask Amex to lower my interest rate

The best way to get American Express to lower the interest rate on your credit card is to call their customer service line at (800) 528-4800 and get on the phone with a representative. You can do this by saying “representative” to the automated customer service menu.

Can you negotiate interest rates

The answer is yes — you can negotiate better mortgage rates and other fees with banks and mortgage lenders, if you're willing to haggle and know what fees to focus on.

How high will interest go in 2023

So far in 2023, the Fed raised rates 0.25 percentage points twice. If they hike rates at the May meeting, it is likely to be another 0.25% jump, meaning interest rates will have increased by 0.75% in 2023, up to 5.25%.

Can credit card companies just raise your interest rate

Your credit card company cannot increase your rate for the first 12 months after you open an account. There are some exceptions: If your card has a variable interest rate tied to an index; your rate can go up whenever the index goes up.