Why did I not receive September’s Child Tax Credit?

What do I do if I didn t receive my September Child Tax Credit

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

Why I never received my Child Tax Credit

Some eligible taxpayers were excluded

Millions of eligible taxpayers did not receive their child tax credits in 2023. In August 2023, the inspector general informed the IRS that eligible taxpayers were not receiving their payments and suggested that the IRS look into discrepancies.

What’s going on with September’s Child Tax Credit

Families who did not get a July or August payment and are getting their first monthly payment in September will still receive their total advance payment for the year of up to $1,800 for each child under age 6 and up to $1,500 for each child ages 6 through 17.

Why is the Child Tax Credit delayed

However, people who claim the refundable portion of the child tax credit will see delayed refunds, at least until February 28, IRS warns. That's because of procedures the agency has had in place for over five years to help prevent the issuance of fraudulent refunds pertaining to refundable tax credits.

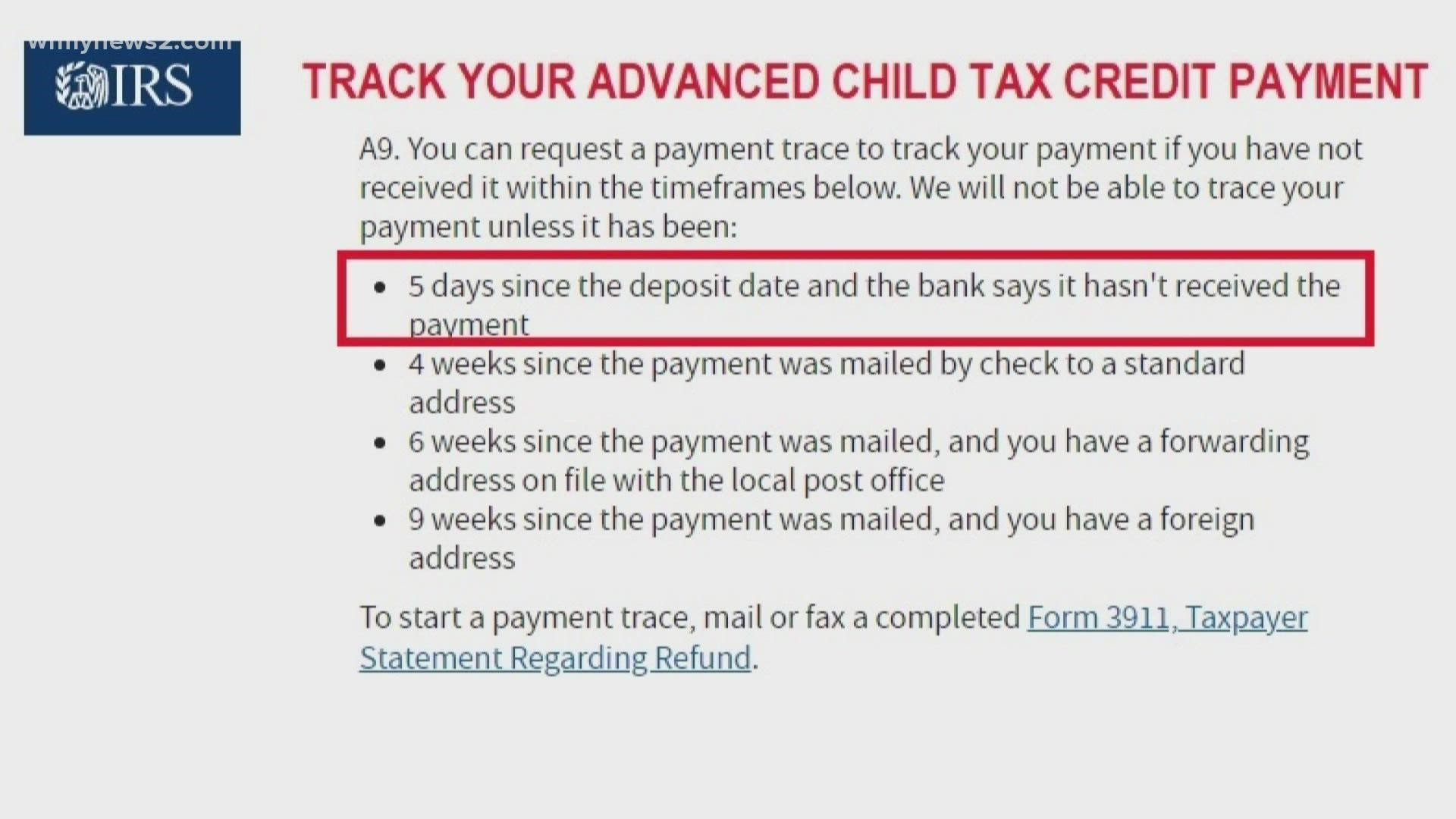

Can I track my child tax credit check

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

How do I claim the rest of my child tax credit

How to get the rest of the credit. The only way to get the full amount of any remaining Child Tax Credit for which you are eligible is to file a tax return for 2023. When you are ready to file, you can use childtaxcredit.gov to find free assistance for filing to receive your Child Tax Credit.

How do I get my child tax credit check reissued

Call the IRS at (800) 919-9835 or (800) 829-1040. If you prefer to send a form, fill out Form 3911 and either fax or mail it to the appropriate address — a link to the relevant IRS addresses is presented here, under Q F3.

Why did I get $250 from IRS today

If you had a tax liability last year, you will receive up to $250 if you filed individually, and up to $500 if you filed jointly.

How much money are we getting in September

Which states are sending out payments in September According to CNET, California residents will receive checks worth up to 1,050 dollars, which will begin going out in October.

Can the child tax credit be late

What to do if you missed the deadline to claim your money. If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, don't worry. You can still claim that money when you file your taxes in 2023 — you just won't receive it this year.

How long will the child tax credit be deposited

For every child 6-17 years old, families will get $250 each month. For every child under 6 years old, families will get $300 each month. The 80% who get their refunds from the IRS through direct deposit will get these payments in their bank account on the 15th of every month until the end of 2023.

How do I report a missing Child Tax Credit check

Call the IRS at (800) 919-9835 or (800) 829-1040. If you prefer to send a form, fill out Form 3911 and either fax or mail it to the appropriate address — a link to the relevant IRS addresses is presented here, under Q F3.

How do I check my EITC status

– It's available 24 hours a day, 7 days a week. If you do not have internet access, call IRS's Refund Hotline at 1-800-829-1954.

How can I check my CTC payment

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Can IRS offset Child Tax Credit

Yes. Refunds of an overpayment of a tax liability, including the portion to which your Child Tax Credit relates, may be reduced (that is, offset) for overdue taxes from previous years or other federal or state debts that you owe.

How long does it take the IRS to reissue a check

about six weeks

If the check hasn't been cashed, you'll get a replacement refund check in about six weeks. If your original refund check was cashed, you'll receive a claim package within six weeks to complete and return to the Bureau of the Fiscal Service to process your claim.

How long does it take to get CTC check from IRS

We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

Why did I get $2800 from the IRS

The third Economic Impact Payment will be larger for most eligible people. Eligible individuals who filed a joint tax return will receive up to $2,800, and all other eligible individuals will receive up to $1,400. Those with qualifying dependents on their tax return will receive up to $1,400 per qualifying dependent.

When can I expect my Georgia surplus refund

6-8 weeks

Please allow 6-8 weeks for Surplus Tax Refunds to be issued (if you filed by the April 18, 2023 deadline) Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund.

Are we getting stimulus in September

Various states have officially announced that they will be sending out stimulus checks or tax rebates to US citizens in September.