Why did my credit score drop after paying a loan?

Why did my score drop when I paid off a loan

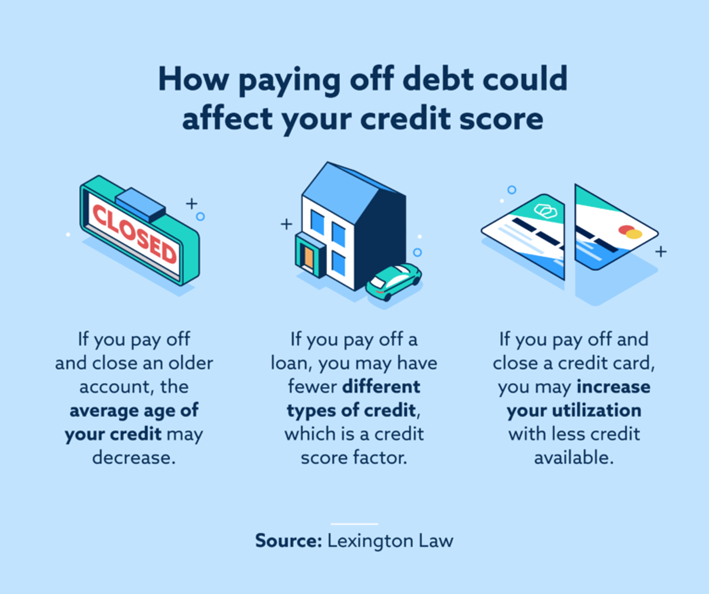

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Cached

Does paying off a loan hurt your credit

In short, yes—paying off a personal loan early could temporarily have a negative impact on your credit scores. You might be thinking, “Isn't paying off debt a good thing” And generally, it is. But credit reporting agencies look at several factors when determining your scores.

Why did my credit limit decrease after paying off debt

As outlined in the Fair Credit Reporting Act, credit card issuers have the right to lower credit limits at will and may do so when a cardholder appears to be in financial trouble. If you missed due dates or carry high debt and only send the minimum payments, the issuer may shorten the limit.

Why did my credit score drop 30 points after paying off a car

Lenders like to see a mix of both installment loans and revolving credit on your credit portfolio. So if you pay off a car loan and don't have any other installment loans, you might actually see that your credit score dropped because you now have only revolving debt.

Cached

Is it bad to pay off a loan early

If you have personal loan debt and are in a financial position to pay it off early, doing so could save you money on interest and boost your credit score. That said, you should only pay off a loan early if you can do so without tilting your budget, and if your lender doesn't charge a prepayment penalty.

Why would my credit score drop 40 points in one month

Your credit score may have dropped by 40 points because a late payment was listed on your credit report or you became further delinquent on past-due bills. It's also possible that your credit score fell because your credit card balances increased, causing your credit utilization to rise.

Is paying off a loan fast bad

If you have personal loan debt and are in a financial position to pay it off early, doing so could save you money on interest and boost your credit score. That said, you should only pay off a loan early if you can do so without tilting your budget, and if your lender doesn't charge a prepayment penalty.

Is it bad to pay off a personal loan early

Paying off the loan early can put you in a situation where you must pay a prepayment penalty, potentially undoing any money you'd save on interest, and it can also impact your credit history.

Why did my credit score drop 40 points

Your credit score may have dropped by 40 points because a late payment was listed on your credit report or you became further delinquent on past-due bills. It's also possible that your credit score fell because your credit card balances increased, causing your credit utilization to rise.

Why did my credit score drop 60 points after paying off my car

You paid off a loan

Paying off something like your car loan can actually cause your credit score to fall because it means having one less credit account in your name. Having a mix of credit makes up 10% of your FICO credit score because it's important to show that you can manage different types of debt.

Why did my credit score drop 70 points in one month

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

Why did my credit score drop 40 points when nothing changed

Reasons for a drop in your credit score when nothing has changed include reported high utilization of credit, closing an account, a new hard inquiry, or errors on your credit report. High utilization, closing an account, or a new hard inquiry can impact your credit score negatively.

Is it better to pay off a loan immediately or over time

The faster you can pay off a loan, the less it will cost you in interest. If you can pay off a personal loan early, it can lower your total cost of borrowing, potentially saving you a considerable amount of money.

Is it better to pay off loans fast or slow

In most cases, paying off a loan early can save money, but check first to make sure prepayment penalties, precomputed interest or tax issues don't neutralize this advantage. Paying off credit cards and high-interest personal loans should come first. This will save money and will almost always improve your credit score.

Why did my credit score drop 60 points in one day

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

How did my credit score drop 60 points in a month

Your credit score may have dropped by 60 points because negative information, like late payments, a collection account, a foreclosure or a repossession, was added to your credit report. Credit scores are based on the contents of your credit report and are adversely impacted by derogatory marks.

Does paying a loan build credit

The borrower makes monthly payments according to the terms of the loan agreement. Making on-time monthly payment builds your credit score and helps contribute to your credit mix. Paying off an installment loan will cause a slight temporary drop in credit score.

Is it worth paying off a loan

Paying off your debt

If you are paying more for your borrowing than you're getting on your savings, then it makes sense to pay off your loans – so long as you can access funds in an emergency (see more on this below) and you'll not be charged high penalties for repaying your loan.

How long does it take for credit score to go up after paying off debt

If you have recently paid off a debt, wait for at least 30 to 45 days to see your credit score go up.

Why did my credit score drop 50 points in a week

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.