Why do I get so many loan offers in the mail?

Are loan offers in the mail real

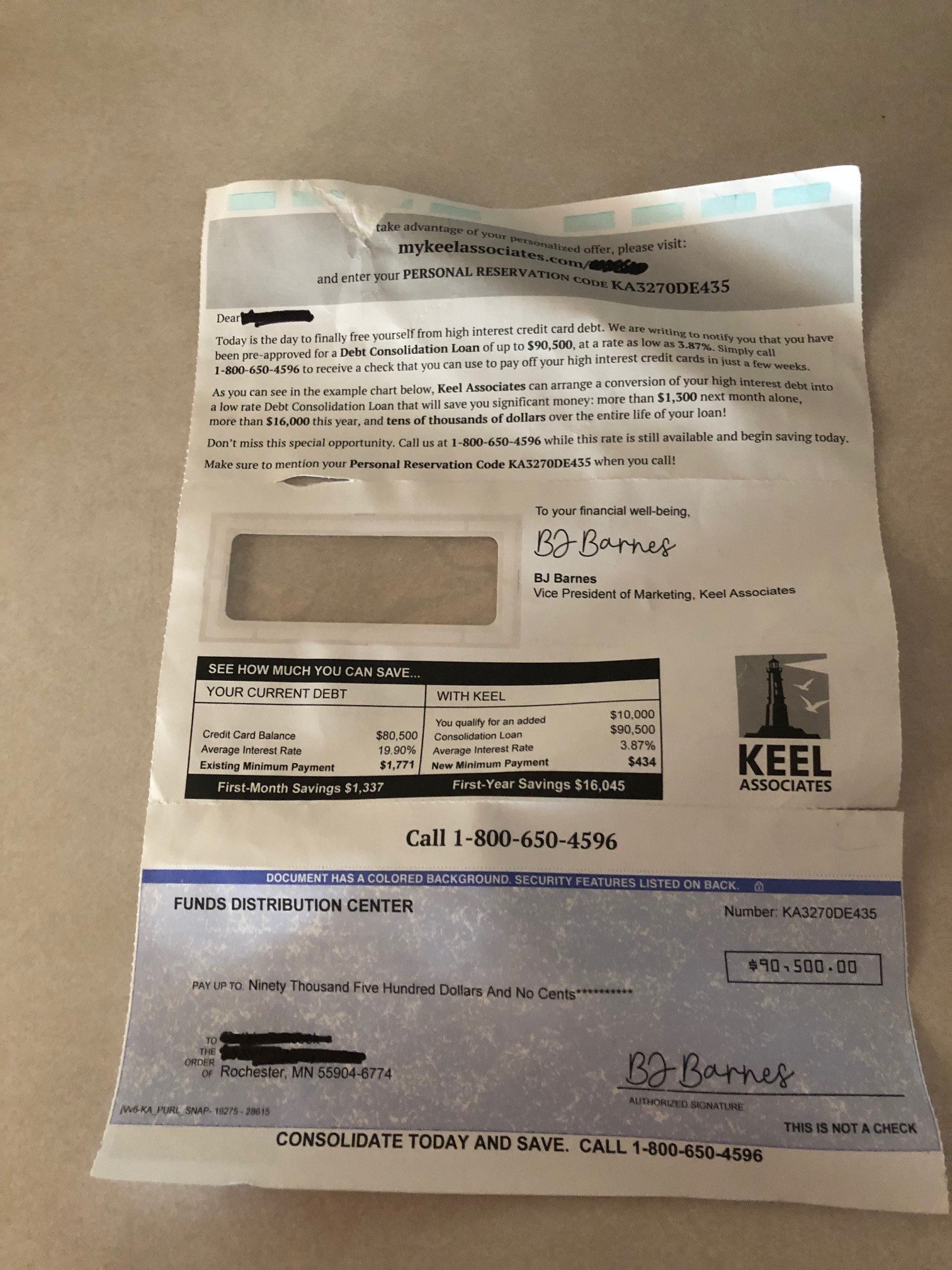

Many reputable companies mail out preapproved loan offers as an effective way to help potential customers get the cash that they need. If you get one in the mail, you might ask, “How did this lender choose me” Typically the lender will work with credit reporting agencies to identify potential customers.

