Why can’t you pay rent with credit card?

Does it look bad to pay rent with credit card

Paying your rent with a credit card will likely increase your credit utilization ratio, which is the percentage of your available balance you're using. Your credit utilization ratio is significant because it accounts for 30 percent of your credit score.

Why do credit cards ask if you pay rent

Banks ask the “rent, own, or other” and related questions to estimate your free cash flow – the amount of your net income left over after paying fixed expenses. Approvals have more, while denials tend to have less.

Can I make a house payment with a credit card

Yes. Technically paying down your mortgage with a credit card is possible, but it is a complicated process. Mortgage lenders do not accept direct credit card payments, so you will need to find a workaround service like Plastiq in order to carry out the transaction.

Can I pay rent with a credit card Amex

If you are making residential rent payments, you can essentially use any payment method, including Visa, Mastercard, American Express, Discover, Diners Club International, and JCB.

Cached

Do apartments care about credit cards

Landlords use credit reports, credit scores or a combination of the two when making rental decisions. Credit card debt can drag down your score if you're using more than 30 percent of your available credit, and landlords may investigate your credit report to find out how you're using credit.

Does paying rent improve credit

Does paying rent build credit Simply paying your rent will not help you build credit. But reporting your rent payments can help you build credit — especially if you are new to credit or do not have a lot of experience using it.

Do landlords care about credit card debt

Landlords use credit reports, credit scores or a combination of the two when making rental decisions. Credit card debt can drag down your score if you're using more than 30 percent of your available credit, and landlords may investigate your credit report to find out how you're using credit.

What bills can you pay with credit card

You may be able to pay a wide range of bills with a credit card, including utility, phone, cable, internet, streaming subscription, insurance, and medical bills. Keep in mind that some companies charge a convenience fee for paying with credit. You can check with billing departments to verify payment policies.

What bills can be paid with a credit card

The short answer is, entertainment and nonessentials can usually be paid with a credit card with no fees. Services, utilities, and taxes, can often be paid with a credit card but with a processing fee. Loan payments, are usually check or bank withdrawal payments only.

Can I pay my car with a credit card

If your car loan lender allows it, you can make a car payment with a credit card. However, credit card purchases impose fees on the merchant, so many loan servicers accept only cash-backed payment methods, like a debit card, check, money order or a direct transfer from a checking or savings account.

Why can’t I use my credit card to pay my mortgage

Mortgage lenders in general don't accept credit cards. One reason is that mortgage lenders would incur transaction-related fees. Lenders also don't like the idea of your paying one debt by taking on another debt. So this means you have to use a third-party service to pay your mortgage with a credit card.

What is the lowest credit score to rent an apartment

There's no set minimum credit score to rent an apartment, but you'll have the best luck with a score approaching 670. This score is considered “good” according to FICO scoring models. A score lower than 620 could make renting more difficult.

What is the lowest credit score to rent a house

620

Generally, most landlords require applicants to have a credit score of at least 620 to be considered for rental housing. This means that if your FICO score is lower than 620, you may be denied an application or asked for additional security deposits or co-signers before being approved.

Does your credit score go down if you don’t pay rent

Not paying rent can affect your credit score negatively, making it drop. However, your landlord needs to report it, and oftentimes unpaid rent might stay off your credit report for a long time. This is because many landlords do not report unpaid rent to credit bureaus.

Is it good to put your rent on your credit report

Reporting your rent to credit bureaus can help your credit by logging more on-time payments. Payment history makes up 35% of your FICO Score, so adding your rental data to this category can help increase your score.

Does renting affect your credit score

Renting, like every other expense, can have a positive or a negative impact on your credit score–especially if you proactively report your rent payments to a credit bureau or your unpaid rent goes to collections. Chances are, you will see a more positive impact if you pay your rent on time, in full every month.

Is 670 a good credit score to rent an apartment

In general, a landlord will look for a credit score that is at least “good,” which is generally in the range of 670 to 739.

