Why do I have a statement balance if I paid everything?

Why do I have a statement balance when I already paid

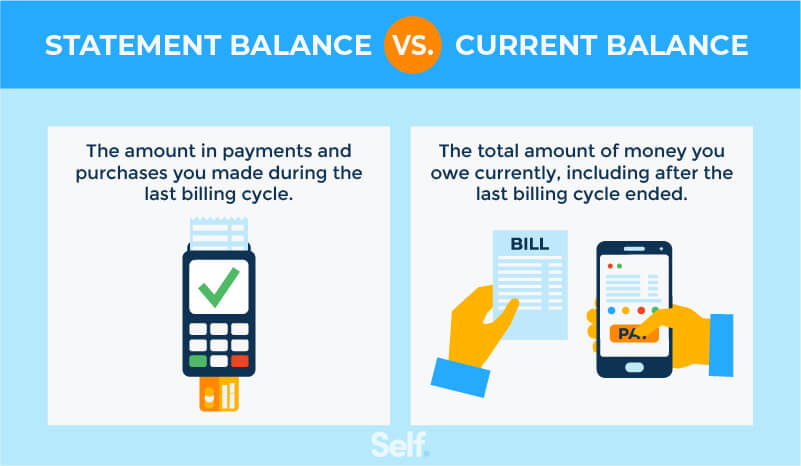

Your statement balance is made up of all the charges you've made that have gone from “pending” to “posted” by the day your billing cycle ends.

Why do I have a statement balance after paying my credit card

Your statement balance is the amount shown on your monthly billing statement. It doesn't reflect any new activity since your last statement ended. Instead, a statement balance represents the purchases and payments on your card during a set period, known as your billing cycle, which falls between 28 to 31 days.

Cached

Are you supposed to pay off your statement balance

If charges you've made since your last billing cycle are creating more debt than you're comfortable with, paying off your current balance early could help improve your credit utilization ratio and credit score. If you're not able to pay your entire statement balance, it's important to make at least the minimum payment.

What happens if you overpay your statement

The Bottom Line

And the credit card issuer is required to return the overpayment, so you won't be out the money, either. This can be accomplished either with a check or deposit to your bank account, or through using the overpayment to cover new charges.

How do I get rid of statement balance

Paying your current balance will pay for your statement balance plus any charges you've made since the end of that billing cycle. It will bring your balance to $0, which is good, but not necessary to avoid interest.

Is it better to pay statement balance or full balance

To avoid a late fee: If you are close to the due date for your monthly payment and cannot pay the entire statement balance, paying the current balance can help you avoid a late fee.

Should I pay statement balance or minimum balance

Experts recommend you pay the statement balance in full every month, but there are times when that may not be possible. In those cases, it's important to make at least the minimum payment so your account stays current and you don't incur any late fees or penalty APRs.

Is it bad to max out a credit card and pay it off immediately

Under normal economic circumstances, when you can afford it and have enough disposable income to exceed your basic expenses, you should pay off your maxed-out card as soon as possible. That's because when you charge up to your credit limit, your credit utilization rate, or your debt-to-credit ratio, increases.

Why do I still owe a statement balance

A statement balance is what you owe at the end of a credit card's billing cycle. It includes purchases, balance transfers, cash advances, and any fees or interest charged. It also will reflect any payments you've made during the billing cycle.

Is it OK to have a statement balance

Should I pay my current balance or statement balance You don't need to pay your entire current balance to avoid paying interest. Just the statement balance that's on your credit card bill. Consistently paying that amount in full by the due date will help you avoid paying interest or late fees.

Is a statement balance how much you owe

What is a statement balance Your statement balance is what you owe at the end of a billing cycle, which is typically 20-45 days. Think of it like a monthly snapshot of your account. It's the total of all the purchases, fees, interest and unpaid balances, minus any payments or credits since the previous statement.

Is paying statement balance early good

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

Is it better to pay off credit card in full

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Is it better to pay statement or full balance to build credit

Carrying a balance does not help your credit score, so it's always best to pay your balance in full each month. The impact of not paying in full each month depends on how large of a balance you're carrying compared to your credit limit.

Is using 100% of credit card bad

Most experts recommend keeping your overall credit card utilization below 30%. Lower credit utilization rates suggest to creditors that you can use credit responsibly without relying too heavily on it, so a low credit utilization rate may be correlated with higher credit scores.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

Should you just pay your statement balance or current balance

Should I pay my statement balance or current balance Generally, you should prioritize paying off your statement balance. As long as you consistently pay off your statement balance in full by its due date each billing cycle, you'll avoid having to pay interest charges on your credit card bill.

Will paying the statement balance hurt my credit score

Paying off your credit card balance every month may not improve your credit score alone, but it's one factor that can help you improve your score. There are several factors that companies use to calculate your credit score, including comparing how much credit you're using to how much credit you have available.

Is it better to pay minimum or statement balance

Experts recommend you pay the statement balance in full every month, but there are times when that may not be possible. In those cases, it's important to make at least the minimum payment so your account stays current and you don't incur any late fees or penalty APRs.

Is it bad to pay off credit card too fast

The answer in almost all cases is no. Paying off credit card debt as quickly as possible will save you money in interest but also help keep your credit in good shape.