Why do I have two different refund amounts?

How do I find out why my tax refund was reduced

The tax refund I received is less than expected. Why is it less than what was on my returnOverdue federal tax debts.Past-due child support.Federal agency nontax debts.State income tax debt.Unemployment compensation debts owed to a state (for fraudulent wages paid or contributions due to a state fund)

Cached

Why does TurboTax show a different refund amount

When you pay your TurboTax fees with your federal refund, the TurboTax fee plus a separate Refund Processing Service (RPS) fee are deducted from your total refund amount. So your IRS-issued tax refund might be less than the amount shown in TurboTax.

Why did I get a refund but it was not the same amount I paid

The amount of your refund depends on the exchange rate. When we refund you, the amount you get back reflects the exchange rate on the day we issue the refund. Exchange rates change every day so the amount you get back won't match what you paid.

Does the IRS make mistakes on refunds

The IRS sometimes makes changes because of a miscalculation. The IRS might also believe, based on other information on the return, that you're eligible for a credit you didn't claim.

What if the IRS changed my refund amount

Under the law, the IRS must send you a letter telling you about the change and giving you 60 days to ask the IRS to undo (“abate”) the change. You have the right to ask the IRS to abate the change. You then can give the IRS information or documents that fix any error or prove your tax return was correct as filed.

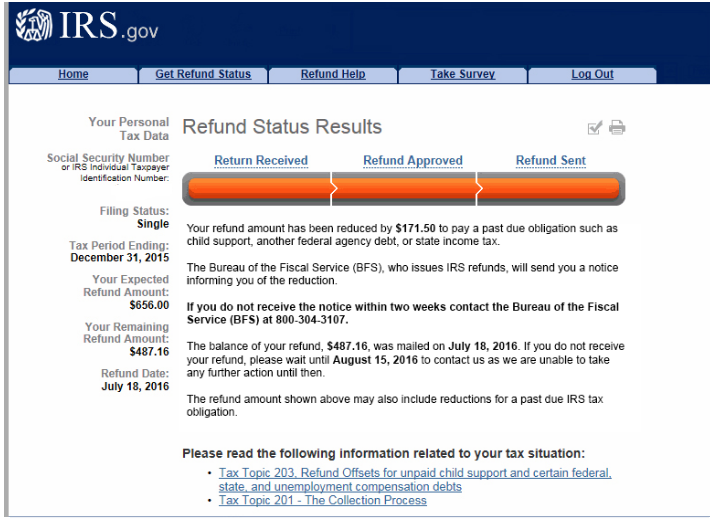

What do I do if IRS reduced my refund

Contact the IRS only if your original refund amount shown on the BFS offset notice differs from the refund amount shown on your tax return. If you don't receive a notice, contact the BFS's TOP call center at 800-304-3107 (or TTY/TDD 800-877-8339), Monday through Friday 7:30 a.m. to 5 p.m. CST.

Is TurboTax accurate on refund amount

TURBOTAX ONLINE GUARANTEES

100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

What do I do if I didn’t get my full refund

Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation).

Why would my refund amount change

If we made any changes to your tax return, your refund amount may change. You'll receive a letter in the mail (Notice of Tax Return Change ) with the details of the changes and the updated refund amount. Common changes include: Withholding or payments don't match our records.

Why is my refund amount wrong

Why is my refund different than the amount on the tax return I filed (updated May 16, 2023) All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans.

How do I know if my tax return has been flagged

If the IRS decides that your return merits a second glance, you'll be issued a CP05 Notice. This notice lets you know that your return is being reviewed to verify any or all of the following: Your income. Your tax withholding.

Can your expected refund amount change

If we made any changes to your tax return, your refund amount may change. You'll receive a letter in the mail (Notice of Tax Return Change ) with the details of the changes and the updated refund amount. Common changes include: Withholding or payments don't match our records.

Can the IRS send the wrong amount

Common refund discrepancy causes

“Most likely it is an arithmetic error,” says Scharin. In these cases, the IRS simply corrects your calculations and sends you the proper refund amount. Even tax software doesn't make you immune to addition and subtraction issues.

Why would IRS change my refund amount

There are many reasons why the IRS may change your expected refund amount, including: You may have listed an incorrect Social Security Number for yourself, your spouse, or child; or. The IRS may not agree with the amounts of Economic Impact Payments or Advance Child Tax Credit entered on your tax return.

How do I know if the IRS changed my refund amount

Telephone Access. If you don't have Internet access, you may call the refund hotline at 800-829-1954 to check on your tax year 2023 refund. To check on an amended return, call 866-464-2050.

What happens if TurboTax messed up my taxes

100% Accurate Calculations Guarantee

If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

How do I get a bigger refund on TurboTax

These six tips may help you lower your tax bill and increase your tax refund.Try Itemizing Your Deductions.Double Check Your Filing Status.Make a Retirement Contribution.Claim Tax Credits.Contribute to Your Health Savings Account.Work With a Tax Professional.

Does tax refund come in two payments

You can ask IRS to direct deposit your refund into just one account, or into two or three different accounts. The choice is yours.

How do I get a full tax refund

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

How often does the IRS make mistakes on refunds

Data on IRS Mistakes

IRS mistakes are actually quite rare. In fact, a 2023 study by the Treasury Inspector General for Tax Administration found that the IRS makes errors in less than 1% of the returns it processes.