Why do credit cards have a fee?

Why do credit cards charge a fee

Why Does My Credit Card Have an Annual Fee An annual fee is one of the ways credit card companies can earn a profit. The fee may cover some or all of the card's extra benefits, such as miles, points, or cash back.

Cached

How can I avoid paying credit card fees

You can avoid finance charges in the short term by choosing a credit card that offers 0 percent APR on purchases, balance transfers or both for a limited time. Many 0 percent interest cards are also no annual fee cards.

Is it legal to charge a fee for using a credit card

Credit card surcharges are optional fees added by a merchant when customers use a credit card to pay at checkout. Surcharges are legal unless restricted by state law. Businesses that choose to add surcharges are required to follow protocols to ensure full transparency.

Who should pay for credit card fees

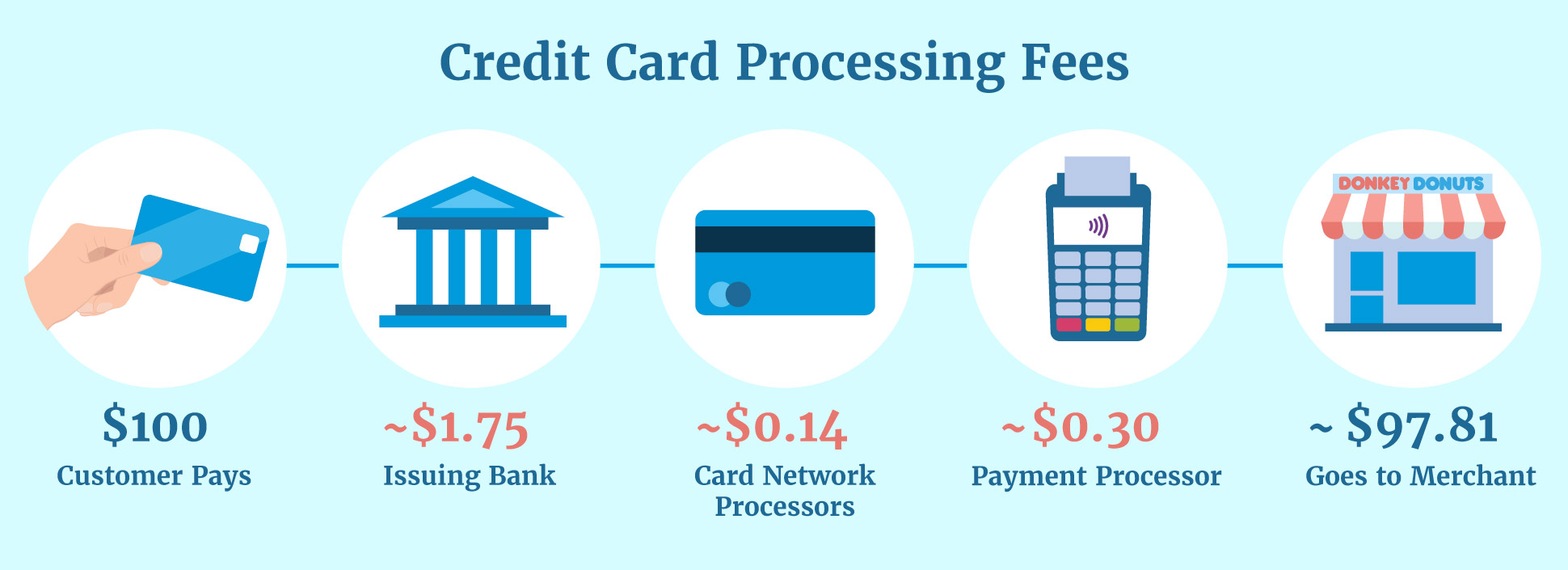

Learn more about different types of fees. Credit card processing fees are paid by the vendor, not by the consumer. Businesses can pay credit card processing fees to the buyer's credit card issuer, to their credit card network and to the payment processor company.

Are credit card fees legal

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

What happens if I don’t pay credit card fees

But generally, if you don't pay your credit card bill, you can expect that your credit scores will suffer, you'll incur charges such as late fees and a higher penalty interest rate, and your account may be closed. And the longer it takes for you to pay that bill, the worse the effects may be.

Can I pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.

Can you refuse to pay a credit card charge

If you used a Visa, MasterCard, or another card not issued by the seller, you can refuse to pay only if: the purchase cost more than $50, and. you made the purchase in the state where you live or, if you live in a different state, within 100 miles of your home.

Are credit card fees normal

Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $500. Most cards charge the same fee every year, though some cards may waive the annual fee for the first year you hold the card.

What states are credit card fees illegal

To date, only two states and one jurisdiction still outlaw the use of credit card surcharges. They are a result of non-qualified transactions of different communications methods.: Connecticut, Massachusetts, and Puerto Rico.

How bad is it to not pay credit card in full

The bottom line. Reporting a balance on your cards of more than about 30 percent of its maximum credit line will hurt your score and carries additional risks. The lower your balances, the better your score — and a very low balance will keep your financial risks low.

What states is it illegal to charge a credit card fee

States that prohibit credit card surcharges and convenience fees. Ten states prohibit credit card surcharges and convenience fees: California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas.

Is charging a card fee illegal

If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Is it OK to charge customers credit card fees

There is no prohibition for credit card surcharges and no statute on discounts for different payment methods. Retailers may not impose credit card surcharges but may offer discounts for payment by cash, check or other methods unrelated to credit cards.

Is it legal to make customers pay credit card fees

Are Credit Card Surcharges Legal If you're wondering if it is legal to charge credit card fees, the short answer is yes. The practice of surcharging was outlawed for several decades until 2013 when a class action lawsuit permitted merchants in several U.S. states to implement surcharges in their businesses.

Is it legal to pass debit card fees to customers

No. It is illegal to apply surcharges to debit cards. Businesses are only allowed to apply surcharges to credit card transactions, and only if surcharging is allowed in their state.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

What is the 15 3 rule

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

Can you pass on credit card fees to customers

With surcharging, merchants are able to automatically pass credit card fees to their customers when a credit card is used at checkout. Credit card surcharging allows businesses to pass on the financial burden of credit card processing fees by attaching an extra fee to each customer's credit card transaction.

Is it legal to charge a convenience fee for credit cards

Convenience fees are legal in all 50 states but must be clearly communicated at the point of sale. Additionally, a convenience fee can only be imposed if there's another preferred form of payment as an option.