Why do companies give employees credit cards?

Why do companies give company credit cards

Companies use corporate credit cards so that employees can charge authorized business expenses, such as hotel stays and flights, without relying on their own credit cards or cash. A corporate card usually carries a company's name as well as the name of the employee designated as the cardholder.

Cached

Should I give my employee a credit card

You should specify that employee credit cards are only to be used for authorized company purchases, not personal charges. You should also put in place accounting procedures to ensure that employee purchases are reconciled, and that no abuse occurs.

Cached

What are the benefits of corporate credit card to employees

Pros of Corporate Credit Cards

You can earn rewards and benefits that help the company. It enables simplified analysis and tracking of all business-related transactions. This prevents employees from making personal charges on a company card. Enables better controls on the spending.

When an employee uses company credit card

While it's not illegal to pay for personal expenses using a company card, it goes against company expense policy and will likely result in disciplinary action if it happens regularly. It will also have adverse effects on the company's tax liabilities. In more serious cases deliberate card misuse is considered fraud.

Cached

What are the risks of corporate credit cards

Businesses should also be aware of the risks of corporate credit cards that are associated with their use, including misuse and fraud, insufficient control, increased accounting complexity, liability, and privacy and data security issues.

Can I get in trouble for using a corporate credit card

This kind of financial fraud involving expense accounts, credit cards or cash allowances from an employer can result in allegations of either fraud or embezzlement. These white-collar crimes can result in financial consequences, jail time and difficulty moving your career forward.

Why do people take credit for your work

If you are sure that the culprit knowingly took credit for your work, this says more about that person than it does about you. This professional might be insecure about their position, status, or role within the company. If this is the case, they probably don't have confidence in their own abilities or ideas.

Does an employee credit card affect your credit

If you are a corporate credit cardholder, your credit will likely not be affected. The issuer may check your credit before your company gives you a card, but the activity on the card (the outstanding balance and payments) is reported on the organization's credit report.

Is it illegal to use a company credit card for personal use

Technically, putting your personal purchases on your business credit card isn't illegal. But making personal purchases on a business credit card likely violates the terms and conditions of your card agreement, which can have some serious consequences.

Do corporate credit cards hurt your credit

If you are a corporate credit cardholder, your credit will likely not be affected. The issuer may check your credit before your company gives you a card, but the activity on the card (the outstanding balance and payments) is reported on the organization's credit report.

Can I get fired for using company credit card

If your employer alleges that you embezzled or engaged in fraudulent spending at their expense, it is likely that they also terminated your employment at the same time if they alerted law enforcement to the issue.

Can I use my corporate card for personal expenses

Technically, putting your personal purchases on your business credit card isn't illegal. But making personal purchases on a business credit card likely violates the terms and conditions of your card agreement, which can have some serious consequences.

What is it called when you give someone credit for their work

What is it called when you give credit in your writing to someone else's quote Giving credit to another person's work is known as attribution. In scholarly writing, attribution is accomplished using both a reference and citation using a standardized style, such as APA.

What to do if people take credit for your work

If your co-worker acknowledges not giving you credit, you can ask her to advise management of your contributions to the project or request that she do so in the future. If she refuses or fails to acknowledge your efforts again, you can make your contributions known to management.

Do employee cards help build credit

Yes, corporate cards can help you build your business credit score. Using a company credit card aids in maintaining a low credit utilization rate, and responsible account activity may help improve the company's credit score, raise their credit limit and reduce their interest rate.

Do companies give employees credit cards

The company credit card remains a popular option for managing business expenses. It gives businesses a standard way to let employees pay for a wide range of work-related expenses: train or plane tickets, restaurant bills, hotel stays, office supplies – whatever they need to do their work.

Is an employee using a company credit card for personal use embezzlement

Regardless of what was spent and for which items, this is theft. It is essentially stealing company funds for personal use.

