Why did the FDIC insurance limit increase?

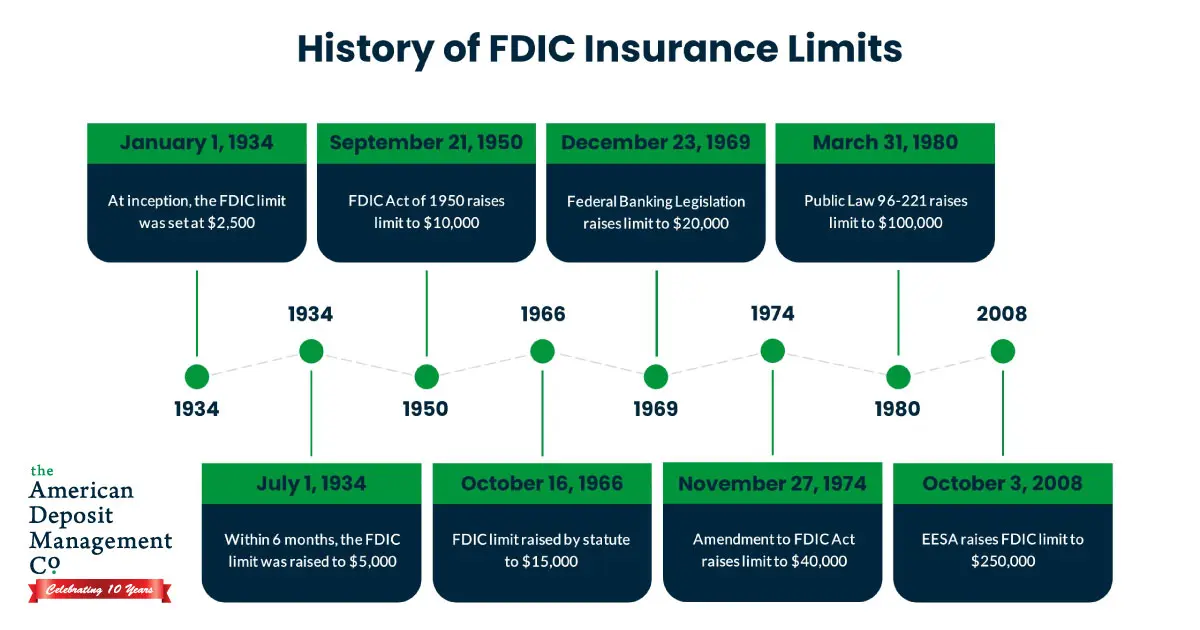

When did FDIC change for $100000 to $250000

2008

Emergency Economic Stabilization Act of 2008 Temporarily Increases Basic FDIC Insurance Coverage from $100,000 to $250,000 Per Depositor.

Cached

What happens if you have more than 250k in the bank

Bottom line. Any individual or entity that has more than $250,000 in deposits at an FDIC-insured bank should see to it that all monies are federally insured. It's not only diligent savers and high-net-worth individuals who might need extra FDIC coverage.

How can I insure more than 250k in bank

Here are four ways you may be able to insure more than $250,000 in deposits:Open accounts at more than one institution. This strategy works as long as the two institutions are distinct.Open accounts in different ownership categories.Use a network.Open a brokerage deposit account.

Cached

Will FDIC banks insure your account upto $250000

A: Yes. The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.

Is a joint account FDIC insured up to $500 000

Insurance Limit

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

What is the new rule of the FDIC

Summary: The Federal Deposit Insurance Corporation (FDIC) adopted a final rule, applicable to all insured depository institutions, to increase initial base deposit insurance assessment rate schedules uniformly by 2 basis points, beginning in the first quarterly assessment period of 2023.

Does FDIC cover $500000 on a joint account

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

Is it safe to keep millions in a bank account

The good news is nearly all banks have insurance through the Federal Deposit Insurance Corporation (FDIC). This protection covers $250,000 “per depositor, per insured bank, for each account ownership category.” This insurance covers a range of deposit accounts, including checking, savings and money market accounts.

What happens if you exceed the FDIC limit

The Depositors Insurance Fund (DIF) is another option for insuring excess deposits. This program covers deposit account balances beyond the $250,000 FDIC limits at member banks. So, once you exhaust your FDIC coverage limits, you're still protected.

How do I insure 2 millions in the bank

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

How to maximize FDIC insurance at one bank

If your balance is higher than your current FDIC insurance coverage amount, consider these strategies to maximize your coverage:Open a single account for each adult family member.Pool your money into joint accounts.Save for your child.Save for retirement with an IRA Savings Account or IRA CD.

Can you have multiple FDIC-insured accounts at the same bank

The FDIC refers to these different categories as “ownership categories.” This means that a bank customer who has multiple accounts may qualify for more than $250,000 in insurance coverage if the customer's funds are deposited in different ownership categories and the requirements for each ownership category are met.

How do you avoid FDIC limits

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

What are the new FDIC rules for 2024

Under the new trust rule, the insurance limit with one owner and 5 or more eligible beneficiaries will be up to $1,250,000 per insured bank. As long as the combined balance of their revocable and irrevocable trust accounts is $1.25 million or less, the depositor is fully insured.

Can you live off interest of $1 million dollars

Once you have $1 million in assets, you can look seriously at living entirely off the returns of a portfolio. After all, the S&P 500 alone averages 10% returns per year. Setting aside taxes and down-year investment portfolio management, a $1 million index fund could provide $100,000 annually.

How many people have $3,000,000 in savings

1,821,745 Households in the United States Have Investment Portfolios Worth $3,000,000 or More.

Do millionaires worry about FDIC insurance

Millionaires don't worry about FDIC insurance. Their money is held in their name and not the name of the custodial private bank. Other millionaires have safe deposit boxes full of cash denominated in many different currencies.

Where do millionaires keep their money insured

Millionaires don't worry about FDIC insurance. Their money is held in their name and not the name of the custodial private bank. Other millionaires have safe deposit boxes full of cash denominated in many different currencies.

How can I avoid FDIC limits

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

How do I get around FDIC limits

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.