Why did I get a 250 tax refund?

Who gets the $250 Georgia refund

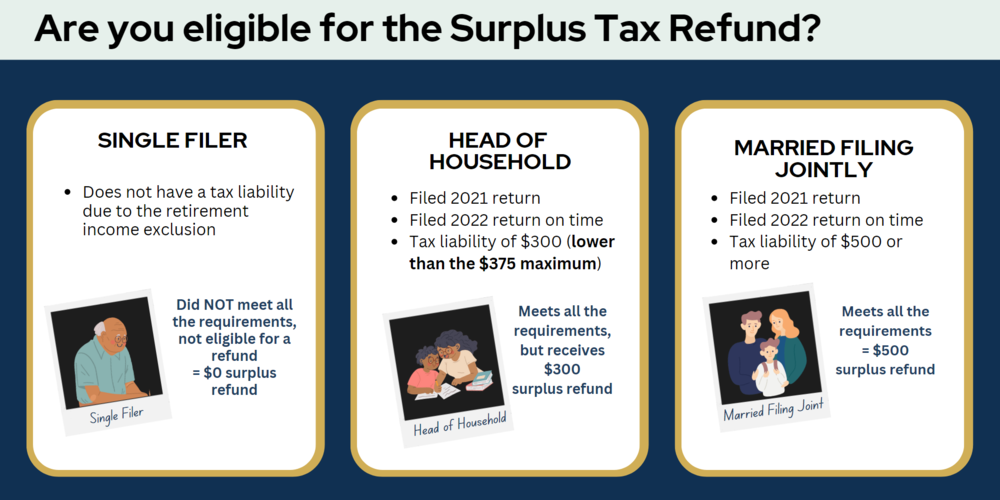

Single filers and married individuals who file separately could receive a maximum refund of $250. Head of household filers could receive a maximum refund of $375. Married individuals who file joint returns could receive a maximum refund of $500.

Cached

Why did I get an unexpected tax refund

— Some people received refund checks from the IRS even though they were told they owed them money. Is it simply just a nice surprise or a mistake One tax expert says it could be the result of an error in completing the return, so the IRS corrected it and sent a refund.

Who qualifies for the Georgia surplus tax refund

To qualify for the latest round of checks you have to have paid taxes to the state of Georgia on any income you earned in 2023. Retirees might have to pay federal taxes on Social Security, but according to the Georgia Department of Revenue that income is exempt from state taxes.

What is the $250 rebate in Georgia

Calculate Refund Amount

HB 162 allows for a tax refund out of the State's surplus to Georgia filers who meet eligibility requirements. Depending on your filing status and tax liability, you could receive a maximum of: $250 for Single/Married Filing Separate. $375 for Head of Household.

Cached

How do I check my Kemp refund

Call the DOR automated telephone line at 877-423-6711 to check the status of your tax refund.

When can I expect my GA surplus refund

But the Georgia Department of Revenue says to allow 6 to 8 weeks for your refund to arrive. And if you're eligible for a Georgia surplus tax refund and haven't filed your 2023 tax return due to a tax deadline extension, your rebate won't be processed until your tax return is.

Why did I just receive money from the IRS

It could be: A refund from a filed tax return, including an amended tax return or an IRS tax adjustment to your tax account – this will show as being from the IRS (“IRS TREAS 310”) and carry the code “TAX REF.”

Can the IRS accidentally send you money

Sometimes, the IRS does find mistakes in your calculations or entries and it will send you a bigger refund than you were expecting. If that is the case it will most likely send you a notice in the mail explaining the reason.

Where is my $250 from Georgia

To check the status of your Georgia state refund online, go to https://dor.georgia.gov/wheres-my-refund.

How much is Georgia surplus refund

HB 162 and HB 1302 provided for surplus tax refunds of up to $500 for Georgia filers.

Is GA getting a tax rebate check

People who filed tax returns in both 2023 and 2023 are eligible to receive the money. Taxpayers must file their taxes before they can get the refund. Eligible Georgians would receive up to $250 for single filers, $375 for heads of household or $500 for married couples filing jointly.

What check is Kemp sending out

Head of household filers could receive a maximum refund of $375. Married individuals who file joint returns could receive a maximum refund of $500. The refund amount will be based on an individual's tax liability for Tax Year 2023.

Why have I not received my GA surplus refund

What are some common reasons I might not have received an HB 162 refund You did not file both a 2023 and 2023 Georgia income tax return prior to the deadline for the 2023 return in calendar year 2023. You did not file by the due date or timely request an extension of October 16th, 2023.

Is Governor Kemp sending out checks in 2023

Atlanta, GA – Governor Brian P. Kemp and the Georgia Department of Revenue (DOR) announced today that the first round of surplus tax refund checks have been issued to Georgia filers. These refunds are a result of House Bill 162, passed by the General Assembly and signed into law by Governor Kemp earlier this year.

What do I do if I get an unexpected check from the IRS

Call the IRS toll-free at 800–829–1040 (individual) or 800–829–4933 (business) to explain why the direct deposit is being returned.

Did the IRS send out money

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status. Most eligible people already received their Economic Impact Payments.

What do I do if I get unexpected money from the IRS

Contact the Automated Clearing House (ACH) department of the bank/financial institution where the direct deposit was received and have them return the refund to the IRS. 2. Call the IRS toll-free at 800–829–1040 (individual) or 800–829–4933 (business) to explain why the direct deposit is being returned.

Why did I get a random deposit from IRS Treas 310

What's an IRS TREAS 310 bank transaction If you receive your tax refund by direct deposit, you may see IRS TREAS 310 for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment (direct deposit).

How do I check my GA surplus check

Ways to check your statusCheck your refund online (does not require a login)Sign up for Georgia Tax Center (GTC) account. GTC provides online access and can send notifications such as when a refund has been issued.Use the automated telephone service at 877-423-6711.

Has anyone received the GA surplus refund

The Georgia Department of Revenue and the governor's office announced Monday that the first round of surplus tax refund checks have been issued. The extra money is an additional refund of income taxes from 2023 stemming from the state's revenue surplus.