Why are there soft inquiries on my credit report?

How do I stop soft inquiries on my credit report

To opt out for five years: Go to optoutprescreen.com or call 1-888-5-OPT-OUT (1-888-567-8688). The major credit bureaus operate the phone number and website.

Are soft credit inquiries OK

A soft inquiry does not affect your credit score in any way. When a lender performs a soft inquiry on your credit file, the inquiry might appear on your credit report but it won't impact your credit score.

Cached

Do soft inquiries appear on credit report

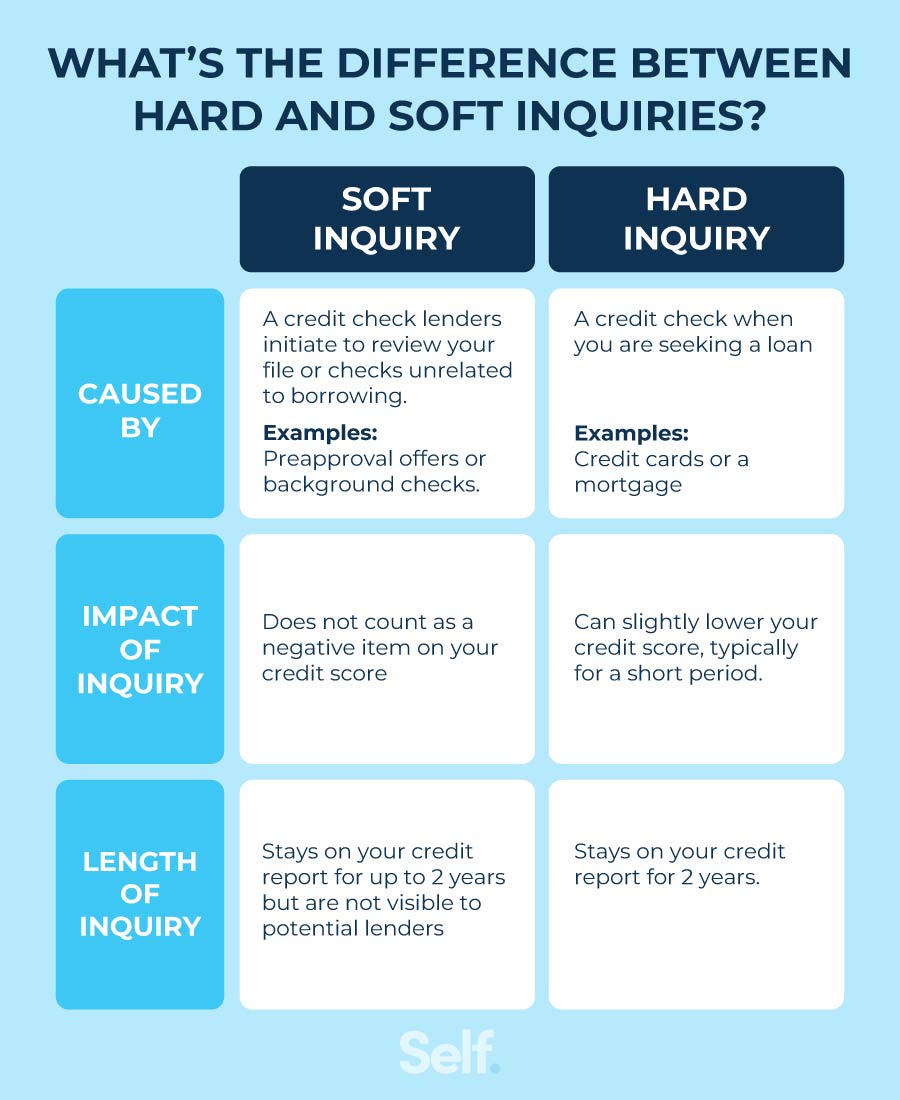

What Is a Soft Inquiry Soft inquiries appear on your credit report when someone runs a credit check for reasons unrelated to lending you money. These events are not associated with greater repayment risk, so they have no effect on your credit scores.

Cached

Why is Credit Karma doing soft inquiries on my credit report

Soft inquiries (also known as “soft pulls” or “soft credit checks”) typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers.

Cached

Can you get soft inquiries removed

One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry (or inquiries) were not authorized, and then request that those inquiries be removed. You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up.

How many soft inquiries is too many

Soft inquiries don't drop your credit score, so there isn't a number that could be considered too much.

Can other lenders see soft inquiries

Soft inquiries or soft credit pulls

These do not impact credit scores and don't look bad to lenders. In fact, lenders can't see soft inquiries at all because they will only show up on the credit reports you check yourself (aka consumer disclosures).

Are soft inquiries visible to lenders

Soft credit inquiries have no impact on your credit score. If a lender checks your credit report, soft credit inquiries won't show up at all. Soft inquiries are only visible on consumer disclosures—credit reports that you request personally.

Which is more accurate Experian or Credit Karma

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Are multiple soft inquiries bad

Soft inquiries have no effect on your credit score. Lenders can't even see how many soft inquiries have been made on your credit report.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Does it matter how many soft inquiries you have

A soft inquiry happens whenever you check your credit report, or when a lender checks your credit report without your knowledge or permission. Soft inquiries have no effect on your credit score. Lenders can't even see how many soft inquiries have been made on your credit report.

How many points does a soft inquiry affect credit score

Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Which of the 3 credit scores is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How long does it take to go from 650 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

Can lenders see your soft inquiries

If a lender checks your credit report, soft credit inquiries won't show up at all. Soft inquiries are only visible on consumer disclosures—credit reports that you request personally. The following types of credit checks are examples of soft inquiries.

Do soft inquiries fall off

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

Who is more accurate Experian or Credit Karma

Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.