Why did I get denied an Apple Card?

Why did I get denied a Apple credit card

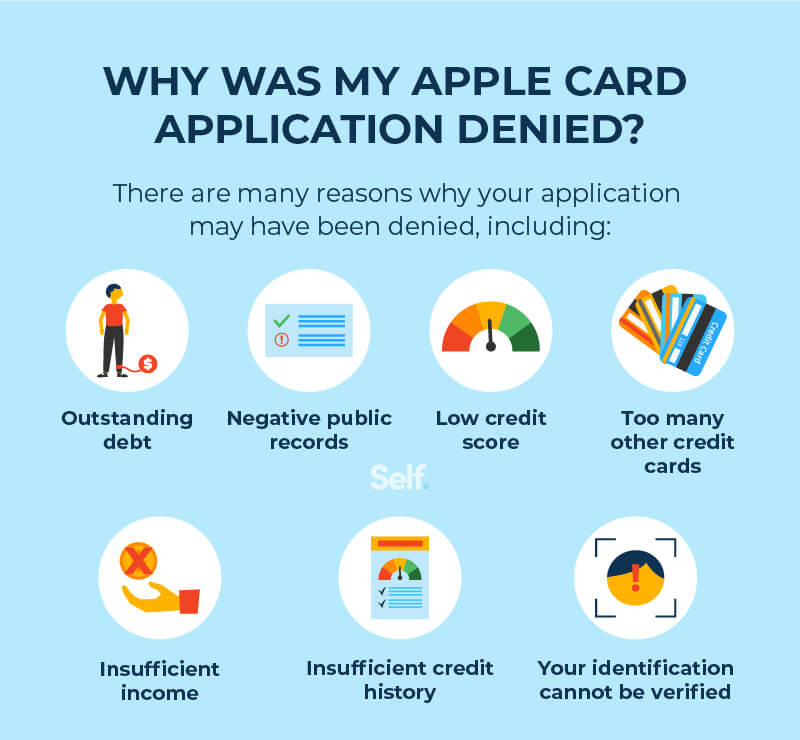

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application. You are currently past due or have recently been past due on a debt obligation. Your checking account was closed by a bank (for example, due to repeatedly spending more than your available account balance).

Cached

Why is it so hard to get approved for an Apple Card

Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for the Apple Card. In order to get the Apple Card, you will have to meet the credit score requirement, have a steady income and be at least 18 years old.

Does everyone get approved for the Apple Card

Applicants with scores above 660 are "considered favorable for credit approval," according the Apple Card's website. In other words, those with at least a "good" score have a chance at getting the card. Apple Card's issuer, Goldman Sachs, uses the FICO Score 9 score model, which ranges from 300 to 850.

Cached

What score do you need for an Apple Card

What credit score do you need for the Apple Card According to Apple, customers with a credit score lower than 600 might not be approved for the Apple Card. This means that some applicants with fair credit (scores ranging from 580 to 669) might be accepted for the Apple Card, while others might be declined.

Can I get Apple Card with 500 credit score

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

What is the minimum income for Apple Card

There is no minimum income limit you need to have.

What is the highest credit limit on the Apple Card

It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000. An Apple Card may be shared using Apple Card Family.

What happens if you don’t get approved for Apple Card

You'll likely get an approval decision instantly in the Wallet app – and, in the case of a denial, an explanation regarding why you were not approved – but you may see a message saying your application is in review. This means Goldman Sachs needs more time to consider your application or verify your identity.

Can I get an Apple Card with a 550 credit score

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

Can I get an Apple Card with a 630 credit score

It's possible to get approved for the Apple Card with a credit score under 670, but your chances improve as your credit score increases. And an excellent credit score doesn't guarantee your approval, other factors are considered, such as income and payment history.

What is the debt to income ratio for Apple Card

Make sure all your unsecured debt obligations are less than 50% of your monthly income; Not have maxed out all of your credit cards within the last 3 months.

What is the max credit limit for Apple Card

The Apple Card has no yearly fees, no fees for transactions, and no fees for penalties. It does have credit limits. The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000.

Can I get an Apple Card with a 580 credit score

Apple Card uses FICO Score 9. FICO Score 9 ranges from 300 to 850, with scores above 660 considered favorable for credit approval.

What is the average credit limit for Apple Card

The Apple Card credit limit is usually around $2,500 to start, according to forum posts, and some cardholders report limits as high as $20,000. Marcus by Goldman Sachs does not include any specific Apple Card credit limit information in the card's terms, though.

Who does Apple Card pull credit from

Goldman Sachs , the bank behind the Apple Card, uses information from the credit bureaus to evaluate each application, including your credit score and your credit report, which shows your current debt obligations. It also considers the income you report on your application.

What’s the highest Apple Card limit

The limits are determined by the cardholder's credit score, credit age, and income at the time of application. Cardholders have reported credit limits as low as $50 and as high as $15,000. An Apple Card may be shared using Apple Card Family. It requires each person to be over 13 years old to share the card.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

Is $30000 a high credit limit

Yes, a $30,000 credit limit is very good, as it is well above the average credit limit in America. The average credit card limit overall is around $13,000, and people who have limits as high as $30,000 typically have good to excellent credit, a high income and little to no existing debt.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.