Why can’t i get approved for Flex?

Why did I get denied for Flex

If your FSA claim is denied, it might be because you had insufficient funds in your account or that the price of the item you tried to purchase is higher than your balance. Be sure to check your balance before you use your card again.

Is it hard to get approved for Flex

Yes, the Chase Freedom Flex℠ is hard to get because it requires at least a good credit score for approval. This means that applicants need a credit score of around 700+ to have decent odds of getting approved for Chase Freedom Flex.

Cached

What credit score is needed for Flex

You'll likely need a good to excellent credit score of at least 670 or higher to be considered for the Freedom Flex card.

Does everyone get approved for Flex

Generally, customers who are fair or better credit, with sufficient deposits and average bank balances will qualify for Flex. Some properties may offer expanded approval to their residents.

Does Flex require a credit check

Do you run a credit check Yes. After you create an account in Flex, we run an ID verification and soft credit check to determine your eligibility to drive with Flex and provide you with personalized pricing. This soft check won't affect your credit score but may appear on your credit report.

What are the downsides of a flex loan

However, flex loans aren't always a good choice. Here are some drawbacks to keep in mind: High interest rates, sometimes up to 200% APR or more. Minimum payments might not cover more than interest and fees, which could keep you in debt longer.

What are the qualifications for Flex

Flex card eligibility

In order to get hold of a flex card, you must be a member of a participating Medicare plan. You must live within the service area of a plan that offers a flex card and enroll during a Medicare enrollment period. This could be your Initial Enrollment Period or annual enrollment.

What are the qualifications for the Flex program

Complete Eligibility Requirements for FLEX AbroadU.S. citizen.15-18.5 years of age at start of program.Enrolled in high school at the time of application.

What bank does Flex use

2.1. 1. Description: “Flexible Rent” is a service that enables you to pay your rent through a line of credit issued by Blue Ridge Bank, N.A. (a “Flex Line of Credit”).

Is Flex pay a good idea

Pros Explained

It can save you money: You can potentially pay a lower APR using Citi Flex Pay than your normal purchase APR. A fixed-rate loan could make budgeting easier: Knowing you have a set payment due every month may work better for your budget than having a credit card bill that varies monthly.

What is the income level for Flex Card

Maximum Annual Dependent Care FSA Contribution Limits

If your tax filing status is Single, your annual limit is: $5,000 if your 2023 earnings were less than $135,000; however, your contributions may not be in excess of your earned income for the plan year. $3,600 if your 2023 earnings were $135,000 or more.

What is the acceptance rate for FLEX

2.3% of applicants receive a FLEX scholarship, compared to the Ivy League's 4-6% acceptance rate.

How competitive is Flex program

Only about one in fifty applicants are ultimately selected. Visit the FLEX website for eligibility criteria and additional program information.

Does Flex run credit

During the application process, Flex runs a soft credit check on the resident which does not affect their credit score.

How do I get approved for FlexPay

In order to qualify for FlexPay, you simply need to sign up for the FlexPay option at checkout. HSN may elect to obtain a consumer report on you when you sign up from a credit reporting agency in order to verify your eligibility.

Who qualifies for a Flexcard

To qualify, the senior should participate in a Medicare Advantage plan. They need to live in the state service area which provides these cards. Apply for the card during the Initial Enrollment Period or Medicare's annual enrollment. No government insurance program offers flex cards.

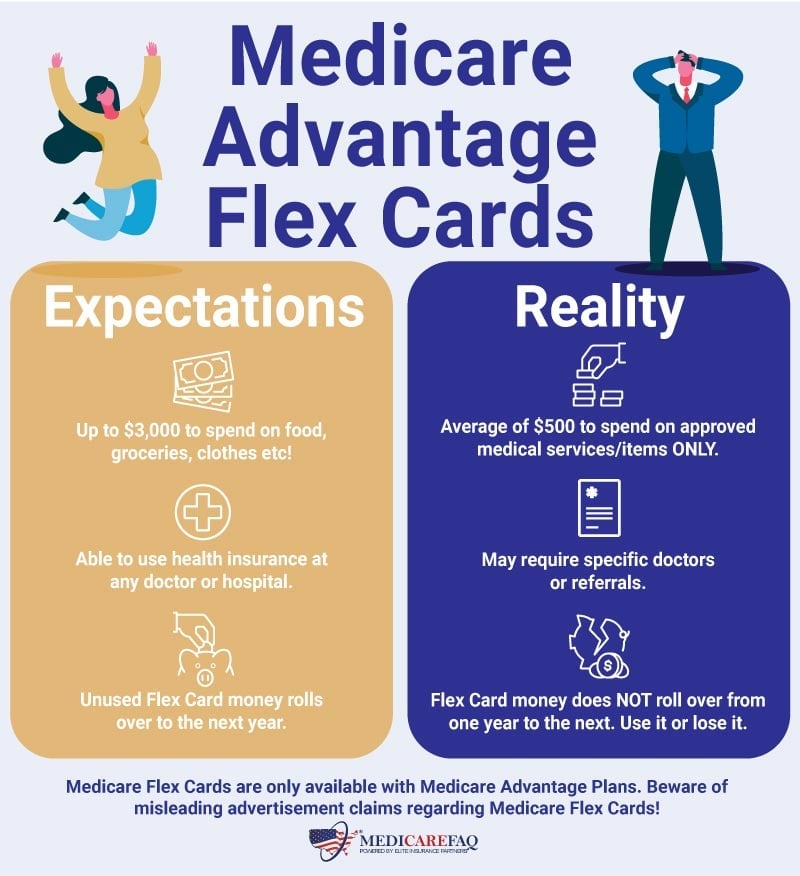

What is the $2800 Flex card

If you've been watching some TV or scrolling through social media channels, you may have seen some enticing posts about “Medicare flex cards” with over $2,800 to use towards groceries, clothes, gas…or anything. Does this sound too good to be true Well it is. This is a scam.

What are the requirements for Flex program

Eligibility requirements for the 2023-2024 program

Be enrolled in a secondary school, 9th,10th, or 1st year lyceum or college at the time of application. Have an academic standing of good or better. Have previously studied English and demonstrate English language ability at the time of registration.

What is the acceptance rate for the FLEX program

2.3% of applicants receive a FLEX scholarship, compared to the Ivy League's 4-6% acceptance rate.

How much can you get with a flex loan

Wells Fargo's small-dollar loan, known as Flex Loan, allows customers to borrow $250 or $500 for a flat fee of $12 or $20, respectively.