Why am I getting pre-approved loan offers

Additionally, you may have received preapproval offers for loans or credit cards by mail, phone or email. These prescreened offers generally mean you appeared on a credit reporting agency's list of consumers that meet a creditor's criteria, and have been sent a firm offer of credit as a result.

How do I know if a loan company is scamming me

5 ways to spot personal loan scamsThe lender asks for fees upfront.The lender guarantees you're approved before you apply.The lender promises to clear your debt.The lender isn't registered in your state.The lender calls you with an offer.

Cached

How do I stop getting flyers in the mail

How Do I Get off Mailing ListsRegister with the Direct Marketing Association's mail preference service.Register with Valassis (Save.com) to stop receiving its mailers.Register with Catalog Choice to reduce unwanted catalog mailings.

What does it mean when you get a loan offer

If you get a loan offer, that means the lender has agreed to lend you money under specific conditions, which generally include a particular interest rate, known as the APR, and the amount of time you have to repay the loan, which is the loan term.

Do you have to accept a loan offer

If you apply for a personal loan and get approved, you're not obligated to accept the offer. This is important to know because not all personal lenders allow you to get preapproved, so you may need to apply just to get an idea of what terms you qualify for.

Should I accept an offer without pre-approval

Do you need a pre-approval letter to see a house Real estate agents prefer showing homes to buyers with a pre-approval letter, because it shows the buyer is financially capable of purchasing. Agents “need to know if you can really buy a home,” Shur says. That said, a pre-approval letter isn't mandatory to tour a home.

Are you guaranteed a loan if you are pre-approved

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. This document is based on certain assumptions and it is not a guaranteed loan offer.

How do I not get scammed by a loan

Here are four ways to recognize and avoid scams so you can borrow money without worrying.Thoroughly research the lender.Don't pay money upfront for a loan.Question lenders that guarantee approval.Pay attention to how the lender is reaching out to you.

What is the LendingClub scandal

The LendingClub scandal refers to when LendingClub was sued by the Federal Trade Commission in 2023 for falsely promising loans with "no hidden fees," telling consumers they had been approved for a loan when that was not true, and making unauthorized withdrawals.

Can I return to sender junk mail

If you have not opened the mailpiece, you may mark it "Return to Sender," and the United States Postal Service will return it with no additional charge to you. If you open the mailpiece and do not like what you find, you may throw it away.

Is it illegal to tape flyers to a mailbox

You can't place non-postage stamped mailers inside mailboxes or hang them on the outside of a mailbox. Doing so can result in a hefty fine for each infraction. It can even lead to a federal investigation because mailbox tampering is considered a federal crime.

Can you decline loans after accepting

After Your Loan Is Disbursed

You have the right to turn down a loan or to request a lower loan amount. If you accept less than the full amount of the loan you're offered, you can increase the amount (up to the offered amount) later on. Was this page helpful

Can I decline a loan after I accepted it

After Your Loan Is Disbursed

You have the right to turn down a loan or to request a lower loan amount. If you accept less than the full amount of the loan you're offered, you can increase the amount (up to the offered amount) later on. Was this page helpful

Does a pre-approval hurt your credit

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have. The good news is that this ding on your credit score is only temporary.

Can you decline a pre-approval

But home buyers must be aware that it's possible to have a mortgage application denied even if you've been preapproved.

Can I get denied if I’m pre-approved

Getting pre-approved for a loan only means that you meet the lender's basic requirements at a specific moment in time. Circumstances can change, and it is possible to be denied for a mortgage after pre-approval.

Can you still get denied after pre-approval personal loan

Prepare with personal loan preapproval

Many lenders allow you to prequalify without impacting your credit score or making a commitment. However, your application could be denied if something changes, such as your income or credit score.

What is loan flipping

How loan flipping works. The typical situation involves a lender that coaxes and convinces a homeowner to repeatedly refinance their mortgage while also persuading them to borrow more money each time.

Why is LendingClub shutting down

According to LendingClub's website, "Unfortunately, under a prospective banking framework, it is not economically practical for LendingClub to continue to offer Notes. So, we had to make the difficult decision to retire the Notes platform effective December 31, 2023."