Why did my credit score drop when an old account was removed?

Does removing old accounts affect credit score

Whether an account is open or closed, your credit score can benefit from an account in positive standing that stays on your report for a long time. Once the account is removed from your report, you lose that piece of your credit history.

Why did my credit score not go up after collection removed

It is not uncommon for credit scores to drop after paying off a collection account. There are several factors as to why your credit score dropped. The first is to look at the age of the debt. The older the date of the debt, the less impact it has on your credit score.

Cached

Should I remove old closed accounts from credit report

You only need to consider removing a closed account if it has an adverse payment history. Otherwise, an account that is in good standing is OK to leave. It shows future lenders you can pay off a loan and make payments on time.

How much will my credit score drop if I close my oldest account

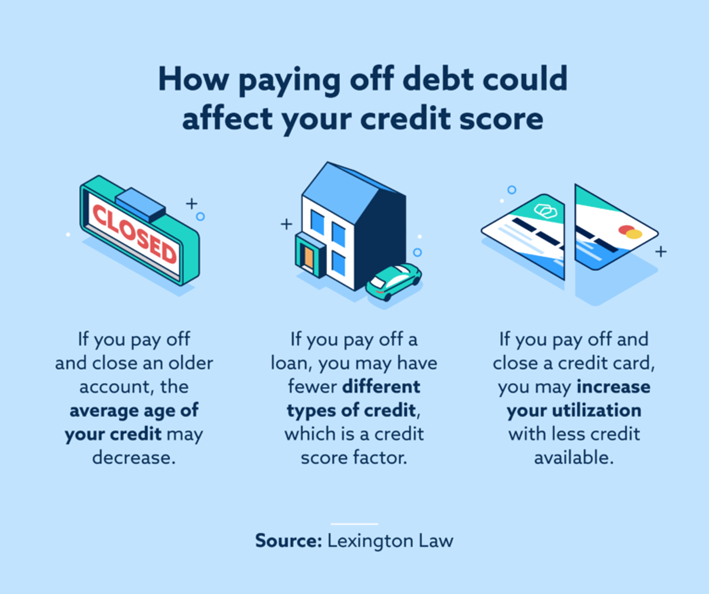

The longer you've been using credit, the better it is for your credit score. Closing your oldest card will shorten the length of your credit history — which accounts for 15 percent of your credit score. The damage from this, though, won't happen for a long time.

Does removing a collection drop your score

If you already paid the debt: Ask for a goodwill deletion

A record of on-time payments since the debt was paid will help your case. Your credit record will still show the late payments leading up to the collection action, but removing the collection itself takes away a source of score damage.

Will my credit score go up if a collection is removed

Will deleting collections improve credit score In most cases, deleting a collections account from your credit report can improve your credit score. In other cases, it may have little-to-no effect on your credit score.

Why shouldn’t you close old credit accounts

Closing an unused credit card causes that account to stop aging, which can negatively affect your average account age and hurt your credit. If the account you close is one of your oldest accounts, that damage can be even worse.

What happens to my credit score if I close my oldest account

The longer you've been using credit, the better it is for your credit score. Closing your oldest card will shorten the length of your credit history — which accounts for 15 percent of your credit score. The damage from this, though, won't happen for a long time.

Is it a bad idea to close your oldest credit card

Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your credit score.

How many points will my credit score go up when a collection is removed

One of the ways to delete a collection account is to call the collection agency and try to negotiate with them. Ask them to delete the collection in exchange for paying off your debt. Also, get the agreement in writing. If they accept it, your credit could increase by as much as 100 points.

Will my credit score go back up after collection is removed

Though your credit score will not automatically improve when you pay off your collections, there are certain benefits to it: For overdue medical or credit card payments, you avoid a debt collection suit.

How many points will my credit score go up when a default is removed

Once a default is more than two years old, the negative effect falls to 250 points, then when it is over 4 years old it drops a bit more to 200 points. These hits to your credit rating aren't reduced when you start to pay the debt, or even when it has been fully repaid.

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

Is it worse to close a credit card or never use it

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

How many points does your credit score drop when you close an account

The numbers look similar when closing a card. Increase your balance and your score drops an average of 12 points, but lower your balance and your score jumps an average of 10 points.

Why did my credit score drop 37 points for no reason

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

What happens after a default is removed

A default will stay on your credit file for six years from the date of default, regardless of whether you pay off the debt. But the good news is that once your default is removed, the lender won't be able to re-register it, even if you still owe them money.

Will my credit score go up if a charge-off is removed

Getting Your Debt Charged-Off

If you decide to pay it, the debt will merely be reflected on your report as a 'paid charge off. ' While it does look better to lenders manually looking through your credit report, it's unlikely to improve your credit score.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.