Why are people Unenrolling from the child tax credit?

Did people have to pay back the child tax credit

The majority of individuals who need to repay excess advance Child Tax Credit payments will satisfy that balance through a reduction in their expected federal income tax refund. However, if you owe a balance in excess of your refund, the IRS routinely works with taxpayers who owe amounts they cannot afford to pay.

What happens if you don’t cash your child tax credit

You should return the payment as soon as possible by following the instructions below. If the payment was a paper check and you have not cashed it: Write "Void" in the endorsement section on the back of the check. Mail the voided Treasury check to the appropriate IRS location listed below.

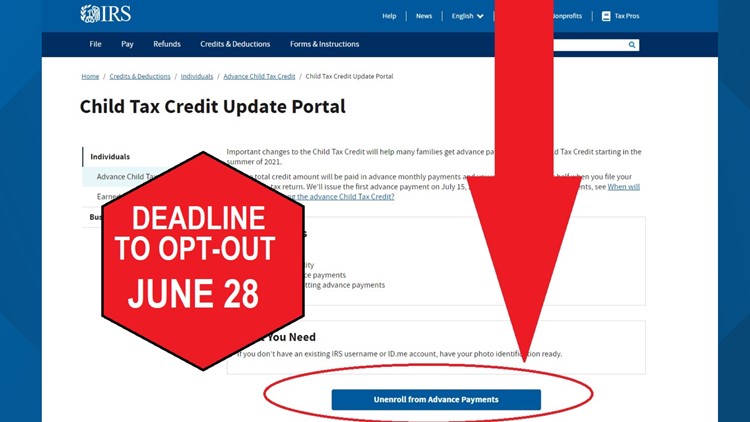

How do I opt out of the IRS child tax credit

If you want to stop advance payments of the 2023 child tax credit, you can opt-out using the IRS's online portal before the monthly deadline. Parents across the country have already received up to four monthly child tax credit payments.

Do we have to pay back Biden child tax credit

The budget also calls for permanently making the child tax credit fully refundable, which means people would still be eligible even if their tax liability was less than the credit amount.

Did Biden up the child tax credit

In his latest budget proposal, President Biden proposes enhancing the Child Tax Credit (CTC) based on the temporary credit that was in effect for 2023 as part of the American Rescue Plan Act. The temporary enhancement was an enormous success, cutting child poverty nearly in half.

Can the IRS hold your Child Tax Credit

Beginning in 2023, if you claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) on your tax return, the IRS must hold your refund until at least February 15. This new law, approved by Congress, requires the IRS to hold the entire refund — even the portion not associated with EITC or ACTC.

Does the Child Tax Credit hurt your taxes

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and you may be able to get a portion of the credit back in the form of a refund.

Should you opt out of the child tax credit payments

If you expect to earn significantly more in 2023 than you did in 2023, you should consider opting out. If you do not opt out, you will have to report the excess child tax credit amount received on your tax return, which may reduce your refund or increase the amount of taxes you owe.

Can you still opt out of advance child tax credit

An individual may opt-out or unenroll from receiving advance payments and claim the entire credit when they file their 2023 return. A taxpayer may consider this option if they do not want to worry about paying back any amount next year, updating their information through the IRS portal, or adjusting their withholding.

What is the monthly Child Tax Credit for 2023

For the 2023 tax year (taxes filed in 2024), the maximum child tax credit will remain $2,000 per qualifying dependent. The partially refundable payment will increase up to $1,600.

Can you file taxes with no income but have a child

If you have no income but have a child/dependent, you can still file your taxes. This may allow you to get a refund if the tax credits you're eligible for are more than your income.

What happened to the child tax credit

2023 Child Tax Credit Changes

Answer: The American Rescue Plan Act of 2023 temporarily expanded the child tax credit for 2023 only. First, the law allowed 17-year-old children to qualify for the credit. Second, it increased the credit to $3,000 per child ($3,600 per child under age 6) for many families.

Did Congress pass the child tax credit

The child tax credit was increased in 2023 from $2,000 per child to up to $3,600 per child under 6 and up to $3,000 for children ages 6 through 17.

Is IRS holding refunds for Child Tax Credit 2023

The law requires the IRS to hold the entire refund – not just the portion associated with EITC or ACTC. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

What happened to the Child Tax Credit

2023 Child Tax Credit Changes

Answer: The American Rescue Plan Act of 2023 temporarily expanded the child tax credit for 2023 only. First, the law allowed 17-year-old children to qualify for the credit. Second, it increased the credit to $3,000 per child ($3,600 per child under age 6) for many families.

What is the new Child Tax Credit for 2023

The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,500 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

Does the child tax credit hurt your taxes

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and you may be able to get a portion of the credit back in the form of a refund.

What happens if you opt out of monthly Child Tax Credit

Yes, you can opt out of future payments at any time after payments begin. If you choose to opt out of advance monthly payments after payments begin, you will receive the rest of your Child Tax Credit as a lump sum when you file your 2023 taxes in 2023 if you are eligible.

Is the Child Tax Credit advanced in 2023

Child tax credit 2023

For the 2023 tax year (taxes filed in 2024), the maximum child tax credit will remain $2,000 per qualifying dependent. The partially refundable payment will increase up to $1,600.

Will tax refunds be bigger in 2023

According to early IRS data, the average tax refund will be about 11% smaller in 2023 versus 2023, largely due to the end of pandemic-related tax credits and deductions.