What is the difference between normal credit card and corporate credit card

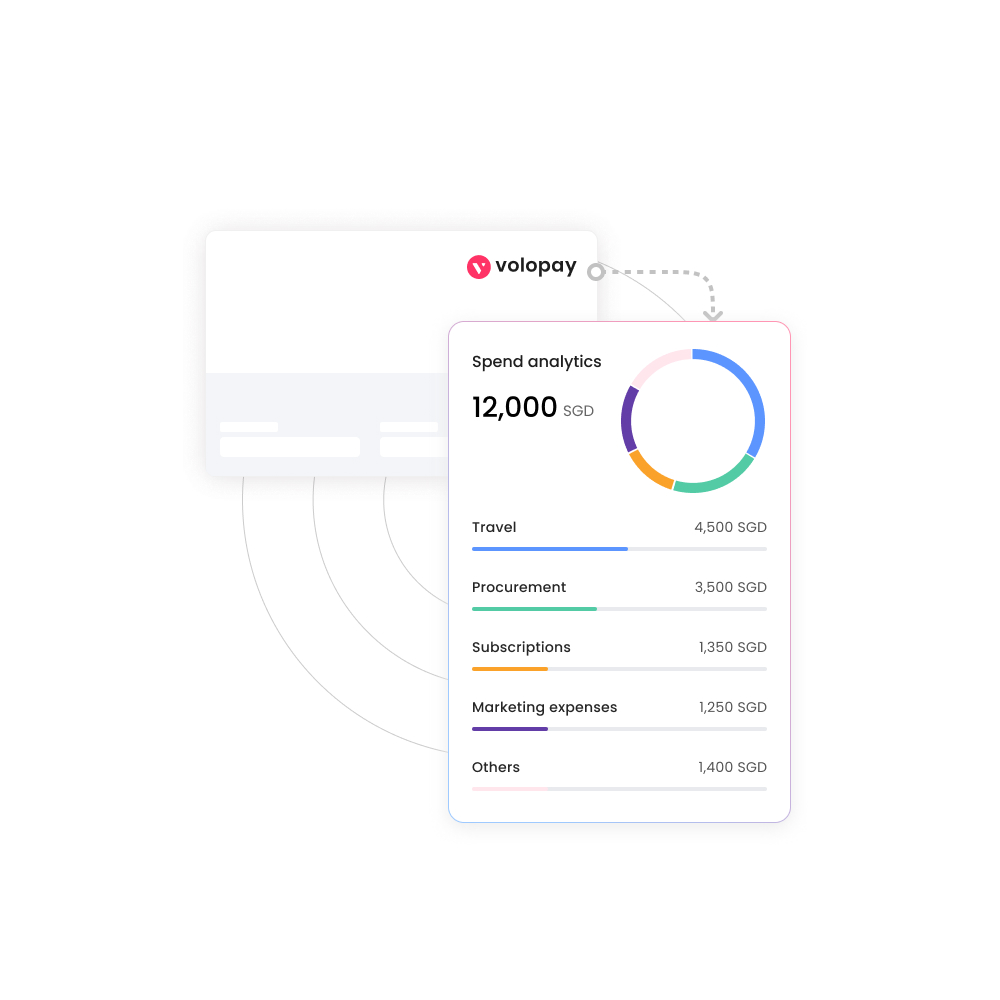

Both corporate and business credit cards allow users to set limits on individual cards, but corporate credit cards give a greater level of control. Many feature built-in analytical tools, such as accounting and tracking options, which can reduce cost and time in expense management.

Do corporate cards affect your credit score

If you are a corporate credit cardholder, your credit will likely not be affected. The issuer may check your credit before your company gives you a card, but the activity on the card (the outstanding balance and payments) is reported on the organization's credit report.

Is misuse of company credit card a crime

This kind of financial fraud involving expense accounts, credit cards or cash allowances from an employer can result in allegations of either fraud or embezzlement. These white-collar crimes can result in financial consequences, jail time and difficulty moving your career forward.