Why can’t I pay a credit card bill with a credit card?

Can I pay a credit card bill with another credit card

Suppose you have high-interest balances on one or multiple credit cards and you're looking to consolidate at a lower APR. You might be asking yourself, "Can you pay off a credit card with another credit card" In short — yes, you can pay a credit card off with another credit card, there's more than one way to do it.

Cached

Can I pay my Capital One credit card with another credit card

First, you should know that at Capital One, you can't directly pay your credit card with another credit card. That means when you go to make a credit card payment on your Capital One account, you won't be able to enter another credit card number to complete the payment.

Cached

How do I transfer money from my credit card to my credit card

Contact the new credit card company to do the balance transfer. The best way to transfer a credit card balance is by contacting the new credit card company with the balance transfer request. You can typically do a balance transfer over the phone or online.

Can I pay my Amex with another credit card

You can make a payment through your online account anytime. Here's how: Choose your payment amount, then select your bank account and payment date. Currently, credit cards and debit cards cannot be accepted as a form of payment.

What bills can be paid with a credit card

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes, can often be paid with a credit card but with a processing fee. Loan payments, are usually check or bank withdrawal payments only.

Can you pay for one bill with two credit cards

Most will not allow this transaction when using multiple cards, debit or credit. When customers use multiple debit or credit cards for one transaction, it can make it difficult for the merchant to properly process the transaction. Additionally, prohibiting using multiple cards helps cut down on fraudulent payments.

Does Capital One allow you to combine credit cards

Capital One only allows linking credit card accounts by grouping them together under the same login details (same username and password). But this doesn't combine or change them in any other way. If you're unhappy with your Capital One credit limit, you can request an increase.

Is it smart to have two Capital One credit cards

If you can keep your credit card accounts in good standing by paying on time and keeping balances low, more than one credit card can help maximize rewards.

Can I transfer money from a credit card to pay a bill

Although you can often do this with an ordinary credit card, depending on your credit card provider's terms, it's usually cheaper to use a money transfer card as charges are typically lower. Once the money is in your bank account, you can use it however you want – for example, to pay off an overdraft or other debt.

How much money can you transfer from one credit card to another

Credit card balance transfers are often limited to an amount equal to the account's credit limit. You typically can't transfer a balance greater than your credit limit—and you won't know your credit limit until you're approved for the account.

Can I transfer money from my American Express credit card to a bank account

Transfer to a U.S. Bank checking or savings account

If you have a checking or savings account with us, you can transfer money from your American Express card in a few ways: Call the number on the back of your card, or our general customer service number at 800-285-8585.

Can I use American Express to pay bills

American Express EPAY service offers you three convenient ways of paying your bills with your American Express Card*.

