Why did the IRS mail my Child Tax Credit instead of direct deposit?

Why is my child tax credit being mailed instead of direct deposit

The IRS sends your payments by direct deposit to the bank account they have on file. If they don't have bank account information for you, a check will be mailed to you.

Cached

Why did I receive a tax refund check in the mail instead of direct deposit

You omit a digit in the account or routing number of an account and the number doesn't pass the IRS's validation check. In this case, the IRS will send you a paper check for the entire refund instead of a direct deposit.

Cached

Will child tax credit payments be mailed

If you don't have a bank account or you would prefer to receive a check instead of direct deposit, payments can be mailed to your address. What if I don't have a permanent address You can receive monthly Child Tax Credit payments even if you don't have a permanent address.

Cached

Why didn’t my child tax get deposited

The IRS may not have an up-to-date mailing address or banking information for you. The mailed check may be held up by the US Postal Service or, if it was a recent payment, the direct deposit payment may still be being processed.

When was the child tax credit mailed

The IRS began disbursing advance Child Tax Credit payments on July 15. After that, payments were disbursed on a monthly basis through December 2023. For more information regarding how advance Child Tax Credit payments were disbursed, see Topic E: Advance Payment Process of the Child Tax Credit.

How do I know if my child tax credit was mailed

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

How long does it take to receive refund check once mailed

(updated May 16, 2023) We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return.

How do I change my IRS refund from mail to direct deposit

Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper. Be sure to double check your entry to avoid errors.

When were Child Tax Credit checks mailed

The IRS began disbursing advance Child Tax Credit payments on July 15. After that, payments were disbursed on a monthly basis through December 2023.

