Why can’t I get my credit score UK?

Why can I not see my credit score

If you've had credit in the past but no longer use credit cards, or you have closed accounts on your report, there won't be recent activity to produce a score for you. And even if you have recent credit activity, you still may not have scores if your lenders don't report to the bureaus.

Does UK credit score work in USA

The credit bureaus – same but different

However, your UK credit history does not translate to the US, and vice versa. In both countries, these credit bureaus collect information about your credit history and credit behaviors, as well as personal information. However, that's pretty much where the similarities stop.

Cached

Are US and UK credit score the same

Many countries, including Canada and the U.K., have credit scoring systems that are similar to the American system. Yet, there is no communication between the systems. So your credit score in the U.S. will not affect your credit score in the U.K.

Cached

Why is Experian not showing my credit score

Many scoring models require that an open and active account be reported for at least three months, and often as long as six months before a credit score can be calculated. If a VantageScore model is used to calculate your score, it may be able to do so with less history.

Cached

How do I get my credit score to show up

Where can I get my credit scoreCheck your credit card or other loan statement. Many major credit card companies and some auto loan companies have begun to provide credit scores for all their customers on a monthly basis.Talk to a non-profit counselor.Use a credit score service.Buy a score.

What happened to my FICO score

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

Can a non U.S. citizen have a credit score

It can take immigrants with no credit several months to build a positive credit report. Generally, it takes at least three months and probably six months of activity before a credit score can be calculated. Many immigrants are able to develop a good score within a year.

How do I get an international credit score

Global credit scores currently don't exist, so you can't transfer a U.S. credit score overseas. Other countries might use their own systems to determine creditworthiness. Giving international lenders a copy of your credit report, employment history and income verification could help you build creditworthiness.

How do I get my credit score UK

How do I build my credit score in the UKMake sure you're on the electoral roll.Open a bank account.Go for small lines of credit.Manage your household bills well.Make your rent count too.

Does UK have a credit score system

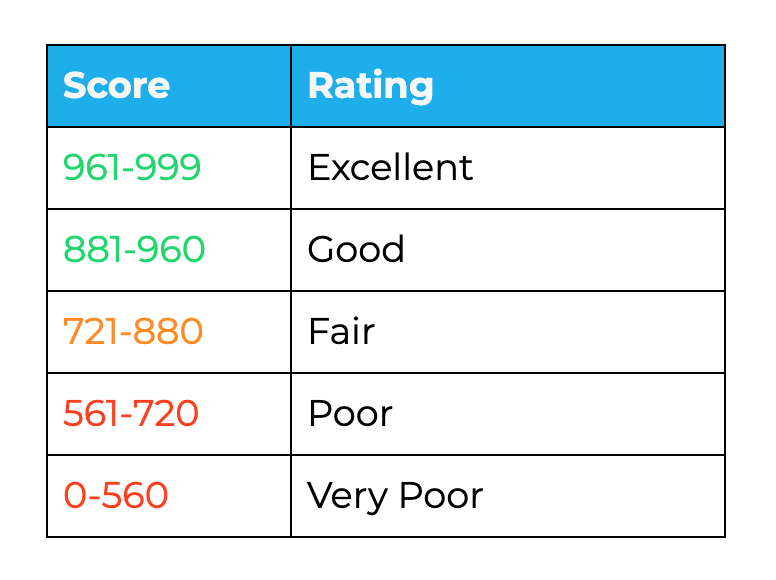

In the UK there are three main credit rating agencies, they are TransUnion, Experian and Equifax. Their credit score range is between 0 and 999. Regardless of the company, the higher the number, the more trustworthy you are deemed financially.

How long until I can see my FICO score

six months

If you're just starting out, you'll need at least one credit account open and reporting to at least one of the major credit bureaus (Experian, TransUnion and Equifax) for at least six months to generate a FICO credit score.

Is A FICO score the same as a credit score

A FICO score is a specific type of credit score—one calculated by credit-scoring company FICO. And while FICO has multiple scoring models of its own, FICO scores generally range from 300 to 850—and the higher the score, the better.

How can a foreigner get a credit score

For immigrants, the easiest way to build a credit history is to go into a bank and ask if they offer a secured credit card. A secured credit card is a special type of credit card that is secured by collateral.

How can I get my US credit score without SSN

Include a government-issued ID with your current address, a current utility bill or bank statement, full name, ITIN, date of birth, and complete addresses for the past two years. An Individual Tax Identification Number (ITIN) can be used to check your credit score.

Can foreigners get a credit score

For immigrants, the easiest way to build a credit history is to go into a bank and ask if they offer a secured credit card. A secured credit card is a special type of credit card that is secured by collateral.

How do I establish credit in the UK as a US citizen

How do I build my credit score in the UKMake sure you're on the electoral roll.Open a bank account.Go for small lines of credit.Manage your household bills well.Make your rent count too.

Does the UK have credit scores

The UK credit score system centres around three main credit reference agencies (CRAs): Experian, Equifax and TransUnion. Each one collects information from creditors and factors these into an algorithm that calculates your credit score. Each CRA uses a unique rating scale and may receive different data points.

How do I find out my credit score UK

Experian is the UK's largest credit reference agency. You can access your Experian credit score by registering on the Experian website. It's quick and doesn't cost anything. To get a peek at your full credit report, you'll need to register for the free 30-day trial of Experian's CreditExpert service.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How long does it take to get a credit score of 700

The time it takes to increase a credit score from 500 to 700 might range from a few months to a few years. Your credit score will increase based on your spending pattern and repayment history. If you do not have a credit card yet, you have a chance to build your credit score.