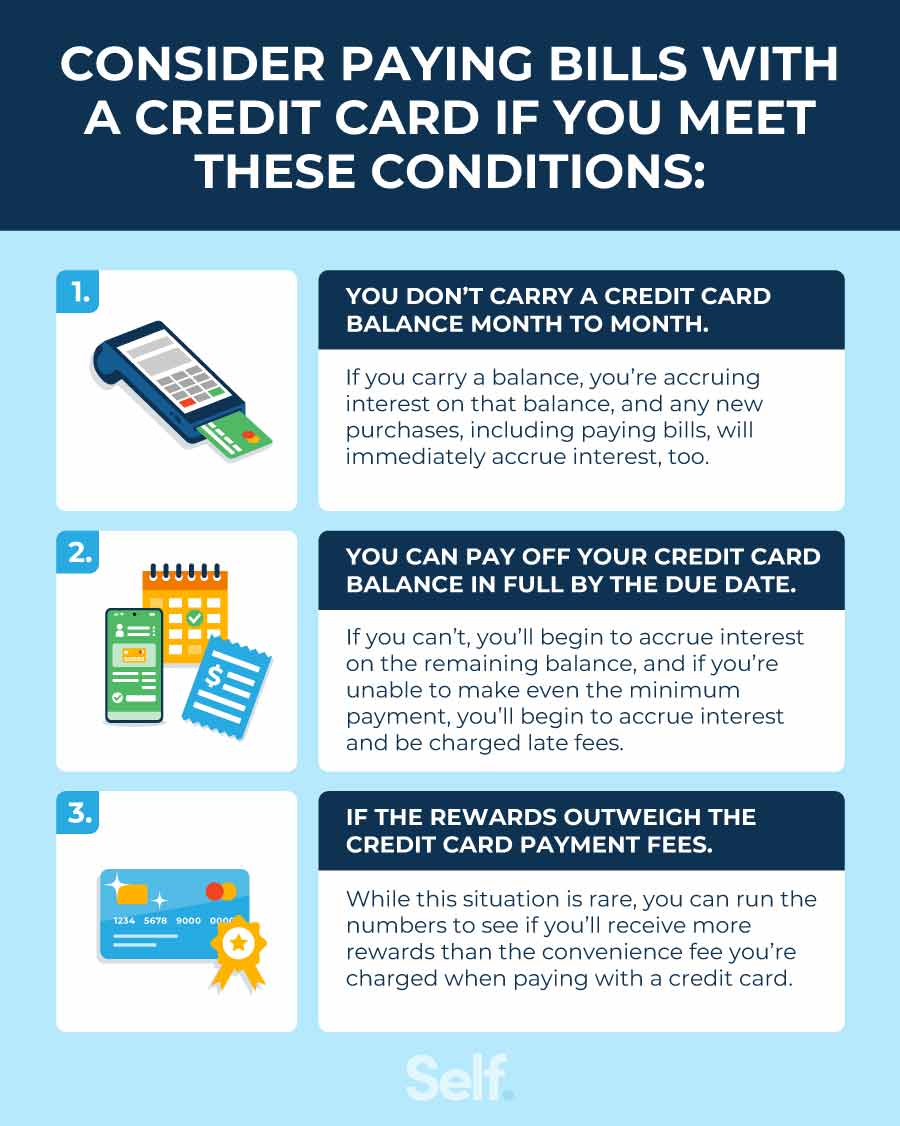

Is it OK to pay bills with a credit card

Generally speaking, paying your monthly bills by credit card can be a good idea as long as you adhere to two rules. Always pay your balance in full and on time each month. Never put bills on a credit card because you can't afford to pay them.

What can I not pay with a credit card

Avoid placing the following expenses on credit cards:Mortgage or rent.Household Bills/household Items.Small indulgences or vacation.Down payment, cash advances or balance transfers.Medical bills.Wedding.Taxes.Student Loans or tuition.

Does paying bills with a credit card hurt your credit score

Paying monthly bills with a credit card can affect your credit score positively or negatively, depending on how you handle it. Using a credit card could hurt your credit score if: You run up a balance and don't pay it off.