How do I know if my Child Tax Credit was mailed

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

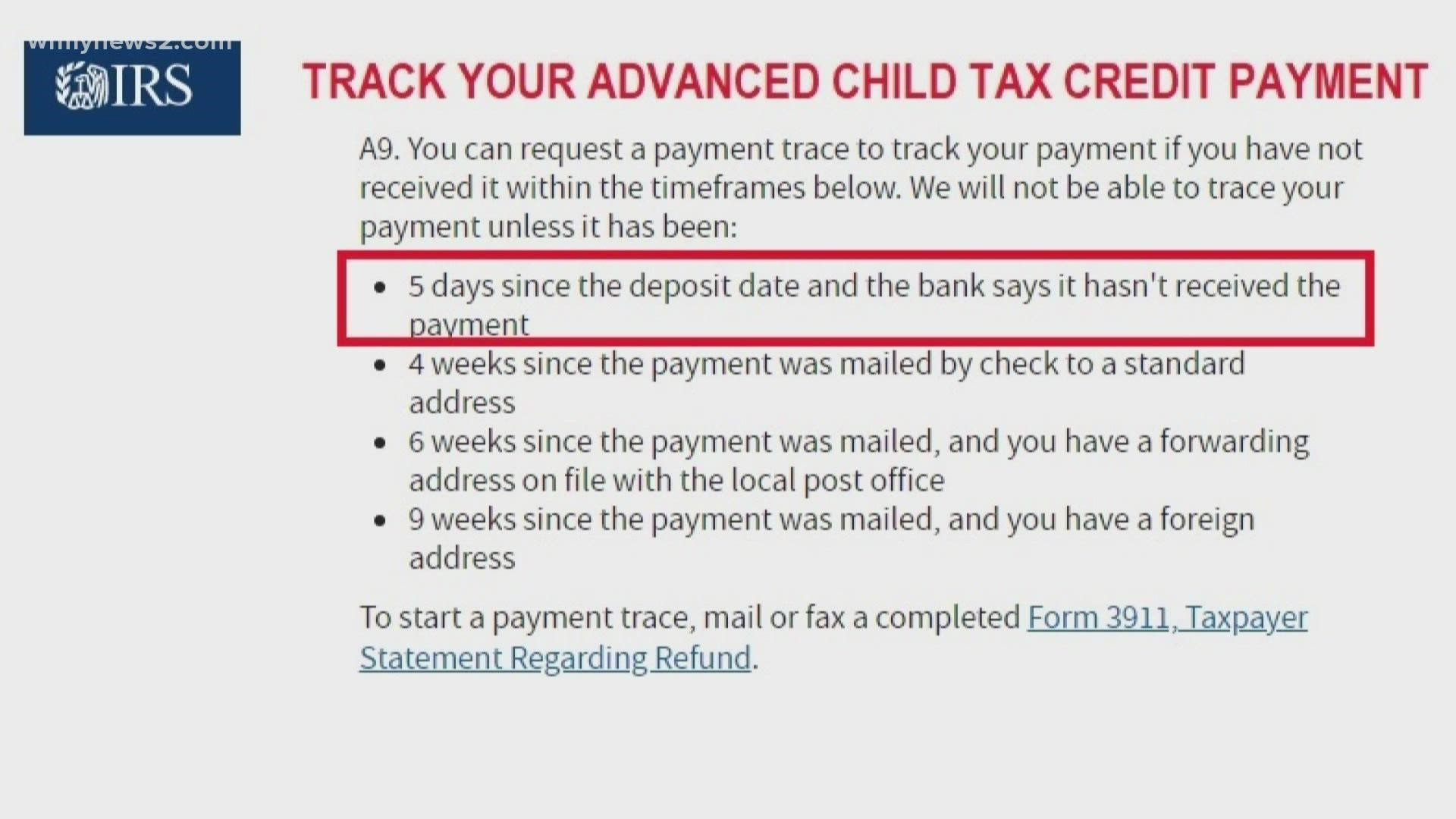

What happens if I didn’t receive my advance Child Tax Credit

If You Didn't Receive Advance Payments

You can claim the full amount of the 2023 Child Tax Credit if you're eligible — even if you don't normally file a tax return. To claim the full Child Tax Credit, file a 2023 tax return.

What is the 750 dollar child tax credit

However, $750 is the maximum amount a taxpayer will receive. It is equivalent to three children. -Single Filers earning $100,000 or less qualify for the rebate. -Joint filers $200,000 or less qualify for the rebate.

Have 6419 letters been mailed

What this letter is about. To help taxpayers reconcile and receive 2023 CTC, the IRS is sending Letter 6419, Advance Child Tax Credit Reconciliation from late December 2023 through January 2023. Taxpayers should keep this, and any other IRS letters about advance CTC payments, with their tax records.

How long does it take to get tax refund once mailed

(updated May 16, 2023) We issue most refunds in less than 21 calendar days. However, if you filed a paper return and expect a refund, it could take four weeks or more to process your return. Where's My Refund

How long does it take for the IRS to deposit a mailed check

As a result, you should receive a refund check in the mail in 3–4 weeks for your 2000 Form 1040 overpayment. If you don't receive your refund check within 4 weeks, please call us at 1-999-999-9999. Visit www.irs.gov/cp53. >

Are tax refunds mailed or direct deposited

The IRS uses direct deposit to electronically issue tax refund payments directly into taxpayers' financial accounts. In most cases, you will receive your tax refund in less than 21 days after you file your federal tax return.

Why would IRS not direct deposit my refund

Your refund should only be deposited directly into accounts that are in your own name, your spouse's name or both, if it's a joint account. These are some of the reasons a financial institution may reject a direct deposit, resulting in a paper check.

When did letter 6419 get mailed

To help taxpayers reconcile and receive 2023 CTC, the IRS is sending Letter 6419, Advance Child Tax Credit Reconciliation from late December 2023 through January 2023.

When were August child tax credit checks mailed

Besides the July 15 and August 13 payments, payment dates are September 15, October 15, November 15 and December 15.

Why did I receive a letter from the IRS about child tax credit

We sent you a letter (notice) because our records show you may be eligible for the EITC but didn't claim it on your tax return. First, find out if you qualify for EITC by following the steps shown in your notice. You can find out more about What You Need to Do and What we Will Do by using one of the links below.