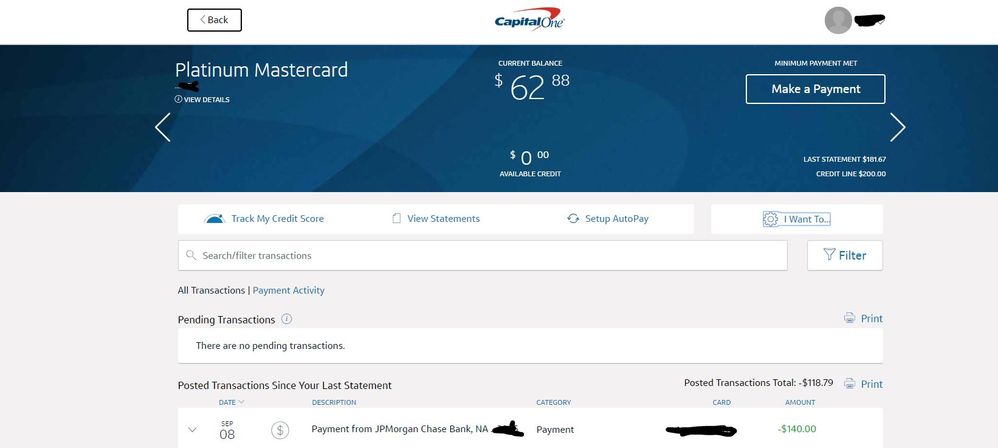

Why do I have no available credit?

Why do I have no available credit after payment

If you've paid off your credit card but have no available credit, the card issuer may have put a hold on the account because you've gone over your credit limit, missed payments, or made a habit of doing these things.

Cached

How long does it take for available credit after payment

It can take one to three business days for an online or phone payment to post to your credit card account and reflect in your available credit. 1 That's because payments made using a checking account and routing number are processed in batches overnight and not in real time.

How do I get my available credit

Your available credit is figured by subtracting your current balance (or amount already used) from your credit limit and adding any outstanding charges that have not posted yet.

Cached

How long does it take for credit to become available credit one

The balance of your payment will increase your available credit within 7 days. For payments made by 2:00 p.m. (Pacific Time) on Saturday, your available credit will reflect the first $100 of your payment within 2 days and the remaining balance of your payment will increase your available credit within 7 days.

How much available credit should I have

There's no magic amount of credit that a person “should” have. Take as much credit as you're offered, try to keep your credit usage below 30 percent of your available credit and pay off your balances regularly. With responsible use and better credit card habits, you can maintain a good credit score.

Do you get more available credit after payment

Paying down your card balances: Each time you pay down your credit card balance, you increase your available credit until you put a new charge on the card. Paying down your current balance before a new purchase can ensure you have enough available credit.

How long does it take for credit card balance to update

This usually happens once a month, or at least every 45 days. However, some lenders may update more frequently than this. So, say you paid down a credit card recently. You may not see your account balance updated on your credit report immediately.

How much should I spend on a $300 credit limit

You should try to spend $90 or less on a credit card with a $300 limit, then pay the bill in full by the due date. The rule of thumb is to keep your credit utilization ratio below 30%, and credit utilization is calculated by dividing your statement balance by your credit limit and multiplying by 100.

How much should your credit limit be

Your credit limit should be at least 3 times higher than your usual monthly spending. That's because your overall credit utilization ratio should stay below 30%. If your spending exceeds that, you risk damaging your credit score.

What is the highest credit limit for Credit One

Key Features of the Credit One Bank Platinum Visa for Rebuilding CreditCredit Limit. This card carries a minimum credit limit of $300 and a maximum credit limit of $1,500.Credit Limit Increase.Earning Cash Back Rewards.Redeeming Cash Back Rewards.Free FICO Score Each Month.Important Fees.Credit Required.

How much credit can Credit One give you

The maximum credit line for a Credit One credit card is not publicly disclosed by the issuer. If approved for a Credit One card, applicants can expect a minimum credit line of $300 to $500 initially, depending on the card and their credit standing.

How much of a $500 credit limit should I use

30%

The less of your available credit you use, the better it is for your credit score (assuming you are also paying on time). Most experts recommend using no more than 30% of available credit on any card.

How much should you spend on a $300 credit limit

You should try to spend $90 or less on a credit card with a $300 limit, then pay the bill in full by the due date. The rule of thumb is to keep your credit utilization ratio below 30%, and credit utilization is calculated by dividing your statement balance by your credit limit and multiplying by 100.

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

Why isn’t my credit balance updating

Not seeing accurate balance information on your credit report could mean your creditor hasn't updated the information yet or reported it incorrectly. You can contact your creditor or dispute inaccurate information with the bureau.

Is it bad to pay credit card balance immediately

Paying early also cuts interest

Not only does that help ensure that you're spending within your means, but it also saves you on interest. If you always pay your full statement balance by the due date, you will maintain a credit card grace period and you will never be charged interest.

Is a 500 dollar credit limit bad

A $500 credit limit is good if you have fair, limited or bad credit, as cards in those categories have low minimum limits. The average credit card limit overall is around $13,000, but you typically need above-average credit, a high income and little to no existing debt to get a limit that high.

How much of a $700 credit limit should I use

NerdWallet suggests using no more than 30% of your limits, and less is better. Charging too much on your cards, especially if you max them out, is associated with being a higher credit risk.

Is a $500 credit limit good

A $500 credit limit is good if you have fair, limited or bad credit, as cards in those categories have low minimum limits. The average credit card limit overall is around $13,000, but you typically need above-average credit, a high income and little to no existing debt to get a limit that high.

How much of a $2000 credit limit should I use

What is a good credit utilization ratio According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.