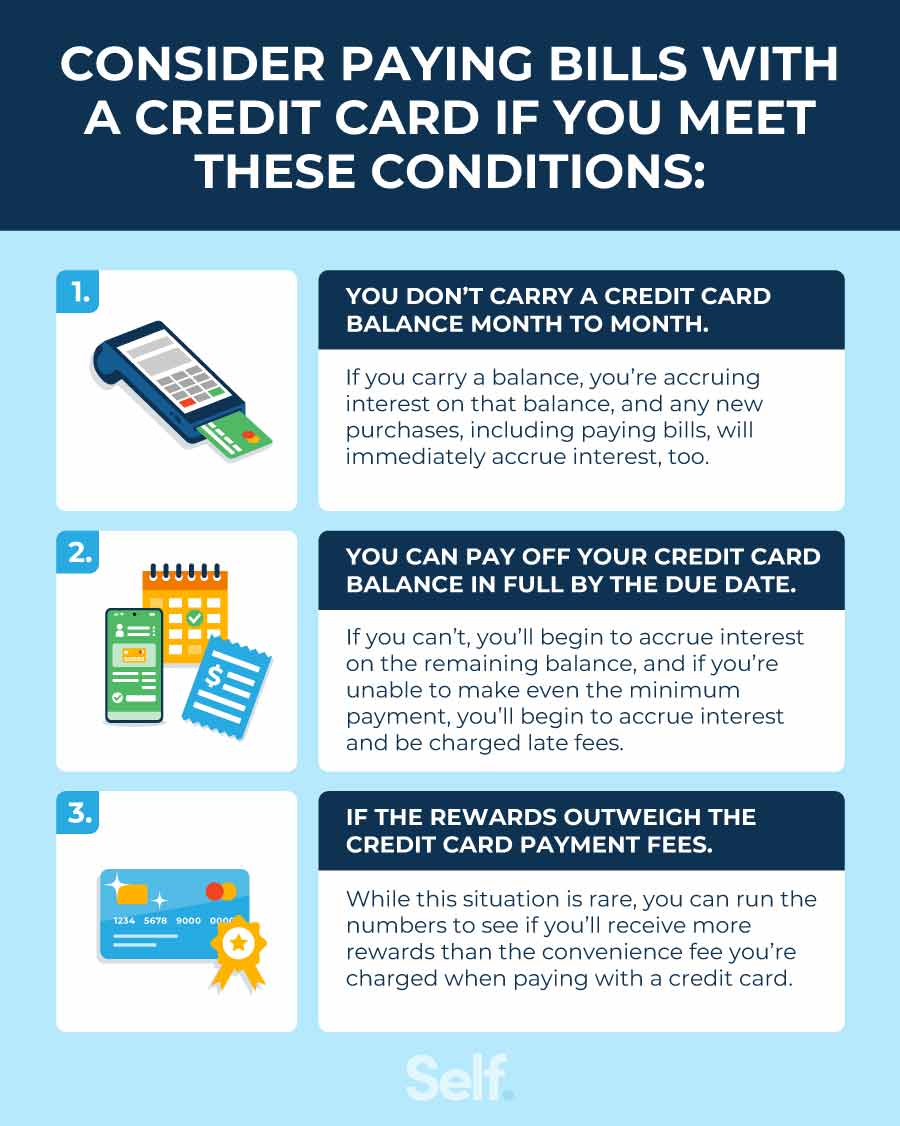

Is it okay to use credit card to pay bills

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you adhere to two rules. Always pay your balance in full and on time each month. Never put bills on a credit card because you can't afford to pay them.

Does paying bills with a credit card hurt your credit score

Paying monthly bills with a credit card can affect your credit score positively or negatively, depending on how you handle it. Using a credit card could hurt your credit score if: You run up a balance and don't pay it off.

Does using two credit cards affect credit score

Having multiple credit cards won't necessarily hurt your credit score, and, in fact, it can sometimes help. But if you have more cards than you can handle or use them irresponsibly, your score could drop considerably.

Is it okay to put two credit cards together

Having more than one credit card may help you keep your credit line utilization ratio per card lower than the recommended 30% by spreading charges. There are potential benefits to having multiple cards, such as pairing various types of rewards cards to optimize earnings on all categories of spending.

Does combining credit cards hurt credit

Debt consolidation — combining multiple debt balances into one new loan — is likely to raise your credit scores over the long term if you use it to pay off debt. But it's possible you'll see a decline in your credit scores at first. That can be OK, as long as you make payments on time and don't rack up more debt.

Does Capital One allow more than 2 credit cards

How many Capital One cards can I have Cardholders can have up to five open personal credit card accounts, but this may vary based on the specific cards held and the cardholder's account standing.

Does Capital One have a 5 24 rule

The most important rule to consider in collecting points is the “5/24 rule.” The rule is simple: If you get 5 personal credit cards in any 24-month period, you're automatically prohibited from getting a 6th Chase or Capital One card.

Does having multiple credit cards hurt your credit

Having too many open credit lines, even if you're not using them, can hurt your credit score by making you look more risky to lenders. Having multiple active accounts also makes it more challenging to control spending and keep track of payment due dates.